I have made it to Orca!

Hi Everyone,

I didn’t become Orca through earning rewards, which is possible but it would have taken a very long time. Instead, I bought about 50,000 Steem, which is roughly equivalent to the new Steem added to the rewards pool in one day. I now have roughly 76,000 Steem Power. It is still possible that I might buy a little more depending on the market.

Investment journey so far

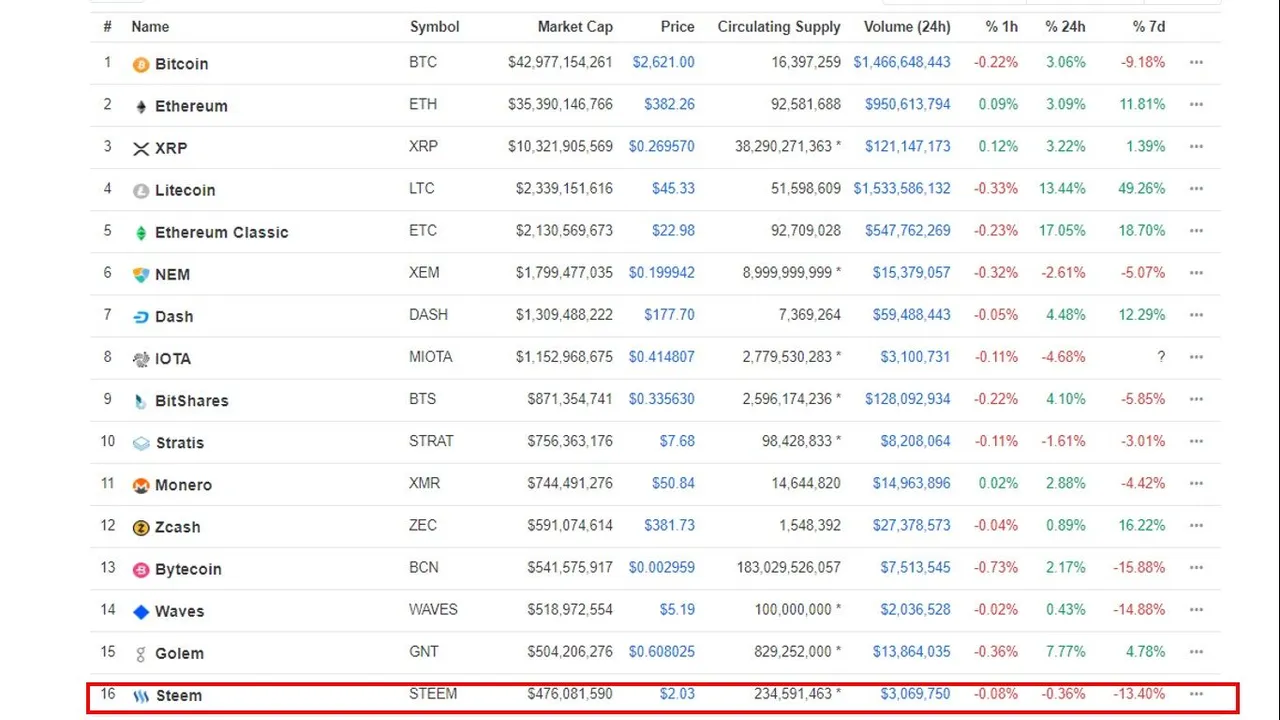

Source: coinmarketcap.com

I joined Steem(it), in June 2017. I did not invest in the first six months. At that time, I was very new to cryptocurrency and I knew nothing about Steem or the Steem ecosystem. I was looking for a platform to present my content. Most of my first few posts were my YouTube videos plus description. Most posts only earned a few cents with the occasional big earner, thanks @curie. I slowly started to learn the ins and outs of posting on Steem.

I made my first large investment in Steem in November 2017. The price was about US$0.90. This was considerably lower than when I joined in June. The price was just over US$2 at that time, see screenshot above. A few months before I joined, the price was as low as US$0.10. I believe I bought roughly about 17,000 Steem. I wanted to buy a little more but I wanted to see how the market was going. It was around this time that Steem Blockchain Dollars (SBD) jumped to over US$12. I had very little SBD back then but I converted most of what I had to Steem.

Source: coinmarketcap.com

December and January rolled around and Steem quickly climbed to US$4 and then to over US$8 but only briefly. I was obviously delighted with the rapid increase in price considering I just bought quite a bit of Steem. I didn’t feel it was necessary to buy anymore at that point. I also didn’t want to sell my Steem either as I wanted to have Steem Power to help promote my own content, upvote other people and earn some passive income.

The price of Steem started its downward trend almost immediately after the highs; there was a slight recovery in April and May before the downward pattern continued. I bought a little more Steem when the price fell to US$3. I have also consistently powered up whatever I have earned on Steem. However, I held onto my SBD for some time when the price fell below that of Steem.

So far, I have not powered down my account or sold any Steem or SBD on external markets. I am using my Steem as a form of investment rather than a liquid income stream. I have been surviving on what I earn from my business ‘Spectrum Economics’.

Why buy now and why so much?

I have become very familiar with the Steem platform and I appreciate the enormous potential of Steem. I watched many of the SteemFest application presentations on YouTube. I am very excited about the development that is taking place. I think Steem has much more going for it now than it did when I joined. The rapid price fall has been caused by a number of reasons some of these reasons fall on Steem (i.e. the fall in market capitalisation rank) but mostly because of the cryptocurrency market as a whole.

I strongly believe that the market will turn at some point and the problems with the Steem ecosystem can and will be solved. Hence, buying Steem at its current low price is very likely to have a good return. It is quite possible that the price of Steem will fall further before it bottoms out. I don’t see that as a problem as I have no intention of selling any Steem in the near future. It is also possible that Steem has reached its bottom. Not buying now could be a missed opportunity that will never come along again.

It is often advised that it is better to diversify risk. I strongly believe that is good advice. However, I have chosen not to diversify my risk in the cryptocurrency market but instead decided to invest only what I can afford to lose into just Steem. I haven’t found any other cryptocurrency that I feel confident in investing based on its own merits. I do not like to invest purely for the purpose of speculation.

I still have money that is tied up in my property as well as superannuation. If I lost all that I have invested in Steem, it would be bad but it wouldn’t ruin my life.

What does this change?

I came to Steem as a content creator, which is not going to change. I have almost 300 posts; most of these posts relate to economics. I have both written posts and videos. The videos normally support the written posts. I ran contests when there was more activity on Steem. Having more Steem Power will enable me to bring back the contests sooner. I do not plan to make any significant changes to my content or my role. I will be looking at some of the new applications currently being developed and possibly delegate some Steem Power. Actifit is interesting and I have begun posting my activity reports. Liketu sounds like an interesting new application that will be arriving on Steem in the New Year. I will also keep my eyes open for more applications.

Just for fun

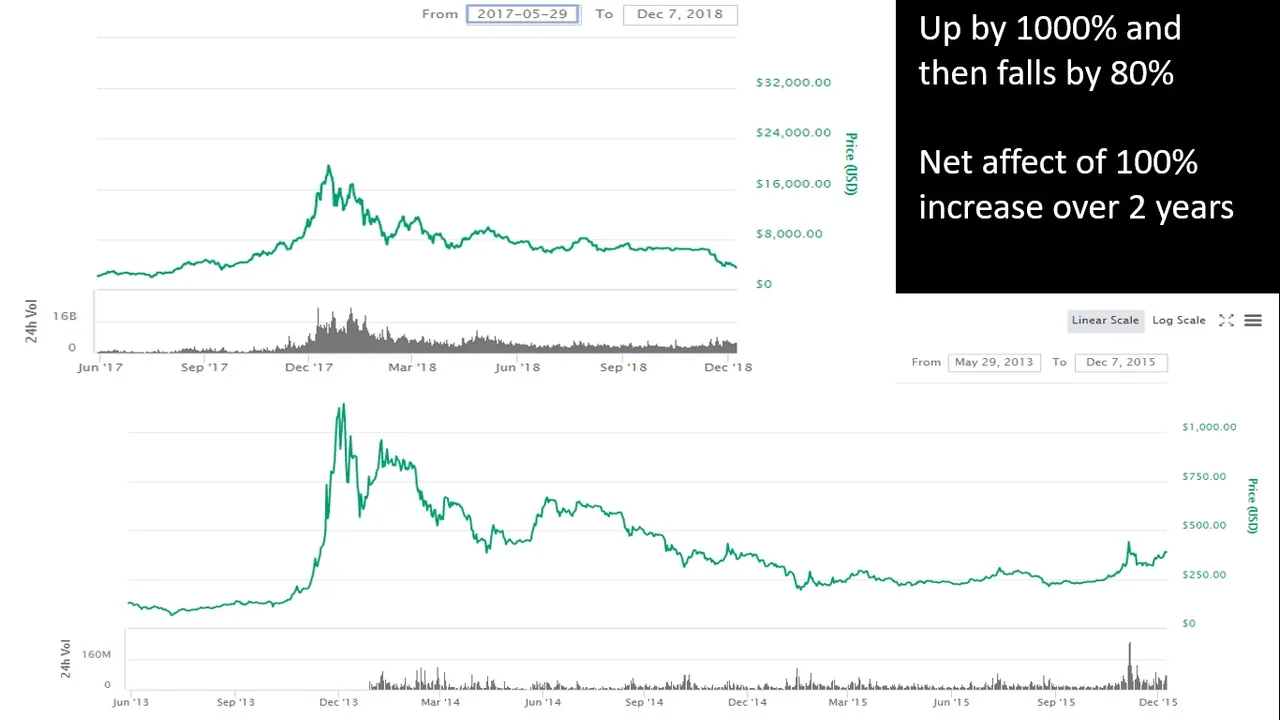

Source: coinmarketcap.com

We are currently in a ferocious cryptocurrency bear market. It feels like Bitcoin is dampening everyone’s mood. To lighten the mood a little I would like to make a quick comparison to the 2014 bear market. From looking at the zoomed out charts on coinmarket.com, it is very difficult to notice the bear market of 2014. If we zoom in closely, there is a very close resemblance to the current 2018 bear market for Bitcoin. The price of Bitcoin jumped dramatically by about 1000% (10 times) and then fell over the course of a year by about 80%. This equates to about a 100% increase in price across the sudden boom following the decline over about a year and a half. The mid 2017 to end of 2018 Bitcoin prices are currently following a very similar trend.

In 2015, the prices of Bitcoin remained close to constant before climbing for much of 2016. If the same pattern repeats, we should be very close to the bottom of the dip. In 2019, we could expect relatively little change in price. In late 2020 and early 2021, we could see Bitcoin approaching new highs.

All the above is based purely on a very rough price comparison between 2014 and 2018. The cryptocurrency market is very different now compared to 2014. The price of Steem is highly correlated, at least in the short-run, to the price of Bitcoin. If the price of Bitcoin stabilises, Steem is less likely to continue its hard fall. Of course we cannot just rely on Bitcoin. It is important than Steem distinguishes itself from other cryptocurrencies and becomes less dependent on cryptocurrency bull markets to succeed.

More posts

To access more of my posts you can click on the links below. These links will lead you to posts containing my collection of works. These posts will be updated frequently.