Dear Hivers

In the previous article we have cover four different topics regarding robiniaswap. Firstly I have told you how to swap your steem/blurt to bsc network with all the steps. Secondly how to install metamask and add a BSC Network to metamask to perform transaction in the bsc chain. Third how to invest in Robiniaswap with your swap currency it's very simple and easy process and lastly RBS token now what to do.

Today I will tell you what are liquidity Pool, how they work and their benifits.

All the links are as follows for your convince :

How to swap your currency/ token.

Metamask Installation/ adding BSC Network

how to invest in Robiniaswap with your swap currency

What should you do with your RBS Token ?

Liquidity pool - Brief.

A liquidity pool is a collection of funds locked in a smart contract. Liquidity pools are used to facilitate decentralized trading, lending, and many more functions we’ll explore later.

Liquidity pools are the backbone of many decentralized exchanges (DEX), such as Uniswap. Users called liquidity providers (LP) add an equal value of two tokens in a pool to create a market. In exchange for providing their funds, they earn trading fees from the trades that happen in their pool, proportional to their share of the total liquidity.

Let's take an example robiniaswap.

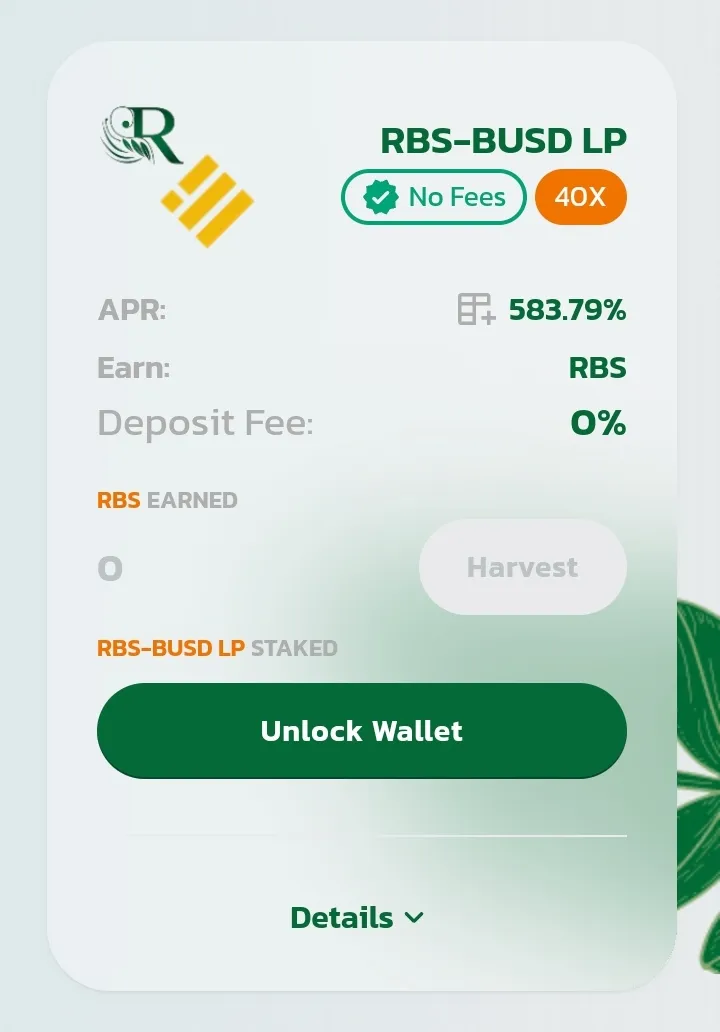

Their are two type of earning you can do in this type of pool. First is the Pair pool and second is the liquidity pool.

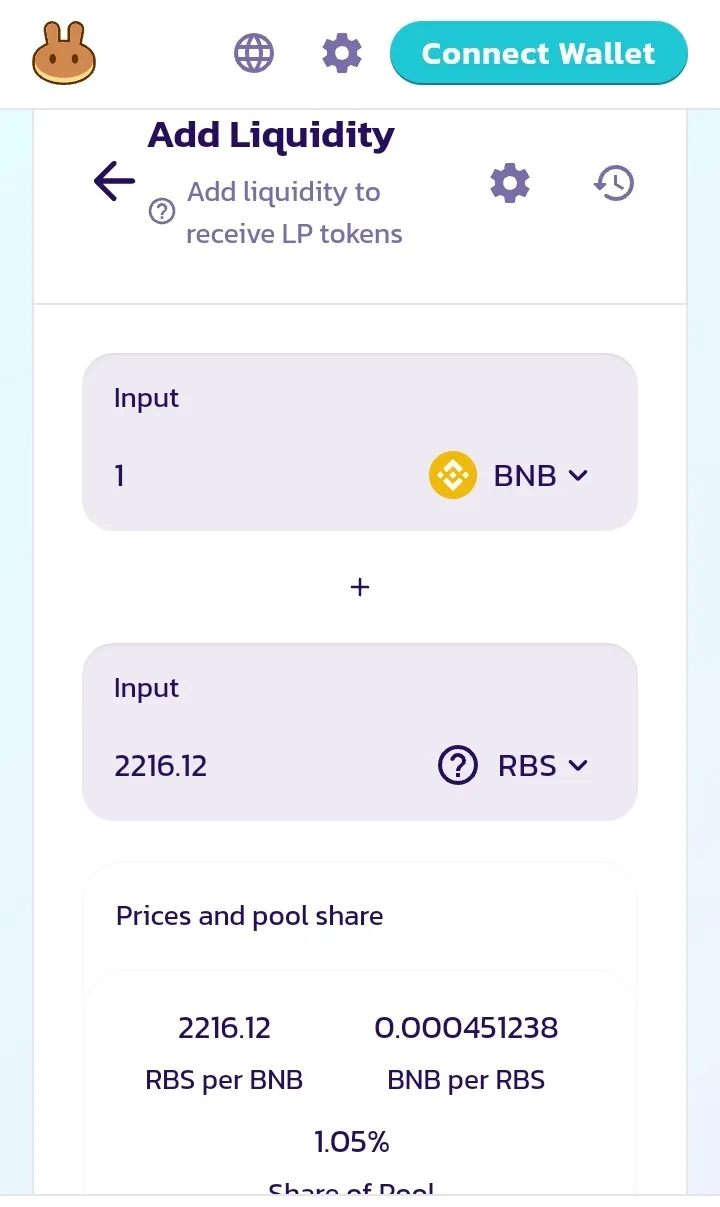

Secondly is the liquidity providers.by this you provide liquid to the pool. In the following pair.by this you will have your share in the pool like if you invest 1 BNB your share in the pool will be 1.05%.

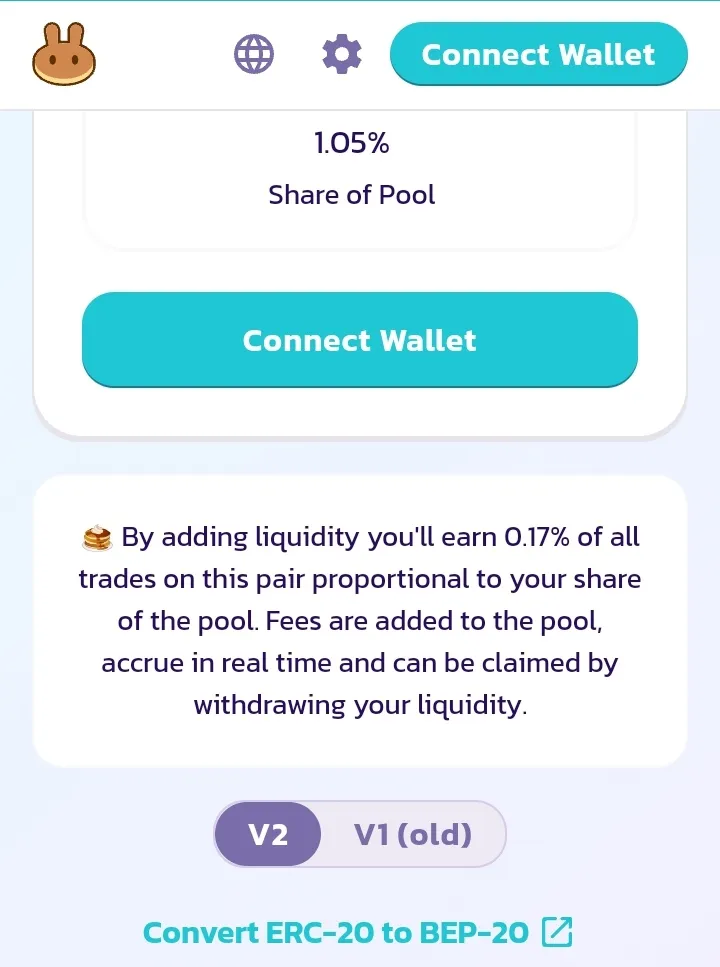

In this manner you will have the share and you will earn a fees of 0.17% from the pool. In this pair pool.

Now someone investment in the same pool RBS-BNB liquidity Pool you will get fees in return.

Now the second part i will explain this is a risky part. In this you have to get the same amount of pair valu. Like RBS-BNP in this you have to have same Amount of value in the both token and you will get the RBS token from the pool.

Risk Involved.

If you are providing liquidity to this type of defi pool or AMM, then you should be knowing about the risk involved in this type of pool. The loss is called impermanent loss.

Impermanent loss means a getting negative value in the dollar in your holding if you are giving liquidity to this kind of pool.

Sometimes the loss is big and sometimes the loss is small depending on the pool size and investment.

In the next article I will be telling about the new development in the robiniaswap and where it will be leading.