In order to qualify for the full State Pension in the U.K. one has to have made the appropriate National Insurance Contributions for at least 35 years.

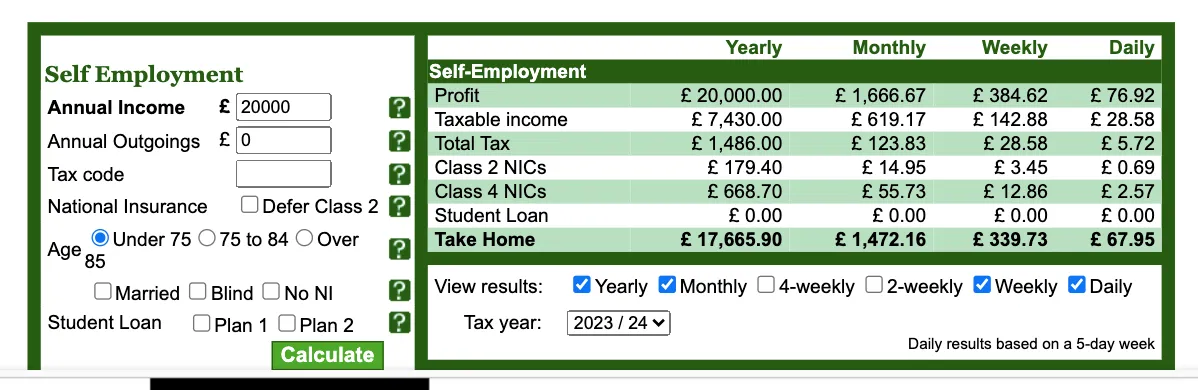

When you're employed this is easy, your employer just takes care of it, and when you're self-employed, it's also easy, it's only the class 2 NICs which are essential to qualify for the state pension, and these are minimal, at only £200 a year, just under in fact.

Assuming you start working at 25 and retire at the current, future state pension age of 68, that gives you 43 years to make these contributions.

That gives you enough time to do a degree, a Masters, and take an additional 8 years off working while you pay no NI, and you still get the State Pension....

Gaps in my record...

I notice I have about 5 years where I haven't paid enough NI contributions, I'm not exactly sure why, actually I've no idea why, anyway, since I've been using an accountant it's all good, the last few years have been paid in full.

I've got 23 good years already covered and need another 12 years of contributions to get that full state pension, with 17 years left before I can claim it.

I may as well just pay the years going forwards...?

I could go back and pay around £800 or thereabouts in voluntary contributions per year, I think it was that much, to bring my State Pension up to full, but I personally can't see how I need to pay this much or why I should!

I mean going forwards it looks like NI rates are going down and I'm likely to be earning LESS than in previous years, which means my class 4 contributions will be less going forwards probably than they would have been in previous years.

Minimal NI contributions if you don't earn very much still contribute to a MAX pension!

So by just aiming to pay 12 out of a potential 17 years (Lord, that sounds LONG!) I can max out that pension relatively cheaply.

I mean there's no point back paying for years when I should have paid more NI at a higher rate, compared to paying less NI going forwards at a lower rate, is there....?

I'm sure I'll always be earning SOMETHING from self-employment every year in the future!

There's also the possibility that the government will keep the voluntary contributions window open longer and longer, they WANT people to pay-in after all.

The only risk here is if I get sick or something, but even then if I did I could claim sickness benefits, even if I wasn't entitled to benefits, I know that just claiming passports you to NI cover if you're genuinely that ill.

In short, I don't get the point of voluntary contributions....?

It seams like a mug's game, you don't get extra for paying in more and you certainly don't get it back if you pay too much!