DEFI is a wonderful thing - so many opportunties to stake your tokens in order to receive more of that token, or more usually, shiny new tokens.

And so many platforms offer you the opportunity to stake these shiny new tokens for EVEN HIGHER returns, again either in that shiny new token, or sometimes in other even newer or even shinier tokens, maybe even NFTs!

This concept of 'layered farming' is now a pretty standard practice in DEFI - it's fundamental to Cub Finance, for example: you stake something sensible like Bitcoin for a 10-15% return, you earn Cub (for example) and you are then tempted to stake the Cub for an incentivised return that's much higher - 70 - 80%, and then even higher returns of well over 100% for staking Cub with the very high market coins BNB and BUSD, for liquidity purposes.

And you see this EVERYWHERE, it has long been the norm on many platforms on Binance Smart Chain and Polygon.

Even with a legitimate DEFI outfit (ie one that isn't a blatant criminal rug-pull scam) there is a significant loss-risk associated with holding what I'm going to call 'layer two' tokens such as Cub - and of pooling them with higher market cap coins for those higher returns -

The loss- risk is much greater than holding or pooling at the 'layer one level' and just farming and selling the layer two tokens immediately simply because the ONLY function of layer two tokens tends to be to earn higher returns, and there is simply simply SO MUCH COMPETITION - so many other VERY SIMILAR PLATFORMS that have the same model that there's a lot of temptation to move on to the shiny new.

IN FACT this is PART OF THE DEFI GAME - timing how long one holds onto those layer two tokens and SELLING them all the right time, moving onto the next platform for higher returns for a day, a week, a month and then rinse and repeat.

The problem with this is that it's just exhausting trying to keep up with it, and increasingly we are seeing new platforms introducing bonus rewards for locking up tokens for longer periods of time.

Examples of Lock-Up Systems

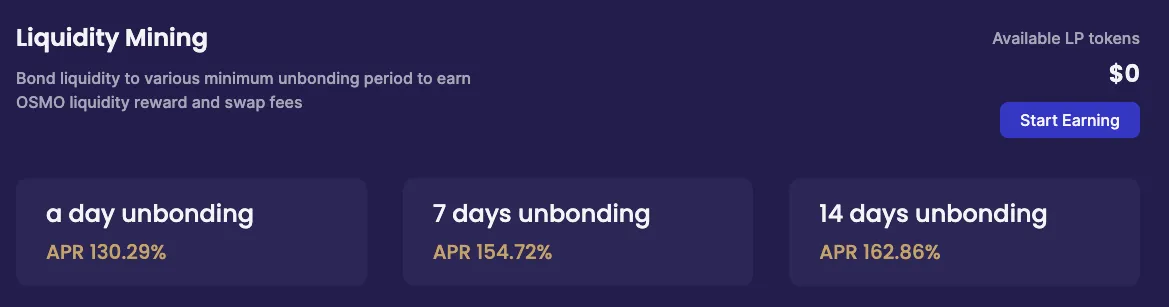

Osmosis has done this for example - you have the option of locking your tokens in for either a day, seven days or a fortnight - if you choose the later you get a higher rate of return, but when you click 'unstake' you won't get your tokens back for a fortnight.

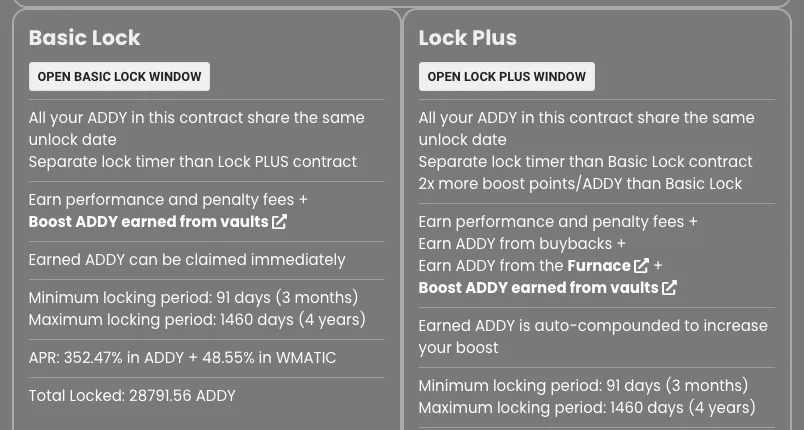

Adamant Finance has a much more 'robust' version of the stake and lock reward system - the ADDY you earn is automatically staked for 3 months with a 50% withdrawal penalty for taking it out before then, and then beyond that you can lock your ADDY in either a lock or lock plus system for up to four years for an almost 400% return.

A less well known example is Crypto Raiders - who offer a 30 to almost 200% return for staking RAIDER, AND more recently, and NFT drop on Raider stakers.

There are certain advantage of these longer lock-in times are

- It encourages more price stability, at least in the short to medium term, ASSUMING you check the current liquidity and token issuance policy first!

- It offers users the opportunity to show support for a project and commit to it.

- It's less mentally exhausting - once you've locked up yer coins, there's not a lot you can do about it!

The Downsides...

You have to check the token issuance policy and schedule and initial liquidity VERY carefully before you lock your tokens up for a longer period of time - it's probably not a good idea having your tokens locked up for 12 months if the lock on the initial IDO tokens releases after 6 months for example.

A month can be a long time in crypto, let alone a year or more - having your money tied up for that long can not only mean you miss out on many other opportunities yourself, it could mean that money stops flowing into the project you've got all your money locked into and into newer more exiting projects.

If you're locked in for a very long time..... market crashes, regulatory changes, there's more scope just for your investment to go tits down - at least if it were more liquid you'd have a chance of saving some of it if the crunch really came.

You also have to really trust the team behind the project - trust that they are going to continue development and make no major changes to the token issuance. The problem here is that things rarely run smoothly in crypto development.

I'm NOT that convinced that too much money is going to flow towards these 'lock-in' projects.... I mean just look at how resistant people have been to Powering up Hive with its 13 week lock-in.

Locking Up Your Coins - A Good Idea?

While I understand why Devs offer higher returns for locking up stake for longer periods, you need to check carefully that the benefits outweigh the risks, in fact I'm going to capitalise this - before locking up any coins for any period

YOU NEED TO CHECK THREE FACTORS VERY CAREFULLY....

- WHAT THE TOKEN EMISSIONS SCHEDULE IS

- WHO ALREADY HAS/ WILL BE GETTING THESE TOKENS

- HOW MANY TOKENS ARE ALREADY LIQUID.

If there's dump potential before you can unlock, avoid locking, whatever the promised bonuses for staking!