The past few weeks have been green, so green it feels like cocaine. While I am in the process of scrutinizing InvictusCapital to see if there may be an opportunity behind their products to realize some hedging for the future bear, my mind wanders again. I don't have a real head for a comprehensive DD these days. Work, albeit completely remote, is grueling - the addictive updating of my trusted portfolio tracking app offers single bright spots in otherwise routinely boring days marked by single spikes of stress.

But for the most part, these weekends have one thing going for them; memes.

After going through dozens of memes and having some smirking kick off my Sunday, I'd like to use this post to not only offer some Sunday entertainment, but also to somewhat describe my thoughts and impressions of the past few months.

But first I have to say a bit about my background. I've been active in the crypto market for over 4 years now - don't have a professional investing background - and have always held cryptocurrencies over that entire time - sometimes more, sometimes less. Over 2017 I made terrific "profits", some of which I never realized because otherwise I would not have been able to meet holding periods of one year. However, I could not complain. Sure, could have been more - but all in all I got out of the bull 2017/2018 very well and always kept an eye on the market. Over 2019 and 2020, I've started accumulating various positions again, most of which I still hold and can thus sell (at least for the most part) without incurring taxes. I will probably drag a part through the bear again - knowing full well that this will lead to red numbers at least in the medium term.

But so be it. So much for me.

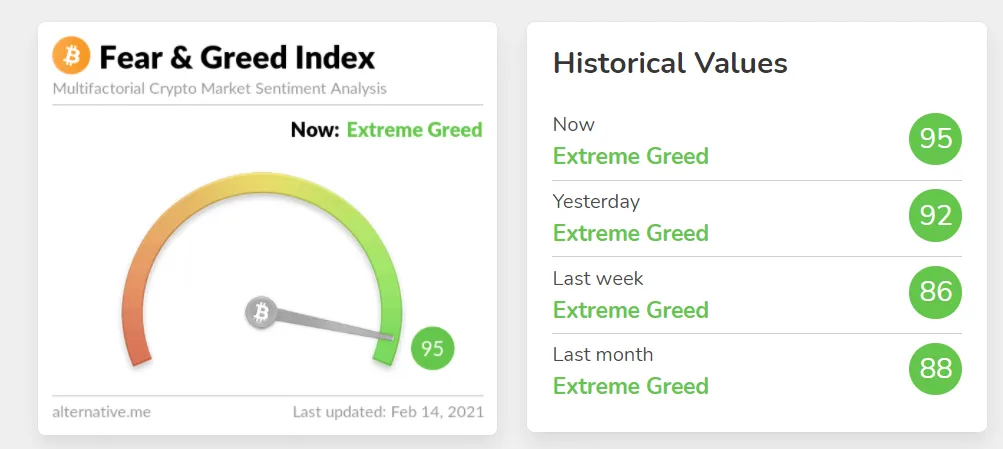

I notice it, you notice it - the days are euphoric. The candles are green, the memes are dreaming of Lambos. But the Fear&Greed Index maps in black and white what we're all feeling:

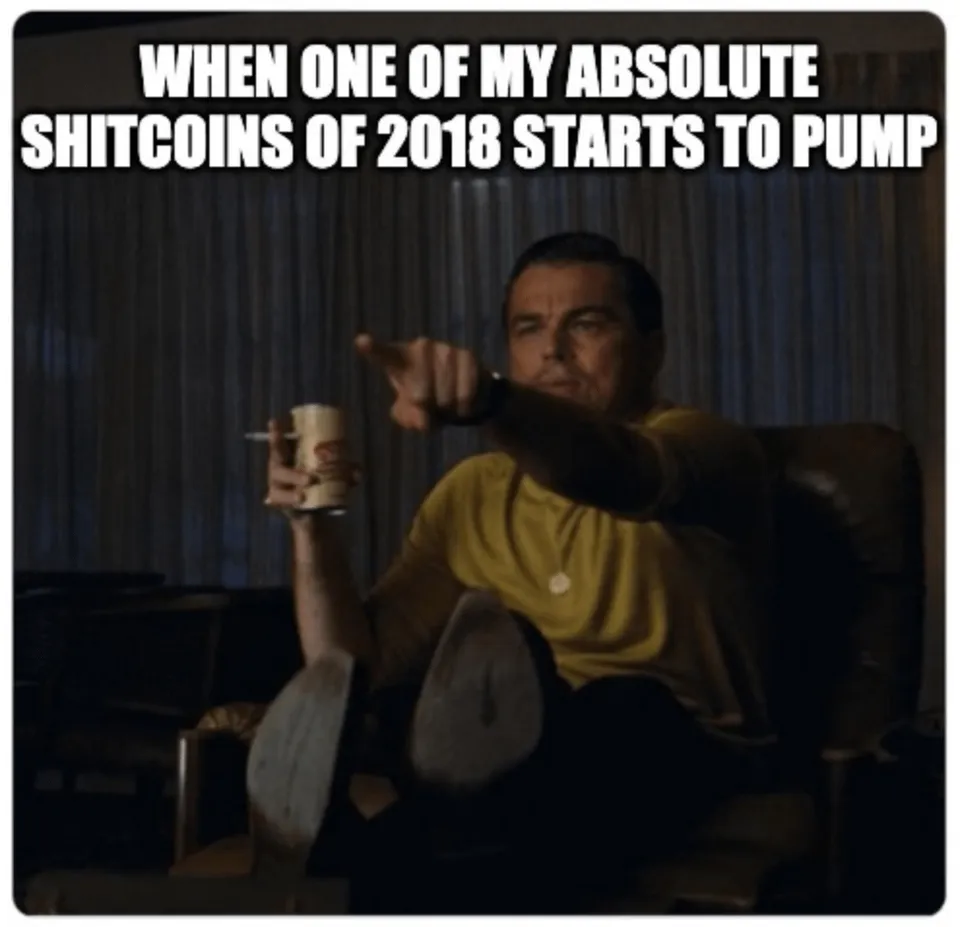

Greed is big young Padavan. They are popping up again everywhere - all the shitposts about some NonSense Coins. Flooded social media feeds with price predictions and pump&dump armies still chasing the last Shitcoin.

Let's be honest scouts, it does look that way with some ;) And the fact is that historically many of these badges have an expiration date. Some will meet again here - but no longer as newcomers, but possibly as veterans. Hand on heart, which "coin that was going to be the next big thing" does the meme remind you of?

I learned my lesson there. Fortunately with small play money - but somewhere I still have the NEO Wallet where these DBC are bumming. Rest in Peace!

Well, I have to admit, one or the other lucky strike was also there - I Gambler did not let me take it.

The last years should have helped some to a little more humility. Certainly, one or the other has understood that you do not necessarily have to be a genius to make profits in a bull market of this caliber. With the realization of the profits and the long-term preservation, it may already look partly different. For this reason also a suggestion. Let's do a test.

Consider this meme:

Be honest with yourself, are you the psyched cat who first sees gains in the triple digits within a short period of time and jumps in circles every day because of it? Let's get to the evaluation.

a) No: You've got this behind you. Congratulations! But remember, greed eats brains.

b) Yes: Then realize one thing. This is not an eternal climb to the sky. Markets still move down, too. If you have unrealized gains that have meaning to you, realize at least some of them. And don't overdiversify your portfolio. little bitcoin > 1000 different shitcoins. You're welcome.

Otherwise you might look more like that cat in the near future, and you don't want that:

Here's a little insertion - if you're going to buy shitcoins, do your homework. Otherwise, you might be investing in a triplet formation.

Just as a joke on the side.

At the same time, I'm not even saying that we're anywhere near the peak of this bull or anything like that. I can't at all and I don't think you should take too much advice from the people who claim to know. But well, what can I say. My strategy is not to explore the summit. I want to realize profits strategically and have prepared myself well in this respect by now. Accordingly, I can't give an outlook on how it looks like at the peak. I think I can, however, give an outlook on what it will look like after the peak.

For that, a quick look at this collection of headlines from r/CryptoCurrency from 3 years ago might be enough:

Yes I know, some are also saying "this time everything will be different, this time the institutions are on board". And I'll say one thing here, people said that in 2018 too. There they said now the volatility is gone, it's not 2013 anymore. Small hint, was not the case - but the case was hard (let's see if the pun works in English...). For me that means one should not give too much on this talk. Be that as it may. At the same time, I definitely don't want to convey the message that it might be too late to get into cryptocurrencies or even explicitly bitcoin. In the long term (5-10+ years), I see gigantic potential and only the first tracks in the snow. If you look at the adaptation rates of new technologies, you can see that the incubation period is quite long, but the spread (the mainstreaming of a technology) is accelerating exponentially.

At this point, my answer to the question whether it is too late to buy Bitcoin: No. A Reddit user describes his experience, which I think hits the nail on the head:

It's 2011, BTC has recently hit $32.

I tell myself "Damn...I should have bought some when it was $0.50 a BTC. $32 is too expensive. Guess it's too late to get into crypto." BTC later falls to $2 and I don't buy any.

It's mid-2013. BTC has recently hit $220.

I tell myself "Damn...I should have bought some when it was $32 a BTC. $220 is too expensive. Guess it's too late to get into crypto." BTC later falls to $70 and I don't buy any.

It's late 2013. BTC has recently hit $1100.

I tell myself "Damn...I should have bought some when it was $220 a BTC. 1100 is too expensive. Guess it's too late to get into crypto." BTC later falls to $315 and I don't buy any.

It's 2017. BTC has recently hit 20k.

I tell myself "Damn...I should have bought some when it was $1100 a BTC. 20000 is too expensive. Guess it's too late to get into crypto." BTC later falls to $3700 and I don't buy any.

BTC has recently hit $40000.

I tell myself....

How often have we heard in the past that Bitcoin is a scam, that Bitcoin is dead, that it has no future? The whole crypto market meaningless internet money with no real added value and no future. But I think we see that this is not the case. Everybody here got that Tesla invested in Bitcoin for 1.5 billion. Everyone has heard that Michael Saylor and his company MicroStrategy are absolutely behind Bitcoin. If you want more, I can only recommend this Medium article from MoneyBlocks:

Why Bitcoin And Crypto Have No Future

On the other hand, of course, not all that glitters is gold. A comparatively young market has to deal with teething problems, scammers are getting involved without being hindered by regulations and gold diggers are looking for their chance to improve their financial situation. Above we had mentioned DeepBrainChain. Another negative example of my crypto investmens is TenX. They had wanted to launch a credit card at the time and did (with a delay) - but it was worthless after a few weeks. Meanwhile ppl are talking about TenX being a Scam and my fortunately small investment vanished into thin air. Done with that.

Once again, back to the topic of being late. Sure, in retrospect you can always think woulda, woulda, coulda. But I tell you one thing, these are the thoughts of failure. The question is what is the future perspective. Is there potential for me as of today? My answer in terms of the crypto market, yes.

Maybe right now in this moment and in terms of your personal position, you are currently in the right place at the right time. Because in our retroperspective, we must never forget one thing: Who is to say that if you bought Bitcoin in the past, you still hold it today and can access it as well? Here's a quote from a redditor on this:

Sometimes I feel like I was very stupid not mining BTC when I first discovered it around 2011. I'd have made a lot of money!

However, the chance of getting REKT or wasting everything in the early days was very high:

- Just losing your wallet on an old computer because it was not valuable at that time

- Wasting it in non-valuable stuff (we all know the pizza guy)

- Being scammed in multiple places (it was wild west at that time)

- I would have probably lost everything in the MtGOX disaster

- I would have probably lost most of it day-tradng

That's why I would like to close this - hopefully nice - meme-interface with this message:

Don't chase short-term profit, chase the long-term. If you understand the idea of Bitcoin and Crypto, it is clear that this is far from the end. Recent activity tells me that it is increasingly unlikely that Crypto will be completely stifled or suppressed. And if it is, you're still at the beginning and possibly in the right place at the right time.

If you did not hear about it yet - Join the #Cryptohunt and solve this riddle to find the lost PrivateKey - 2 Weeks left.

Understanding blockchain? Let's play pack your bags

Michael Saylor's 15.000.000 USD BTC prediction

Global Cryptocurrency Adoption Index 2020: Look at Russia

What a bonsai tree has in common with financial success