Nigerian citizens cannot get enough of cryptocurrencies, despite the efforts of the national bank. As you know, the Nigerian government is doing everything in its power to suppress and make impossible the local cryptocurrency ecosystem. However, their efforts have so far failed.

The cryptocurrency market is booming, and the head of state power is growing. That's the situation in a nutshell, but let us dig deeper.

Last month, peer-to-peer (P2P) BTC trading volume, i.e. direct, private-to-private BTC trading, reached its second strongest level ever. P2P exchange platforms became very popular in Nigeria after the government banned the trading of cryptocurrencies in February this year, which backfired and pushed the public even more towards cryptos.

Image source: https://ftnnews.com.

During the period, by the way, the purchase price of bitcoin in the country was trading at a premium, as some would have bid up to $72 000 USD for a unit, which is $8 000 US

D more than the world's peak price. However, the regulation only applied to banks and other financial institutions, not to transactions between individuals, which would be impossible to regulate in any meaningful way.

The authorities tried to save the day in May 2021, when the CBN (Central Bank of Nigeria) announced in an official statement that it would henceforth allow trading in digital assets.

Nigeria's strange internal affairs

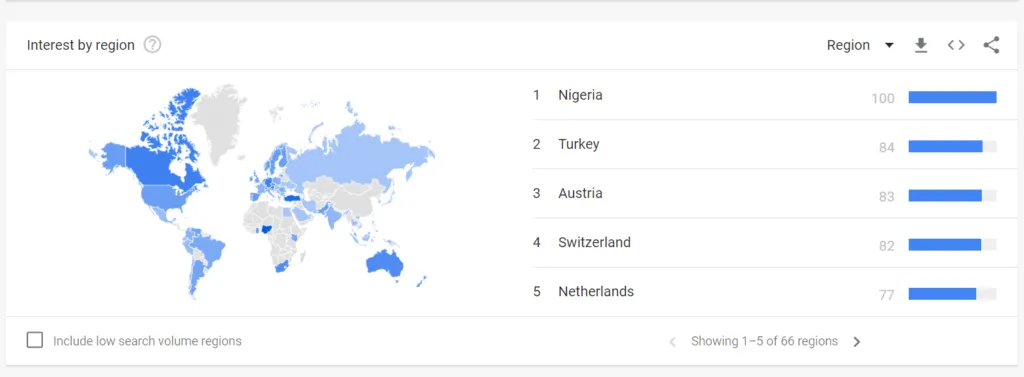

Now let's jump back to the present. According to the latest data from Google Trends, Nigerians are still the most searched for "bitcoin" in the world. Moreover, in the P2P market, Nigeria is only overtaken by the United States, which has the second largest exchange.

Google Trends - Searches for 'bitcoin' by country over the past 12 months.

As a result, P2P volume in the sub-Saharan country is the highest in the world, at $18.8 million per week. In the US, the volume was $18 million last week.

The ongoing political and economic crisis in the country is further fuelling the penetration of cryptocurrencies into the public consciousness. The brutal social repression and high inflation in this case are just fuel for the fire.

The Nigerian government's actions have been heavily criticised in the foreign press as well as in international politics, forcing the apparatus to change its attitude.

Despite their aversion to cryptos, the public administration has been toying with the idea of issuing its own digital currency (CBDC) for some time. At the end of July, the central bank announced that it would start live testing of the CBDC from 1 October.