The power of second layer tokenization on Hive has been documented throughout these monthly leaderboard posts. As we track the top 25 authors on LeoFinance and see how their rewards stack up as LEO vs. HIVE, we've seen a very clear trend:

LEO author rewards flipped HIVE author rewards long ago. Since then, the depth of this gap (where LEO is more valuable and rewarding than HIVE) has only grown more significant with time.

Authors who post consistently and build their brand on the Hive blockchain through https://leofinance.io are the most rewarded users on the entire chain. Not only do they earn their normal HIVE rewards, they're actually earning LEO rewards that are - in many cases - more than 3x as valuable as the HIVE they're getting.

Last Month, the top 25 authors earned 30,842 LEO and 30,768 HIVE in author rewards only.

It was interesting to see that these authors actually earned almost the same amount of LEO tokens as they earned HIVE tokens. The key difference though is in the value of those payouts. At the time, the value of total LEO earned and total HIVE earned was 5,891 USD for the LEO rewards and $4,492 USD for the HIVE rewards.

This Month, the top 25 authors earned 26,160 LEO and 33,101 HIVE as LEO rewards have widened out to a larger pool of users.

Over the course of October to November, the LEO token price increased while HIVE's token price decreased. The value of 26,160 LEO was $6,801.54 versus the value of 33,101 HIVE at $4,303.16 USD.

So authors are earning less actual LEO tokens (as the rewards have been distributed more widely) and their earning more actual HIVE tokens. Yet the U.S. Dollar value of rewards they're earning from LEO have increased compared to the HIVE rewards.

The Trend Will Only Continue

It's been clear to us from the beginning that this trend will only continue. The rewards that users earn from creating content (and curating, but curation isn't factored into this Author Rewards Only post) on https://leofinance.io is outpacing HIVE at an incredible rate.

Is this bad for HIVE?

Absolutely not. It's been funny to see some HIVE purists come out against posts like this and say that we're talking down about HIVE. Every user on LeoFinance.io is also a Hive user.

We've been signing up dozens of new accounts every single day and creating more new Hive users than any other Hive blockchain application. With LeoInfra V2 going live just 2 weeks ago, we've seen a surge in daily accounts being created and overall activity on https://leofinance.io.

We're bringing the users to Hive but we're not leading them down the black hole of trying to get noticed and rewarded in the Hive ecosystem. Instead, we're teaching our users to focus on the second layer and the ease of use that comes from being a LeoFinance user.

Buy More LEO?

If you check the latest @leo.stats weekly stats posts, then you'll notice that there is a continuation of the trend to stake as many LEOs as you can get. Staking increases your LEO POWER which of course, increases your LEO curation rewards (in the very same way that HIVE works). LEO curation yields anywhere from a 22-30% APY. More than double what most people earn with HIVE POWER.

Second-Layer Tokenization is the future of HIVE. We'll just wait here and keep buidling while everyone else catches up to this idea. Meanwhile, our users continue to be the highest rewarded community in the entire Hive ecosystem.

The time to post, curate, earn and stake LEO is now.

Top 25 LEO Authors

The following is a chart ranking the top 25 LeoFinance authors by the amount of LEO tokens they earned throughout the month (from author rewards only).

Many of our top authors are now earning hundreds of USD per month solely from content creation on https://leofinance.io. If you check the wallets of these users, they also stake almost all the LEO they're earning. This has led to us having more than 76% of the entire LEO token supply staked at all times.

It also increases their monthly rewards from curation. If you combine this post with our monthly Curator Leaderboard posts, you'll find that many users on this list are actually earning $1,000+ from LEO rewards per month when you add both author/curator rewards together.

| Rank | Author | LEO $ | HIVE $ |

|---|---|---|---|

| 1 | rollandthomas | $538 | $130 |

| 2 | taskmaster4450 | $497 | $676 |

| 3 | jrcornel | $436 | $400 |

| 4 | taskmaster4450le | $425 | $149 |

| 5 | dalz | $391 | $185 |

| 6 | khaleelkazi | $369 | $323 |

| 7 | edicted | $364 | $303 |

| 8 | trumpman | $355 | $130 |

| 9 | hitmeasap | $311 | $115 |

| 10 | scaredycatguide | $304 | $110 |

| 11 | acesontop | $268 | $140 |

| 12 | leofinance | $257 | $269 |

| 13 | behiver | $230 | $59 |

| 14 | onealfa | $213 | $42 |

| 15 | shortsegments | $209 | $48 |

| 16 | jondoe | $180 | $134 |

| 17 | spinvest | $176 | $75 |

| 18 | coyotelation | $153 | $42 |

| 19 | forexbrokr | $153 | $45 |

| 20 | tarazkp | $149 | $605 |

| 21 | chekohler | $146 | $183 |

| 22 | whatageek | $139 | $35 |

| 23 | jk6276 | $135 | $36 |

| 24 | inalittlewhile | $133 | $32 |

| 25 | r1s2g3 | $132 | $38 |

To calculate the $ value of the LEO and HIVE received, we used the average value of LEO/HIVE throughout the month:

- LEO: $0.26 USD

- HIVE: $0.13 USD

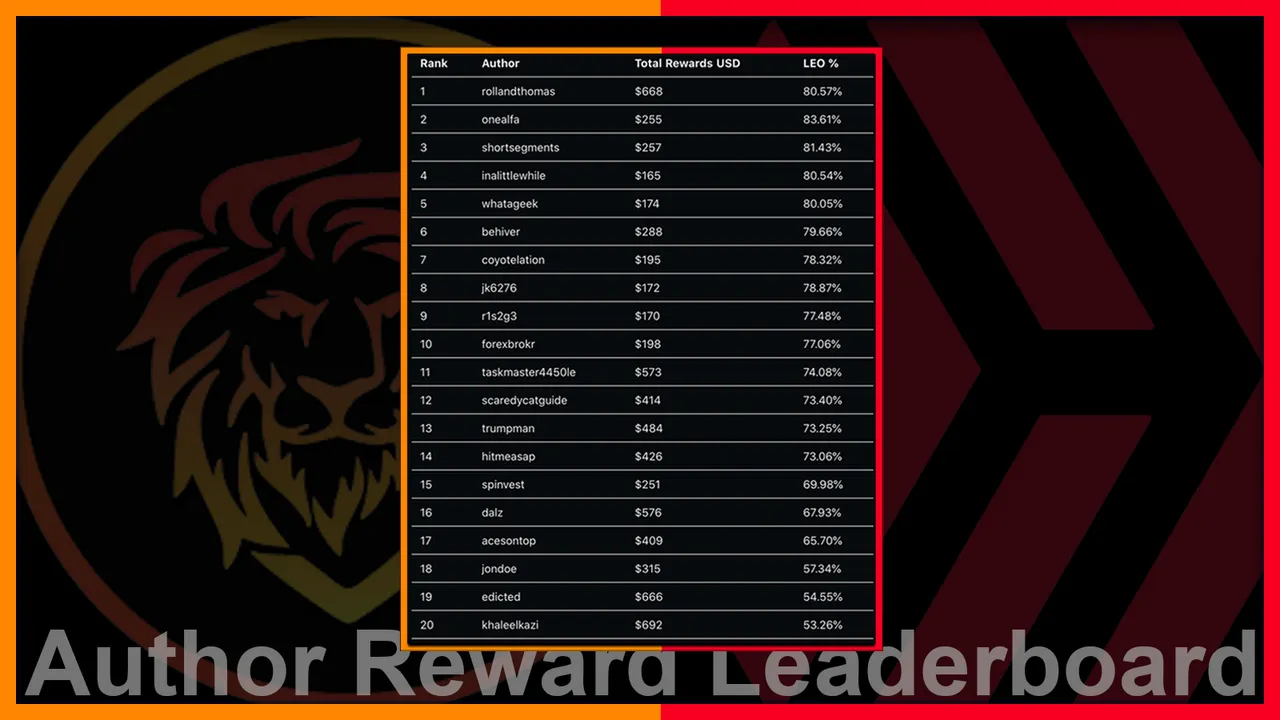

Top 25 LEO Authors by % of Total Rewards

The following is the same list of the top 25 authors but ranked using the percentage share of their total rewards denominated in LEO. This simply takes the total USD rewards they earn each month (LEO + HIVE rewards) and then displays the LEO % of those total USD rewards.

In this chart, you'll see that the % of LEO rewards has only continued to trend higher. This means that the top authors on https://leofinance.io are earning more of their total rewards on the Hive blockchain from LEO than HIVE. Second-Layer tokenized rewards at its finest.

| Rank | Author | Total Rewards USD | LEO % |

|---|---|---|---|

| 1 | rollandthomas | $668 | 80.57% |

| 2 | onealfa | $255 | 83.61% |

| 3 | shortsegments | $257 | 81.43% |

| 4 | inalittlewhile | $165 | 80.54% |

| 5 | whatageek | $174 | 80.05% |

| 6 | behiver | $288 | 79.66% |

| 7 | coyotelation | $195 | 78.32% |

| 8 | jk6276 | $172 | 78.87% |

| 9 | r1s2g3 | $170 | 77.48% |

| 10 | forexbrokr | $198 | 77.06% |

| 11 | taskmaster4450le | $573 | 74.08% |

| 12 | scaredycatguide | $414 | 73.40% |

| 13 | trumpman | $484 | 73.25% |

| 14 | hitmeasap | $426 | 73.06% |

| 15 | spinvest | $251 | 69.98% |

| 16 | dalz | $576 | 67.93% |

| 17 | acesontop | $409 | 65.70% |

| 18 | jondoe | $315 | 57.34% |

| 19 | edicted | $666 | 54.55% |

| 20 | khaleelkazi | $692 | 53.26% |

| 21 | jrcornel | $836 | 52.19% |

| 22 | leofinance | $526 | 48.91% |

| 23 | chekohler | $329 | 44.32% |

| 24 | taskmaster4450 | $1,173 | 42.36% |

| 25 | tarazkp | $753 | 19.72% |

How Far We've Come

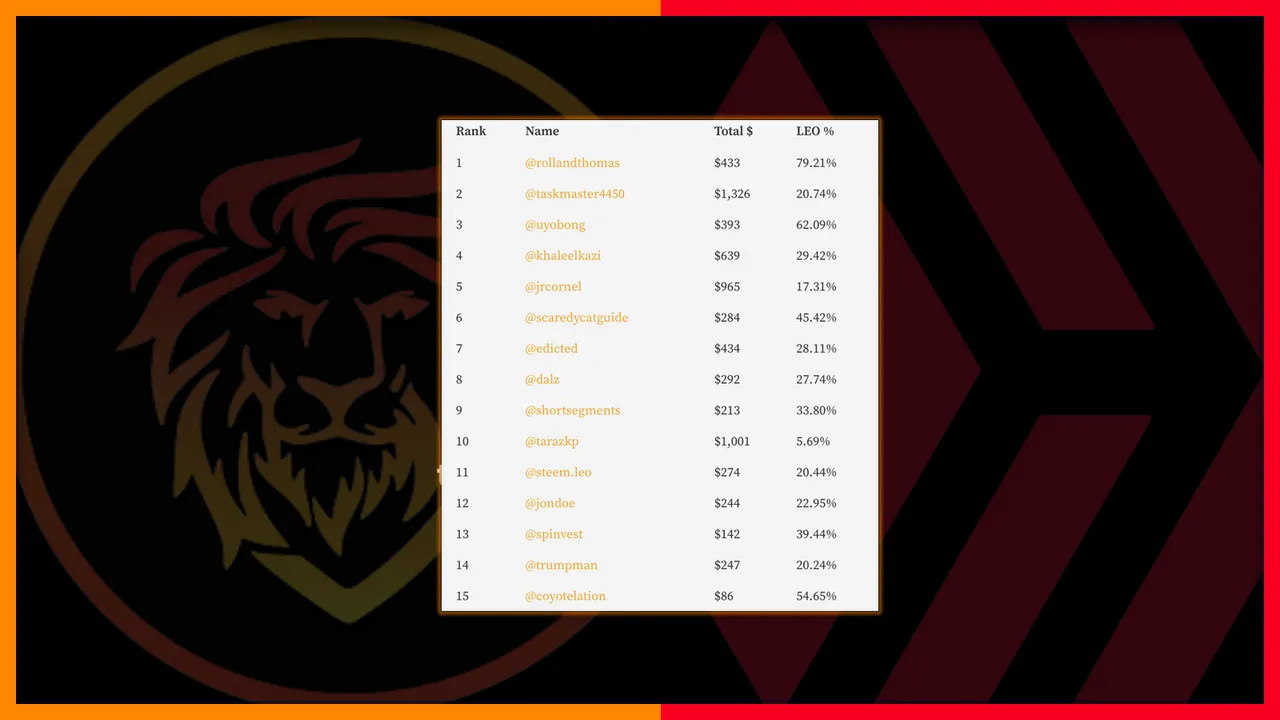

5 months ago, we posted the first ever HIVE vs. LEO Author Reward Leaderboard. We already knew back then that we were on to something big.

Author rewards from LEO would one day become more valuable than author rewards from HIVE.

I highly recommend giving that first report a quick read after you've read today's report. The perspective you will walk away with is incredible.

Here are a few key snippets:

"The conversion rates for LEO and HIVE are the average price for June 2020, $0.245 for HIVE and $0.047 for LEO."

Yeah, you're reading that right. The price of LEO back then was $0.047 per LEO and the price of HIVE was $0.245. Today, the price of LEO is over $0.23 and the price of HIVE is $0.115.

"Two fun examples from this data set are @tarazkp and @rollandthomas. Taraz is one of the highest paid authors on Hive and LEO is still able to represent over 5% of his author rewards. Not a bad chunk when you compare the rewards pool sizing of LEO vs. Hive. Rolland is an underappreciated HIVE author, so sitting on the other side of the spectrum, his LEO earnings represent a massive 79% chunk of his total earnings on Hive."

@tarazkp is probably my favorite example throughout these leaderboard charts. He is one of the highest paid authors in terms of HIVE (I believe @dalz has posted a chart in the past on the HIVE top authors).

5 months ago, we talked about how his LEO rewards accounted for only 5% of his total author rewards. Here's how the breakdown looked for Tarazkp back then:

- LEO Author Rank: #10

- HIVE Rewards earned: $944 USD

- LEO Rewards Earned: $57 USD

- LEO % of Total Rewards: 5.69%

Compared to the data in today's report:

- LEO Author Rank: #20

- HIVE Rewards earned: $605 USD

- LEO Rewards Earned: $149 USD

- LEO % of Total Rewards: 19.72%

One of the main reasons why I think Tarazkp is an interesting example to follow is because he is the edge case scenario. Most authors on Hive would only dream of earning the amount that he earns from his content. He earns that amount through consistency, being around the Hive ecosystem for a long time, engaging, etc.

The trend of his LEO % of Total Rewards increasing will only continue as he continues to be a great author and the value of LEO rises against the value of HIVE.

If you want to look at other examples, I highly recommend it. It's especially fun to see authors who went from making 25% of their total rewards in LEO to making over 75% of their total rewards from LEO. Their total USD reward values are also showing off the charts level growth.

For example, @forexbrokr earned only $66 per month from content creation 5 months ago (total rewards from HIVE + LEO). The total % of his LEO rewards back then was already 59.09%. He was (and still is) a very underappreciated author on the Hive blockchain - in terms of HIVE rewards.

Today, he's earning over $198 per month from content creation. LEO now accounts for 77.06% of his total author rewards.

This is only over the course of 5 months. I can't wait to see what the data reveals in 7 months when we can see the 12 month results of this flippening.

Other Developments

I've been a bit quiet lately on Discord and posting here. We've been head down on developing a number of different projects.

LEO Lightning DB is about to enter the testing phase. This is an entirely new server which creates a layered content management system that will run a significant portion of the LeoFinance.io backend. We call it Lightning because it brings the speed of Web2 but maintains the principles of Web3. I can't wait to push this into production. The speed will absolutely blow your mind.

The Lightning layer also decreases our reliance on Hive-Engine/Scotbot (as content will be served through this layer as opposed to pulling all of it from their APIs). This is just the first in a series of rollouts to replace Hive-Engine/Scotbot entirely as we move LEO onto it's own second layer throughout 2021. More updates on our long-term plans will drop with the 2021 roadmap in a few weeks.

LeoFi is about to enter early development stages. I just finished the design work for LeoFi and I am so excited about it. I'll leave my explanation of it here and let you imagine what it will look like: imagine a love child between Uniswap, Curve.fi and DLease on the front end.

Now take the back end as being a beautiful synchronization of the Ethereum blockchain and the Hive blockchain. Bridging the gap for DeFi on Ethereum to DeFi on Hive. Here, you'll be able to manage your Liquidity Pool positions (for WLEO), instantly swap WLEO for any other cryptocurrency, lease or request LEO POWER delegations and in a later version, request collateralized loans using LEO/WLEO/WLEO UNI-V2 LP tokens.

LeoFi is coming and it is going to be one of our biggest projects yet. More details are coming in the 2021 roadmap.

Lastly, I'll just give a quick mention about Microblogging - many of you are already publishing posts and speculating about what Microblogging will look like/mean for LeoFinance. It's fun to see these posts and I encourage you to keep speculating. Similar to pretty much any other launch, this will be unlike anything you've ever seen on Hive.

There we go. I hit my 2,000 word quota. Have a great day 🦁

LeoFinance is a blockchain-based social media community for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

| Trade Hive Tokens | Wrapped LEO | Hive Witness |

|---|---|---|

| LeoDex | wLEO On Uniswap | Vote |

|  |  |