Inflated Price of SBD

Hasn't it been a massive boon for Steem holders that SBD has been trading so highly? Hasn't it?

..Has it? Steem completely failed to translate the high SBD price back to high Steem price. Over the entire bull market, SBD has soared but Steem failed to get anywhere near its ATH set in January 2018, or even the original peak from 2016. Now with the bull market over, Steem and Hive token prices trading blows, the chickens are coming home to roost.

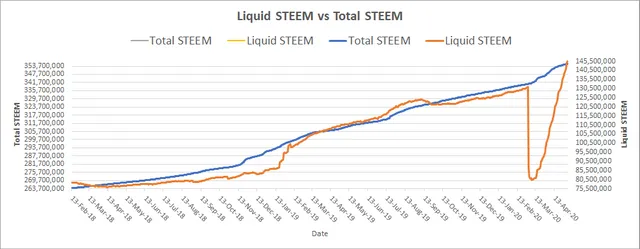

History of Steem Inflation

In 2018, the SBD supply just continued to grow until low SBD demand meant low prices and high rates of conversion, alongside low prices of Steem. In 2019 Steem inflation grew at a rate way beyond the scheduled rate, upwards of 20% per year at the highest rate. This was caused by the build up of SBD debt during the 2017 and 2018 bull runs. At low prices of Steem - the network could not handle the debt burden and experienced massive inflation. It was somewhat slowed down when it hit the debt limits such that it ceased to print SBD, and the SBD haircut limit, but inflation continued to be very high even into 2020 after the chain had forked into two branches.

^Source: @socky

Current Outlook

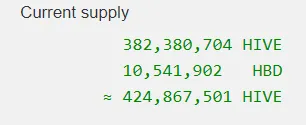

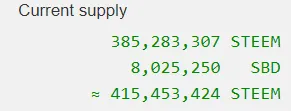

A casual look at hiveblocks.com and steemd.com might make it seem like Hive has more debt than Steem. After all, just compare the supply of HBD to SBD, and the virtual supply of each.

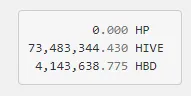

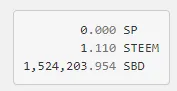

Given that HBD and SBD amount to debt for Hive and Steem holders, it looks pretty bad for Hive, with over 10 million HBD of debt outstanding. However - not so fast, this is ignoring the extremely important factor of the DAO. @hive.fund on Hive and @steem.dao on Steem.

When you factor out the balance of the DAO's, Hive has $6,398,264 in debt and Steem has $6,501,047 in debt. That again, might make it seem like they are in similar positions - but it's still not really factoring in the difference between Hive and Steem DAO's.

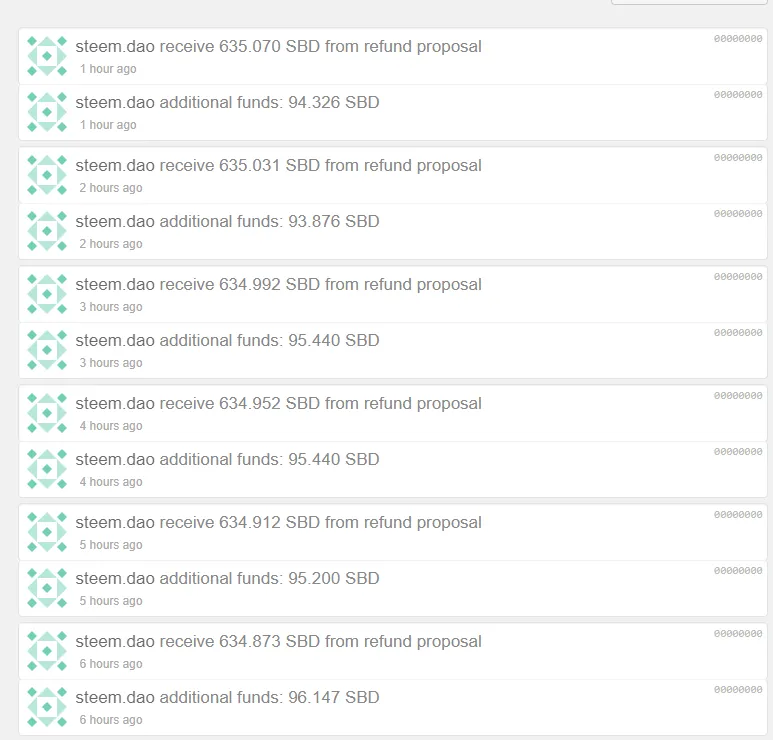

Steem DAO is totally inactive and has missed out on the recent developments which Hive has made. It literally makes no payouts at all.

In contrast, the Hive DAO in conjunction with HBD stabilizer is actively managing the debt of the Hive blockchain. Instead of waiting for the price of SBD to collapse below $1 and conversions to happen en masse, at low Steem prices, Hive is converting HBD from the DAO to settle debts now - before they become a debt-fuelled inflation crisis. In fact in doing so it can reduce inflation further by making a profit on conversions and sequestering that profit in the DAO.

Staking HBD in savings is also being made very attractive, to increase demand for HBD, and successfully stabilizing the token will increase the natural demand for a stablecoin, which is much more useful for actual commerce, as well as shelter from crypto bear markets.

To replicate this - Steem would need to implement hard fork changes, and there is no development going on at Steem at all.

Conclusion and Prediction:

High SBD prices have allowed a build up of debt on the Steem blockchain without transfering value to Steem and without repaying the debt as the price of Steem declines. There will be no repaying of that debt until the depths of the bear market. How low will Steem price be then, how many Steem will need to be printed per Steem Dollar?

SBD prices will not stay inflated forever. In the last two weeks they have dropped over 50% in price. Once SBD prices drop below $1, it will start to be an enormous debt burden on the Steem blockchain. I expect very high rates of inflation, approaching 20% per year or even higher.

In contrast, Hive should start to experience inflation sooner, but by converting sooner and sequestering profits in the DAO, it will create less inflation overall, and we may even see periods of deflation again.