Some loves to pay taxes and believes it's the right thing to do, others are against it. This is not about right or wrong, and it's not a debate about taxes being good or bad. This is only to "ventilate" my tiny bit of frustration and the poor rules and regulations we have in Sweden regarding crypto taxes. It feels like we are years behind..

- We pay 30% taxes on our profits.

I don't know if that is high or low compared to other countries, but I personally think it's fair to pay 30% on our profits. Especially as I pay 33% taxes on my salary.

However, things aren't that easy...

Well, it could've been, if I didn't use Hive, and never had used it.

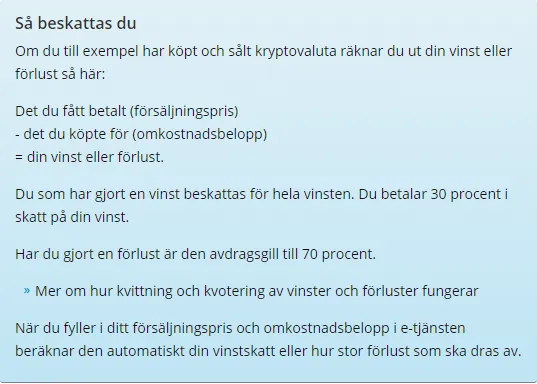

This is from Skatteverket. The swedish tax agency.

I'm a bit lazy so I'll just translate this part using google translate, and here's the result:

For example, if you have bought and sold cryptocurrency, calculate your profit or loss as follows:

What you got paid (sales price)

-what you bought for (overhead amount)

=your profit or loss.

You who have made a profit are taxed for the entire profit. You pay 30 percent in tax on your profits.

If you have made a loss, it is deductible to 70 percent.

That doesn't sound too bad... But that's not the problem. The problem actually begins before that part. It begins straight from the start when we see this:

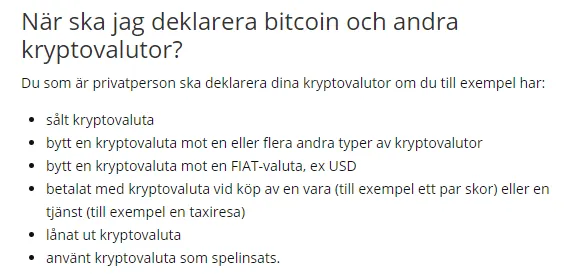

So, google translate, here we go!

When should I declare bitcoin and other cryptocurrencies?

If you are a private individual, you must declare your cryptocurrencies if, for example, you have:

sold cryptocurrency

exchange a cryptocurrency for one or more other types of cryptocurrencies

exchange a cryptocurrency for a FIAT currency, ex USD

paid with cryptocurrency when buying a product (for example a pair of shoes) or a service (for example a taxi ride)

lent cryptocurrency

used cryptocurrency as a gaming stake.

Perhaps you can't see the problem I'm talking about... And Skatteverket is actually really good at not sharing the exact details. Let me explain this further..

Like I stated at the top of this article. We pay 30% on our profits. It looks like this:

If there is a capital gain over the year, 30% tax must be paid.

However, this is the "fine print" so to speak:

This means that every transaction when trading, exchanging or using cryptocurrency when purchasing products must be stated.

There you have it. The big and extreme problem. Especially when you use Hive (or STEEM) and live in Sweden. If you want to pay taxes...

It's rather easy to calculate the amount of Hive you paid for, and if you made profit or not.. But it's more or less impossible for "Bob" or "Alice" (Lars or Erik as they would most likely have Swedish names).

- Why would it be so difficult for those people to pay taxes?

Because every transaction have to be included, calculated and paid for. You are likely not a stranger to Hive and how the rewards works, but regardless, we have both curation rewards, author rewards and we can also see this text in our wallets:

"HIVE POWER increases at an APR of approximately 3.42%"

On top of those things, we have transfers to and from accounts on more or less a daily basis. Some have more and others less obviously. What we have to do, is to know the exact value of the tokens when we make the transfer. That's the information we need to give Skatteverket.

So, for instance:

If I have published an article and have 10 Hive in pending rewards, I need to know the price of Hive when I receive those rewards, as those rewards will give me more Hive than I previously had.

It doesn't even matter if that specific transfer means a profit or loss at that point. I just need to know the price of Hive for each transfer. So, you can probably see the huge issue if we take curation rewards into account?

Not only do I have to track the incoming author rewards, I also need to know the price of Hive for each curation reward I earn. For each transfer.

Hey, wait!

You said: "trading, exchanging or using cryptocurrency when purchasing products"?

- Exactly.

And here's the funny part about that. Rewards on Hive are not trading, but it goes as exchanging, because it goes from one hand to another. Who's hand it goes from doesn't matter. So it doesn't matter if it's from a reward pool or a person.

That's all there is to it. Skatteverket calls it exchanging, and because of that, you are basically fucked as a Hive user in Sweden if you want to pay taxes and if you want to do the "right thing".

Just think about how things are if you are being rewarded leo, neoxian, stem, pal or any other token on top of that..

Let's end this with a note:

The penalty for serious tax evasion in Sweden is imprisonment. A minimum of six months and a maximum of six years.