A beginner's guide to Avalanche crypto (AVAX), the fastest smart contracts platform in the industry.

Avalanche is a relatively new blockchain platform that was launched in 2020.

It aims to address some of the scalability and interoperability issues that have been a challenge for many existing blockchain networks.

The platform is powered by its native cryptocurrency, AVAX, which is used for transaction fees, staking, and governance.

Avalanche has attracted significant attention in the cryptocurrency community, and its native cryptocurrency, AVAX, has seen substantial price growth since its launch.

The platform has also been adopted by a number of projects and developers, who are using it to build decentralised applications and explore the platform's features.

Introduction to Avalanche crypto (AVAX)

One of the key features of Avalanche is its consensus mechanism, which is called Avalanche Consensus.

This consensus mechanism allows the network to process thousands of transactions per second, making it one of the fastest blockchain platforms currently available.

Additionally, Avalanche Consensus enables the platform to support the creation of subnets, which are customisable, independent blockchain networks that can be used to host decentralised applications (dApps).

Another notable feature of Avalanche is its interoperability.

The platform is designed to be compatible with other blockchain networks, which means that assets and data can be transferred between Avalanche and other blockchains.

This interoperability is made possible by the platform's use of a technology called the Avalanche-X bridge, which facilitates communication between different blockchain networks.

In this guide to Avalanche (AVAX), we will explore the various features and use cases, as well as provide an overview of its native cryptocurrency.

We will also discuss the benefits and challenges of the platform, as well as its potential for future growth and development.

How does Avalanche crypto work?

Having launched its mainnet in September of 2020, Avalanche is one of the new kids on the block.

A review of the Official Website shows Avalanche was created by Ava Labs (a company formed by former Cornell University researcher Emin Gün Sirer).

Avalanche boasts of sub-second transaction times coupled with low fees.

But how does Avalanche crypto work to provide that which it boasts?

How does Avalanche (AVAX) work?

To examine how Avalanche crypto works, two specific topics will be discussed:

- Avalanche's triple blockchain strategy

- Avalanche's Consensus

Triple blockchain strategy

For Avalanche, the key factor present is the availability to build blockchains.

Each new blockchain created in the ecosystem is known as a 'subset'.

In the creation processes of these new blockchains within Avalanche, the blockchain developers exercise full programmability (meaning they can create their own network token, set their own blockchain rules, and set their own fee schedules).

Interestingly, anyone is free to create their own blockchain (subset) on Avalanche by the mere payment of a subscription fee.

The three chains comprising Avalanche's Triple Blockchain Strategy are:

1. X-CHAIN: Within the Avalanche ecosystem, the first blockchain is an easily programmable, decentralized chain known as the X-Chain. This X-Chain's network allows for the creation and minting of new, unique digital assets (i.e., utility tokens, wrapped tokens, stablecoins, equities, NFT's, etc.).

2. C-CHAIN: The purpose behind the C-Chain is to provide easier conversions for Ethereum Decentralized Application developers. This C-Chain operates as a conversion chain within Avalanche permitting developers a seamless method of migrating an Ethereum Dapp to the Avalanche blockchain. The C-Chain may be used by all of the available essential Ethereum tools and provides support for many Ethereum features (i.e., Web3.js, Embark, and Metamask to name a few).

3. P-CHAIN: Within the Avalanche ecosystem, the P-Chain is where the utilities of the network run (staking, coordination of validators, creation of new 'subsets', and the monitoring of existing 'subsets'.

So, in its most basic form for an explanation, each of these three chains are representations of a virtual machine.

Each of the virtual machines are then deployed on to the 'subnet'.

Then within each 'subnet' working in unison are a special set of validators providing consensus (with each 'subnet' providing its own incentives to ensure validator honesty).

Avalanche can be referred to as a "platform of platforms".

This is because there are literally thousands of subnetworks that come together to form one interoperable network.

Consensus

- STAKING: Regular coin holders can delegate their tokens to an established Validator correspondingly receiving rewards of AVAX tokens in return. To become a validator a user must hold a minimum of 2000 AVAX. The hardware requirements are minimal and earnings average around 10 percent (give or take). Validators are permitted to validate as many 'subnets' as their capacity allows but must additionally validate the primary network as well.

- CONSENSUS PROTOCOL: Avalanche uses a unique hybrid delegated proof-of-stake (DPoS) mechanism, which due to its reduced consensus requirements is much faster than the singular PoS or PoW mechanisms, The Avalanche chain is constructed so that millions of validators may be accommodated adding more layers of decentralization in the system.

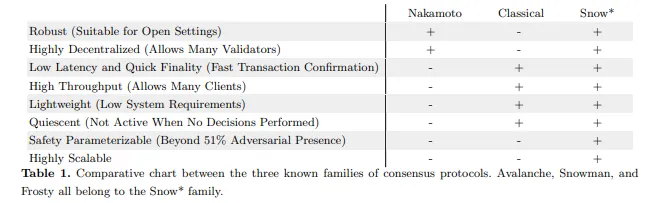

Specifically, "The Snow” family of protocols, introduced by Avalanche, combine the best properties of classical consensus protocols with the best of Nakamoto consensus.

Based on a lightweight network sampling mechanism, they achieve low latency and high throughput without needing to agree on the precise membership of the system.

According to the Avalanche Whitepaper, they scale well from thousands to millions of participants with direct participation in the consensus protocol.

In table format, this appears:

According to founder Emin Gün Sirer:

“Only three times in the 45-year-old history of distributed systems have we had a new family emerge. Avalanche is a brand-new family, as big of a breakthrough as Satoshi’s protocol was; it combines the best of Satoshi with the best of classical in scales like no other that allow anyone to integrate themselves into the consensus layer.”

By utilizing this unique delegated proof-of-stake consensus, Avalanche protocols are very fast.

"They can achieve irreversible finality in sub 2 seconds (with most happening sub 1 second), quicker than a typical credit card transaction. They support many thousands of transactions per second, in excess of Visa’s typical throughput of 4500 TPS".

And the metrics presented are base layer, which is further enhanced in Layer-2.

For a much more detailed and technical view of the Avalanche consensus protocol, you may consult the Avalanche Whitepaper which we’ve linked to in this section of the guide, just above.

Concluding how Avalanche crypto works

Clearly the unique technical features of Avalanche make this a stand-out project in the cryptosphere.

It is very likely that as the problems plaguing the Ethereum ecosystem continue, more and more developers looking for alternatives will look to Avalanche for its speedy transaction times, latency, security, ease of use, and lower transaction costs.

What is Avalanche crypto (AVAX) used for?

In this section of our Avalanche guide, we are going to check out what is Avalanche crypto (AVAX) used for.

We are going to see the potential use cases and also the currently available implementations of the Avalanche Blockchain.

1. Blockchain Interoperability

Like Polkadot, Avalanche has the means to have interoperable chains under its main chain.

It is made up of a heterogeneous, interoperable network of many subnets.

This comes in handy for addressing future crypto and the industry networks, as new problems come into the market which can't be addressed with existing subnets or chains under the main chain.

2. Scalable Blockchain Service

Financial networks, markets and asset services require their blockchains to be scalable.

Unlike Ethereum, you will find that Avalanche makes use of a scalable subnet network of chains.

This allows adjusting to the demands in the market, as well as any transaction variances.

The current usage scenario shows Avalanche crypto is much more scalable than Ethereum for asset and financial transactions.

3. Financial Gateway & DeFi

Avalanche has been proposed as a gateway for various financial services and markets.

A lot of interchain financial transfers and asset transfers through DeFi and CeFi market would be possible using the AVAX token.

Unlike Ethereum and other smart chains, you would find Avalance would make this possible without much transfer fee between the two parties.

This is also useful in the DeFi and CeFi markets.

4. Platform Development Support

Avalanche has a program called Avalanche-X that is designed to create grants for developers to create avalanche platform specific products.

This is for encouraging more developers to create products that could benefit platform users and investors without starving the developers.

5. Store of Value

The AVAX token itself does not have the means to be used as a currency as of yet due to capped supply and inflation limitations.

However, the potential store value would be for the validators who stake the coins for the internetwork usage, DeFi and stakes.

This is what creates value in the network and market.

6. Web3 Development

Blockchains like Solana and Polkadot present themselves as a means to develop the Web3 internet chains.

Avalanche too has the features and means to become one of such chains.

It offers interoperability, scalability and customizability for the development of the decentralized web.

7. Trading Assets

Avalanche was designed with trading in mind.

The complex rule sets for NFTs, digital assets and markets can be set up for each use case.

This comes in handy when you want to run either CeFi or DeFi markets on the top of such chains.

This also means regulation and compliance can be enforced in such tradable assets markets.

8. Cross Chain Bridge

We previously discussed the interoperability in the chain.

However, the Avalanche crypto network is capable of creating bridges onto other chains like Ethereum, by making use of the external EVMs forming a bridge.

This solution forms bridges and converters.

In turn, one can interact with chains like Bitcoin, Ethereum and other blockchain networks.

Concluding what Avalanche crypto is used for

Avalanche is one of the blockchains that has managed to achieve a higher number of transactions per second.

It can be used to replace existing chains that are rather slow and transaction wise, expensive like Ethereum.

Considering it has no limit on available subnets and is also secure when it comes to on and off chain connectivity, Avalanche crypto can be used in many financial and non-financial products or dApps, while addressing the various use cases we’ve talked about above.

7 random facts about Avalanche (AVAX)

1. PoS Consensus: Avalanche uses Proof of Stake (PoS) consensus which is quite unique in the sense that it combines all the benefits of Nakamoto consensus and Classical consensus. It is faster, more secure, and eco-friendly as compared to Proof of Work (PoW) used by Bitcoin Network.

2. Decentralization: Avalanche Network can scale to millions of validators securing the network and participating in consensus for every transaction. It's great for decentralizing the network even more. This aspect is missing in many of the present blockchain networks.

3. Security: The network is resilient (up)to 60% malicious attacks. As the number of validators increases, the platform will become even more secure.

4. Performance: Avalanche network can process 4500+ transactions per second. This number is comparable to VISA which claims to handle around only 1700 transactions per second.

5. Fees: Avalanche uses a trichain blockchain system. All transactions that happen on C-Chain are charged a dynamic fee. Check out Avalanche fees in their documentation. Moreover, anyone can create their own blockchain by paying a subscription fee.

6. Tokenomics: $AVAX has a fixed capped supply of 720 million, creating a scarcity element for the token which is missing in other blockchains with high inflation in supply. 360 million tokens were minted at launch (with vesting periods between 1 and 10 years) whilst the other 360 million are used for rewards for staking released over decades. With each transaction, the fee charged by the network gets burned to put $AVAX out of the supply forever. A huge benefit for the current stakeholder. Buying pressure on the token can increase over time with adoption.

7. Customizability: Avalanche also allows the creation of unlimited no of. customized, interoperable blockchains. A subscription fee is charged in $AVAX which is burned as well.

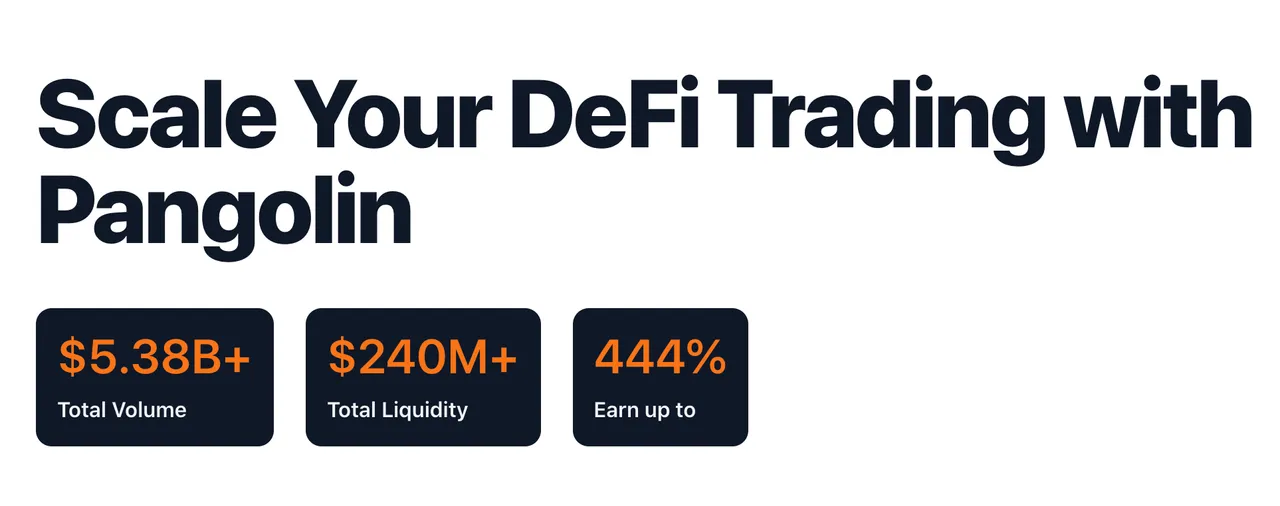

What is Avalanche's Pangolin DEX?

With the Avalanche blockchain gaining popularity, we take a look at the newly launched Pangolin DEX and PNG token.

Pangolin is the biggest and most popular decentralised exchange built on the Avalanche blockchain.

You can think of Pangolin as Avalanche’s answer to Uniswap, running the same automated market-making (AMM) model.

But while Pangolin is built on Avalanche, it is actually fully compatible with Ethereum assets.

It is just a faster, cheaper, fairer decentralised exchange that can offer traders new opportunities to find and maximize their yield.

In this subsection of our Avalanche crypto guide, we continue to discuss the Pangolin Exchange itself before diving into Pangolin’s native PNG token.

The Pangolin Exchange

Launch the Pangolin DEX itself by clicking the exchange tab at the top of their website.

If you’re familiar with BSC, Polygon and the like, then Pangolin is actually really easy to use with MetaMask.

Create an Avalanche wallet and then follow this official tutorial to set up MetaMask for use with the Avalanche network.

It’s worth noting that Pangolin therefore also supports MetaMask compatible devices like Ledger.

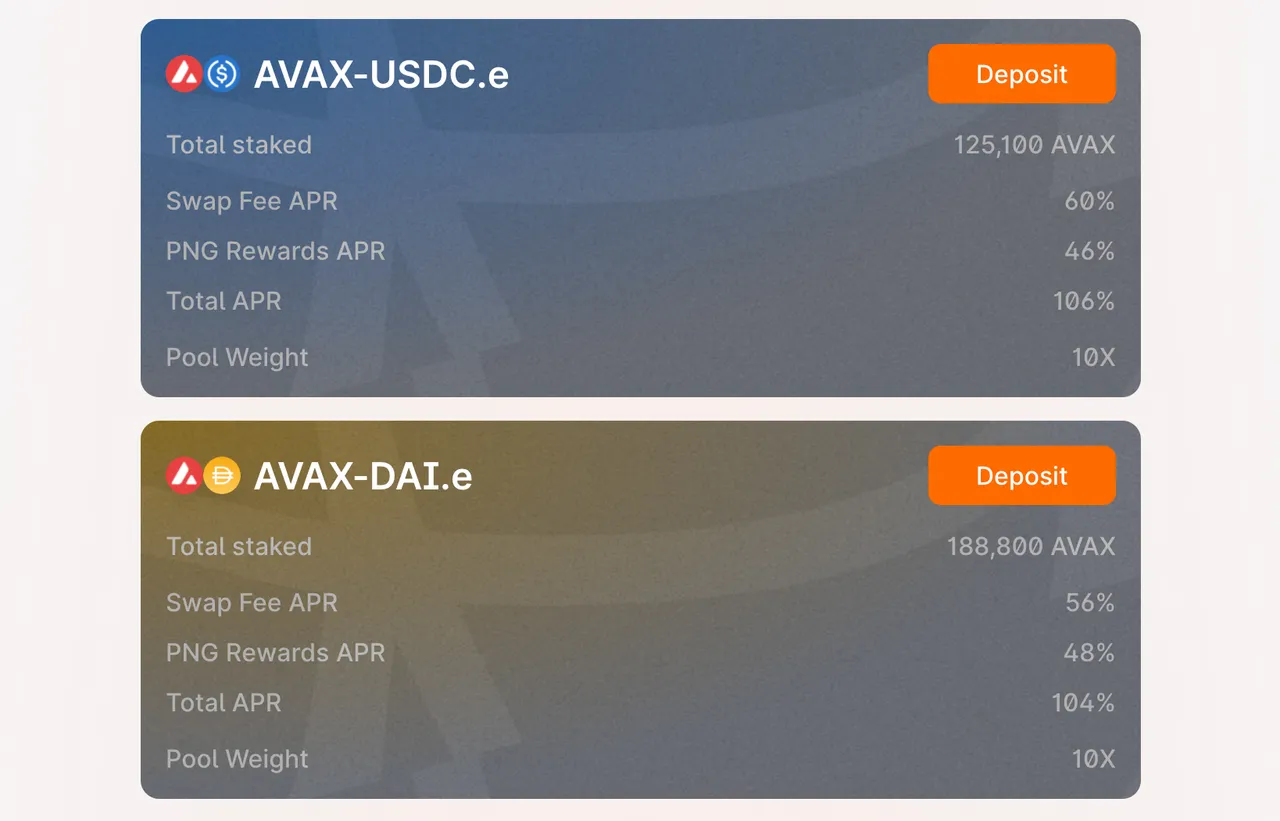

Once you’re in the Pangolin app, check out some of the pools offered and their APYs.

Some of the PNG-incentivised pools offered in Pangolin have some pretty juicy APYs, especially on stablecoins.

When it comes to fees for trading on Pangolin, there is a 0.3% liquidity provider fee for each completed swap.

Not bad at all in the grand scheme of things.

Pangolin’s PNG token

PNG is the governance token of the Pangolin DEX.

This means that alongside providing liquidity on the decentralised exchange, holders of PNG tokens can also vote on proposals.

Acting as a governance token, PNG allows the community itself to drive the direction of the project.

Exactly what you want to see from a decentralised project.

Now, remember above when we mentioned that one of Pangolin’s strengths over Uniswap is that it’s fairer?

The fact that no PNG tokens are reserved for the team means that Pangolin remains entirely community-driven, democratic and ultimately as fair as you will get.

That’s right, there are zero allocations to the team, advisors, investors and insiders.

Users with skin in the game have all the control when it comes to driving direction and development.

For more info on tokenomics and price stats of the PNG token, we recommend checking out CoinGecko as always.

Still room for price to grow?

We’ll leave that decision up to you.

Avalanche (AVAX) vs Ethereum (ETH)

In this section of our Avalanche crypto guide, we are going to compare two blockchains:

- Avalanche (AVAX)

- Ethereum (ETH)

Avalanche vs Ethereum comparison table

This guide is meant to show you an unbiased feature set comparison of these 2 blockchains in thediscussion.

The below table shows you the comparison points between each.

| Avalanche (AVAX) | Ethereum (ETH) | |

|---|---|---|

| Avalanche project launched in 2020 and the mainnet was released in Sept. 2020. | Ethereum whitepaper was released in 2013 and the mainnet went live in 30th July 2015. | |

| Avalanche has 720,000,000 tokens in supply and the current 70,000,000 are in circulation. | Ethereum has a $365,186,415,050 coins in Supply while 117,046,619 coins in circulation. | |

| Avalanche has Proof of Stake based it's own modified consensus algorithm which makes use of traditional stake along with Nakamoto based stake as a part of algorithm. | Ethereum currently is making use of the Proof of Work as it's consensus algorithm but in near future it may likely to make use of the proof of stake consensus. | |

| Avalanche allows smart contracts, dApps and migration of smart asset on it's chain. It is designed to be a marketplace for DeFi like applications on it's blockchain. | Ethereum supports the EVM through which various layers of the dApps, smart contracts and the DeFi applications can be deployed. | |

| Avalanche allows making use of the existing virtual machines that includes - EVM, WASM and BTC and they can even create their own blockchains on the chain. | Ethereum allows the layer 2 solutions on it's EVM and also allow feature to create your own tokens or the chain on it's chain. | |

| Avalanche can make use of the Solidity for creating it's smart contracts, NFT, DeFi and other smart assets. It also supports go, javascript as a side languages to use on it's chain. | Ethereum makes use of Solidity as it's base language. While there are libraries written in Python, Javascript, Go for developing dApps, smart contracts on EVM. | |

| Avalanche has more than 10 million nodes which currently records the TPS of 11,000+ transactions per second. | Ethereum has 25 to 30 TPS per second which is currently one of the issues getting the ETH to scale in comparison to other chains. | |

| Avalanche like Polkadot allows the public and private chains on it's chain as it was designed with financial markets in mind. | Ethereum does not have the parachain mechanism for distributing the transactions like Avalanche or Polkadot. | |

| Avalanche chain makes use of Slash-Snowflake-Snowball-Avalanche consensus for it's governance model. This way 51% attacks can be handled in the network. | Ethereum suffered with the 51% attacks in 2020 and since then it has being tweaked to prevent and adjust to such attacks in near future. | |

| Avalanche has a use case in financial networks, asset movement and transaction management suitable for payment gateway market. It's even suitable and preferred solution for financial DEFI and dApps. | Ethereum has an EVM which makes it's use case from currency to the NFT, Digital asset, dApps, DEFI and other extended solutions. |

Should you choose Avalanche (AVAX) or Ethereum (ETH)?

Avalanche was designed with the financial industry and the asset market in mind.

Like Polkadot, Avalanche has the means to take care of sidechains, while not compromising the speed and the security of the transactions.

Ethereum on the other hand appears like a supercomputer that has the capability to address different solutions to the problems in the crypto industry.

The only limiting factor being Ethereum is slower than the Avalanche network.

For the asset developers, financial market and the DEFI solutions the Avalanche network seems to be offering a better solution with a faster and more secure network.

Meanwhile, Ethereum continues its journey with NFTs, dApps and other consumer-centric solutions.

Avalanche crypto (AVAX) pros and cons

Avalanche has been billed by many as a 'platform of platforms' as its protocol easily permits the creation of application-specific blockchains, in virtually any form chosen by the developer.

Additionally, by availing itself with Avalanche, the newly created blockchain may share and benefit from Avalanche's unique consensus mechanism.

In this subsection of our Avalanche coin guide, we investigate the pros and cons surrounding the project to gain valuable insight into the viability of this protocol.

Avalanche crypto pros

- Both public and private blockchains can easily be created on Avalanche which are readily customizable, secure and reliable.

- New networks with specifically designed specifications for validators may be created allowing for the construction of new assets (of any type).

- Ultra high speed of transactions and scalability are present benefiting Decentralized Applications.

- The Avalanche ecosystem supports a high trading volume for Decentralized Finance providing speeds of 4500 trx/sec.

- The Avalanche Consensus mechanism is based on a hybrid Delegated Proof of Stake (DPoS), which is much faster than PoS and PoW.

- The Consensus mechanism of randomly sampling of nodes is unique in determining system agreement.

- Network validators exhibit great influence within the ecosystem in the area of deciding the validity of transactions.

- System throughput is demonstrably high and efficient as a result of the consensus system utilized all without sacrificing decentralization.

- Launched in February 2021, the Avalanche-Ethereum Bridge is a two way bridge allowing the transmission of ERC-20 and ERC-721 transfers interchain.

- Due to the consensus mechanism utilized by Avalanche, the high throughput levels make Avalanche an excellent payment platform in the cryptosphere.

- There exists a fixed capped supply of Avalanche coins available so scarcity is built in for price appreciation.

- Many of the ecosystem fees generated are burned thereby further reducing coin supply in the market driving price.

- Staking rates paid on Avalanche coins are market competitive.

Avalanche crypto cons

- Transactions may be delayed if validators fail to reach an agreement on transaction status.

- When conflicting transactions are present in the consensus mechanism, a liveness guarantee is absent. "The liveness threshold is the number of malicious participants that can be tolerated before the protocol is unable to make progress". [Avalanche. Avalanche Consensus. (Accessed September 7, 2021).

- Due to the fact that the Avalanche coin is not inflationary biased due to the capped supply, it does not meet the conditions necessary to be used as currency.

- Theoretically, Avalanche as an alternative to Ethereum looks real good, but we will have to see how its technical prowess plays out in real world applications - in other words, Avalanche has yet to prove itself.

Are there more Avalanche pros or cons?

A quick review of the above shows that with respect to Avalanche (AVAX), the 'pros' (in number) appear to outweigh the 'cons'.

Just because the sheer number of 'pros' outweigh the number of 'cons', this fact alone in no way implies the 'cons' should be ignored or are de minimis.

As with any investment decision, you must first assess your present financial condition, your overall investment strategy, as well as your tolerance for risk.

Armed with this information you should then follow a path of doing your own diligent research into the asset being considered.

With all of this information assembled you are finally ready to make your ultimate investment decision.

And finally, please remember, never invest more than you can afford to lose.

Should I buy Avalanche crypto (AVAX) in 2023?

In summary, Avalanche crypto is an open-source, programmable smart contracts platform to create Decentralized Applications.

It was founded in 2018 by Ava Labs, led by Emin Gun Sirer who is currently serving as a Computer Science professor at Cornell University.

The main network was launched in 2020 and they got funded with over $60 million in the Initial Coin Offering (ICO) campaign.

$AVAX is the native token of Avalanche which is used for staking, payment of fees, and peer-to-peer transactions within the network.

It is also used as the base unit for the blockchains created on the Avalanche Network.

Our Avalanche crypto guide has hopefully helped you learn more about the Avalanche network and AVAX token.

But let’s finally get into whether AVAX is a good investment or not.

Should You Buy AVAX in 2023?

Avalanche is a relatively new blockchain network in the smart contracts space and it has grown rapidly.

AVAX's demand and usage are increasing with the growing number of dApps catering to DeFi and NFT markets.

There is a huge growth potential for the project since it provides a better user experience when you compare it with the competitors like Ethereum, Polkadot, Cosmos, Polygon, etc.

It is capable to scale at one trillion transactions per second which are speeds not offered by other blockchains.

Due to its fee-burning mechanism, the current token holders get benefited because the supply can go very low over time.

At the time of writing, more than 227,194 AVAX have been burned and that number is increasing rapidly.

Is AVAX a good investment?

Yes, depending upon the developers if they manage to live up to the expectations listed in their roadmap.

Fundamentally, Avalanche has aced all the pain points of current users and investments.

Recently they expanded into DeFi with a campaign they’ve called AvalancheRush, a $180M liquidity mining incentive program in collaboration with leading DeFi like AAVE and CUVE.

Before this, an Ethereum bridge to Avalanche was created for easy asset migration.

Is AVAX a risky investment?

Yes, because it is a fairly new platform and there are so many projects out there with as strong fundamentals as Avalanche has.

If you are thinking to invest then maximise your earnings by Staking Avalanche and delegating it to validators for rewards.

We hope this guide to Avalanche crypto helped you to make a better-informed decision on what is Avalanche and its native AVAX token.

LeoFinance Crypto Guides.

Why not leave a comment below and share your thoughts on our guide to Avalanche crypto (AVAX)? All comments that add something to the discussion will be upvoted.

This Avalanche crypto guide is exclusive to leofinance.io.