We all do our Investments in differnt cryptos to let our money grow and create wealth. In process we might comes across APY, which is common synonyms associated with Rate of Interest. Especially, in the crypto circle it is most frequently been seen while Staking or saving in any of the exchanges. I came across of it many a times but usually avoid to drill down considering it to be same things as simple rate of interest associated with any investments. However, It’s an important term to know for anyone focused on saving more money.

APY stands for Annual Percentage Yield. It is the projected rate of annual return on your investment. It is the amount of money,or interest, we earn on our investment over a period of time. APY calculate the total amount after taking compounding interest into account.

Compounding is an important tool in interest calculation to see our money grow faster. This is due to the fact that every time it compounds the interest earned over that period is added to the principal balance and future interest payments are calculated. I.e future interest will be calculated on Principal + Interest earned previously, rather than only on Principal amount. Comparing rates of return by simply stating the percentage value of each over one year gives an inaccurate result, and this is where compounding comes into play.

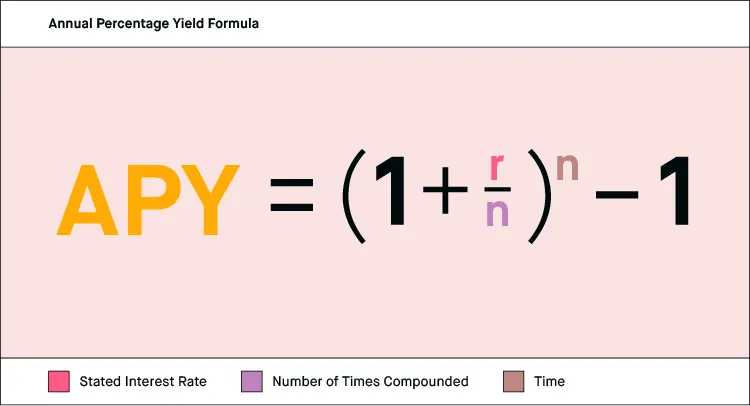

APY standardizes the rate of return. It does this by stating the real percentage of growth that will be earned in compound interest. Assuming that the money is deposited for one year. The formula for calculating APY is:

APY = (1+r/n)n - 1

r = rate

n = number of compounding periods.

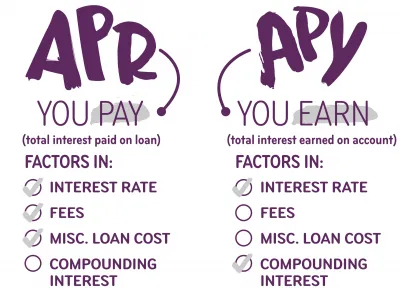

Here it is very important to differentiate it with APR. Both sounds to be similar and same however in actual there exist vast differences between APY & APR.

APR is also the annual rate of interest paid on investments without accounting for the compounding of interest within that year. APR is expressed as a percentage that represents the actual yearly cost of funds over the term of a loan or income earned on an investment

When the effects of compounding are included by calculating the APY on your investments, then the money market investment actually yields much more than what a normal rate of return would reap for you. It is quite a normal words still it is essential to let your money grow faster.