I've been in the Gold & Silver investment segment for almost 20+ years in various forms including mining stocks, coins and bullion. I've never seen sentiment this bad. The premiums on pre-1933 Gold are near $0, the premiums on Constitutional "aka Junk" Silver are near $0 and with a record amount of debt continuing to pile up throughout the World, US Mint Sales of bullion Gold and Silver coins are tanking in 2018 versus 2017 which was already a down year in and of itself.

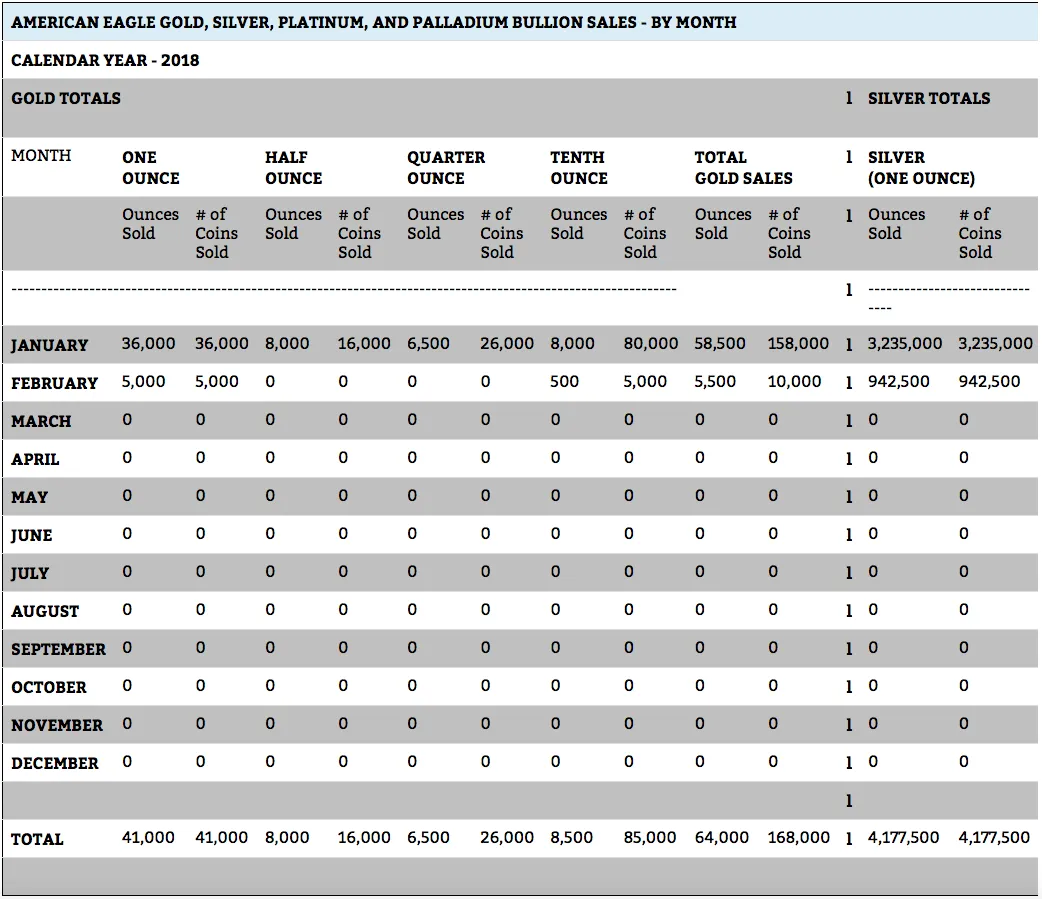

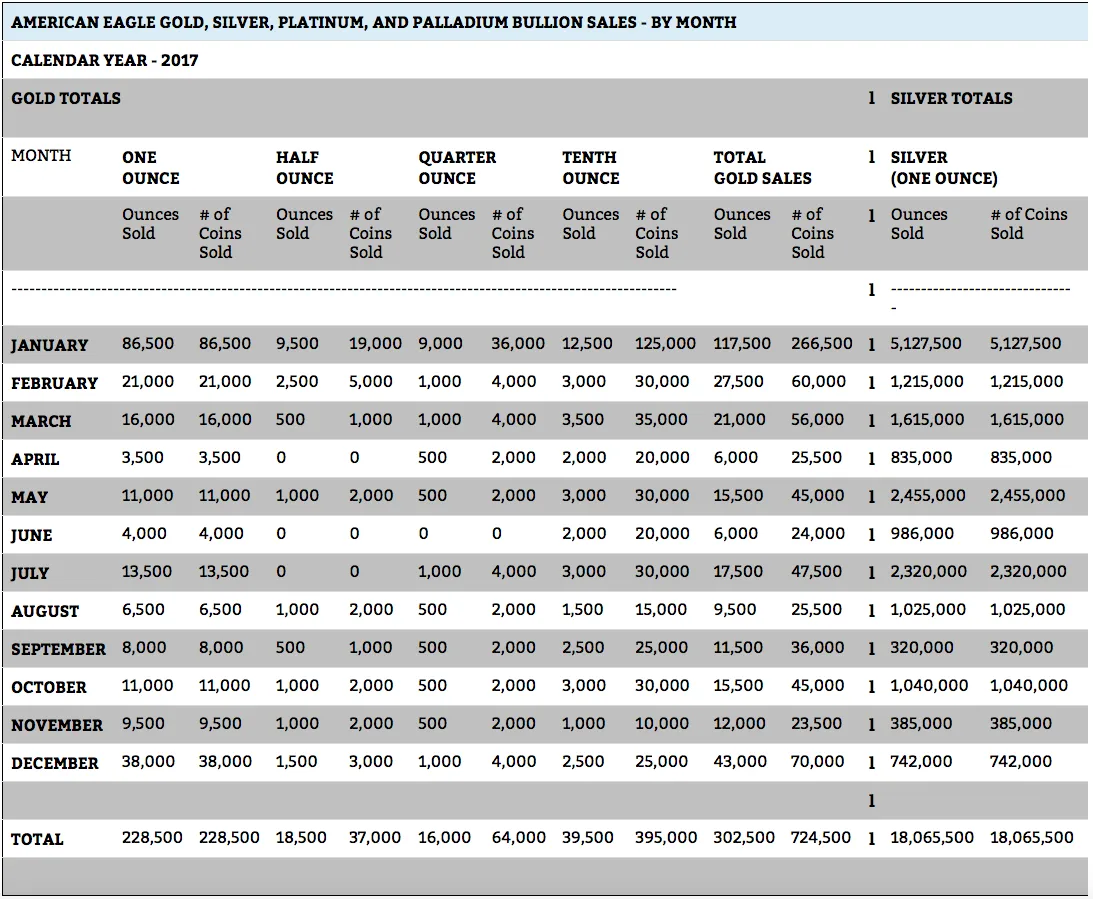

2018 Gold sales for the first 2 months of the year came in at 64,000 oz versus 145,000 oz in prior year 2017. This is a reduction of nearly 56% in just 1 year!

2018 Silver sales for the first 2 months of the year came in at 4,177,500 oz versus 6,342,500 oz in prior year 2017. This is a reduction of nearly 35% in just 1 year!

At this pace, we will be lucky to see a year of over 15,000,000 Silver Eagle sales in 2018. For reference, just a few years ago, we were pushing total sales of almost 50,000,000 US Silver Eagle sales. This is a reduction of over 70%! The good news is, that I have a very long term perspective on this investment/financial insurance. With premiums this low, we are all able to buy more ounces with our fiat.

I am @matthewwarn and I have Stackitis... there are worse problems to have in life.

Photos from https://www.usmint.gov

To invest in Mene24k Gold Jewerly click Here

To open your own BitShares account, click Here