With the completion of Hard Fork 25, things changed regarding the Hive Backed Dollar. This is something that garnered a great deal of attention of late, and for good reason. This token could provide a valuable service to the Hive community. For this reason, the attention is likely going to move things forward.

Source

Before going any further, it is good to look back. What exactly is HBD and what role does it serve? To do this, we refer to the Steem White Paper, last updated in August 2017. Obviously, we can swap the word "Hive" where "Steem" is.

Stability is an important feature of successful global economies. Without stability, individuals across the world could not have low cognitive costs while engaging in commerce and savings. Because stability is an important feature of successful economies, Steem Dollars were designed as an attempt to bring stability to the world of cryptocurrency and to the individuals who use the Steem network.

Steem Dollars are created by a mechanism similar to convertible notes, which are often used to fund startups. In the startup world, convertible notes are short-term debt instruments that can be converted to ownership at a rate determined in the future, typically during a future funding round. A blockchain based token can be viewed as ownership in the community whereas a convertible note can be viewed as a debt

denominated in any other commodity or currency. The terms of the convertible note allow the holder to convert to the backing token with a minimum notice at the fair market price of the token. Creating token-convertible-dollars enables blockchains to grow their network effect while maximizing the return for token holders.

This gives is a good overview of what the role of the token truly is. Notice how the main focuses is stability. This is something that we will refer to in a bit.

Let us start by looking at some of the changes.

HBD In Savings

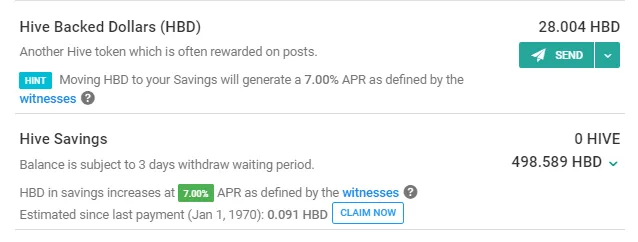

A short time ago, the Witnesses decided to pay interest on HBD. This was something that was referred to in the White Paper but never implemented. What started at 3% moved to 5% and now sits at 7%. In fact, if we look at the Witness page, we see a few of the consensus Witnesses already moved their node to 10%.

One of the biggest changes from the hard fork as it relates to HBD is that the interest is no longer on non-saved HBD. To earn the interest rate, the HBD has to be moved into one's savings. This prevents exchanges from earning interest for HBD on their platform as well as incentivizing people to hold HBD on chain.

The interest paid is an incentive to attract people to utilize HBD as an asset that will provide a return while trying to stabilize the network. The second part is crucial as we, ultimately, want this to be used for commerce and other transactional purposes.

Hive-to-HBD Conversion

The second feature that was added is the ability to create HBD. Now, anyone in the community can use the conversion tool to swap Hive for HBD (this is different than trading on the internal exchange). What this does is allows people to increase the amount of HBD by using this tool. Previously, one could reduce HBD by converting it into Hive but the reverse did not exist.

While this could possibly open up the door to manipulation, it does place control in the hands of the community. There are certain parameters in place if the ratio of HBD to Hive in dollar terms gets too high. In addition to this, markets can now arbitrage the situation in an effort to keep the peg in place.

For example, if the price of HBD moved to $1.20, then more sellers are brought into the market to take advantage of the profit situation, understanding that the price will end up drifting down. We also see the reverse happening, which will bring more buyers of HBD into the market as the price moves below the peg. Those looking to arbitrage bring a valuable service to the community and provide one leg of holding the peg.

Through the two-way conversion, the community can now control the amount of HBD that is out there. If it is to low, more can be "printed" by converting Hive while the previous tool allows for the lowering of the total. The HBD Stabilizer that is funded through the DAO can be programmed to work both sides as needed.

This puts one aspect of the monetary policy in the hands of the community.

Interest Rate

The natural inclination is for people to want the best interest rate possible. After all, this is the "age of yield farming". However, that is not sound principle.

Interest rates are established to reflect economic conditions as they present themselves. They are meant to be fluid as monetary and economic variables are always in place.

In this instance, the Witnesses have the ability to help the peg by adjusting the interest rates. We already see that the blockchain offers another leg in aiding this by cutting the production of HBD if the ratio crosses 10%.

Here again, if the rate starts to lose the peg on the high side, the Witnesses simply can lower the interest rate to make the holding of HBD less attractive. This will produce selling pressure, pushing the price down. The flipside also should be undertaken. If the peg is lost on the downside, increasing the rate of interest will stimulate buying, which will raise the price.

What is the proper rate? That will have to be experimented with. Either way, a range of where the token trades will likely be established and the Witnesses can simply adapt the rate of interest as both ends of the range are hit.

The idea behind the interest rate in this situation is to help keep the peg in place. It is not to provide the greatest rewards and incentivize people to swap their holdings to HBD. At times, that is the aim while others, the need is for people to dump some of their holdings.

Of course, this is only referring to the blockchain level. There is nothing preventing someone establishing an application that utilizes HBD and pays whatever percentage to have people staking. If one can set up a DeFi application that accepts HBD and can match or surpass the yield that other DeFi projects pay, then go for it. That would likely be a great business model and a major help to the ecosystem. Yet this is paid out in existing HBD (or whatever other token is used), not creating it like it does at the blockchain level.

Commerce

Which brings us to the end goal of all this peg stuff: commerce.

It is vital that the Hive economy start to build out its commercial purposes. That is where we can see the entire ecosystem flourish. In the age of networked economies, it is vital to get the velocity of money going. To do this, commercial applications have to be build and utilized. As more money is flowing through the system, the greater the value it will command.

HBD is essential for this since it can offer a consistent value of payment. One of the challenges within cryptocurrency is the fact that prices jump all over the place. This is not great for merchants who rely on the consistency that come from a stable currency. This is what was mentioned earlier.

The attraction to HBD is what is backing it. Many are question some of the stablecoins like Tether and is it really backed by a dollar. This is not even considered with HBD. What backs HBD? Simply it is $1 worth of Hive. There is no USD associated with it. That is just a numerical consideration that provides a basis people understand. How much Hive that is worth at each interval will vary since the price of Hive fluctuates. The greater the value, obviously, the less Hive per HBD.

Just keep in mind the two ways things can now go:

- 1 HBD can be converted for $1 worth of Hive

- $1 worth of Hive can be converted for 1 HBD

This is important because it shows the pair is not tied to USD but each other. Thus, if we get more commerce going using HBD, there is incentive to pull more Hive off the exchanges and have it on chain. Why? Because it is going to be needed to create more HBD. This should reduce the selling pressure on the open market, which will increase the price.

The key here is transparency. Anyone can look up the ratios of HBD to total market cap of Hive. At the same time, the actions of the Witnesses pertaining to the interest rates is available for all to see. We can also delve into the conversions that the community is doing. Finally, the price of Hive is set by the market, hence we know exactly how much Hive is equal to 1 HBD on conversion.

With the additional tools the community has to help peg HBD, this could be a major step forward. We could see the economy propelled forward by a stablecoin that is tied to the blockchain, avoiding many of the mishaps or questions that are associated with other stablecoins.

All of this is opening up many possibilities. We will see what the community does with this but the impact of HBD on the ecosystem could be great.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z