It seems the Koreans are at it again.

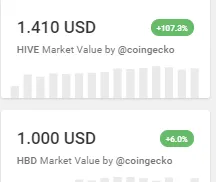

Here is what the price was at, according to Coingecko, just a few minutes ago. The market is very volatile right now so who knows what the price will be when you read this.

This is quite a jump from earlier in the day. We can see it is more than double where it was earlier in the day.

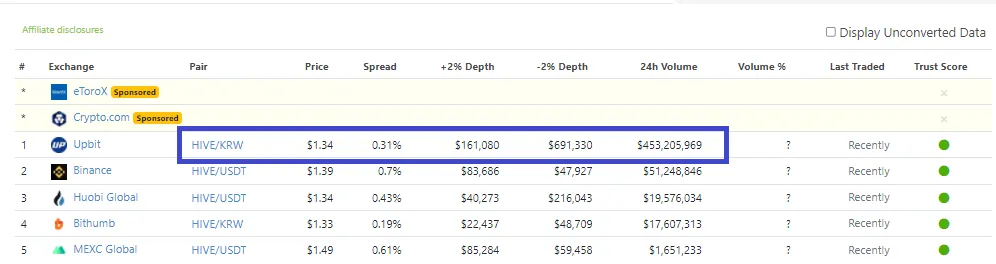

How do we know it was the Koreans? Other than the fact that they tend to do this periodically, we only need to look at the exchange information, again from Coingecko.

Look at the volume on Upbit compared to the other exchanges. This is most of the volume.

A Quick Trade

I tend not to do a lot of trading but, in this instance, I couldn't not pass it up. Fortunately, I had a couple thousand Hive in liquid form to take advantage of the pump.

What did I do?

I put in three different sell orders:

1000 Hive at $1.03 (1030 HBD)

500 Hive at $1.15 (575 HBD)

600 Hive at $1.19 (714 HBD)

All of these were done on the internal exchange on Hive.

This means I sold 2,100 Hive for 2,319 HBD. This puts my average sell price at about $1.10.

You will notice this pricing does not match what was on the external exchanges. That is how arbitrage opportunities arise. In this instance, I am not playing the game with different exchanges. Instead, my idea is to cash out the Hive to HBD and then wait for the inevitable dump to happen.

Since this is a situation that we saw happen many times before, I feel it is a low risk move. It is further mitigated by the fact that if need be, I would just move the HBD to savings and earn the 10% since building a stake in that area is what I am after.

However, that is not my main goal. This is one of the few times I am looking at this as a trade.

If the price of Hive drops back to about the 70 cent range, then I should be able to net 1,000 Hive by swapping the HBD I just picked up. That would be a bit over 40% if it works out that way.

Powder In The Keg

There is a saying among traders to always have some powder in the keg. In this instance, I was able to jump onto the trade since I had a couple thousand Hive liquid. This is the first lesson.

Secondly, being able to jump on the internal exchange made it easier to trade. I do not have an external exchange to trade upon so I was probably harmed by some of the lack of liquidity. Nevertheless, I did set my sell prices and eventually got them hit.

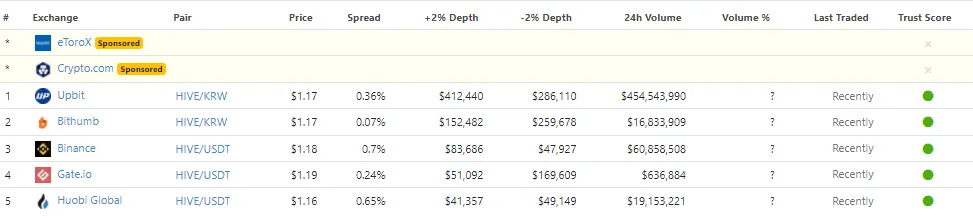

Also, never get too greedy. I did three separate trades, perhaps leaving some money on the table. As I write this, the price on Upbit is pulling back a bit yet is still strong on the internal exchange. Naturally, we can expect that to change if the dump keeps going.

In fact, here is the latest shot from Coingecko. We can see that Upbit came back in line with the other exchanges.

We will see how it goes over the next couple days. I believe, since this has all the markings of another pump, that we will see the price of Hive return to the range it was before the pump.

If that happens, this is a nice little trade. I will give it a few days to see where the price settles down at.

For someone who doesn't do a lot of trading anymore, sometimes fortune is tossed our way. Hive is the gift that keeps on giving.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z