The World Rankings for crypto adoption by country have changed dramatically in the last year.

Countries in Africa and Asia have seen the most significant increases in crypto adoption since 2020.

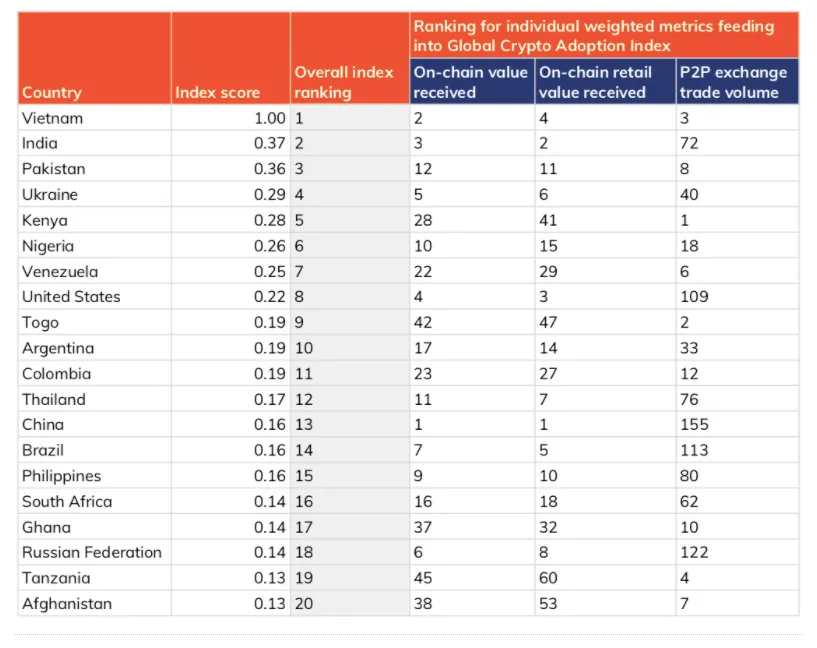

In the latest August 2021 Chain Analysis Crypto Adoption stats Vietnam, India and Pakistan are now in the first three places, with Kenya being ranked 5th. The first three countries were ranked 10th, 11th and 15th in 2020 respectively, while Kenya has retained its 5th overall position but is now ranked first in P2P volumes, up from 11th last year.

In the same period, The United States, China and the United Kingdom have all fallen a long way down the rankings, with the later now out of the top 20 altogether.

Overall crypto-adoption country rankings in 2021

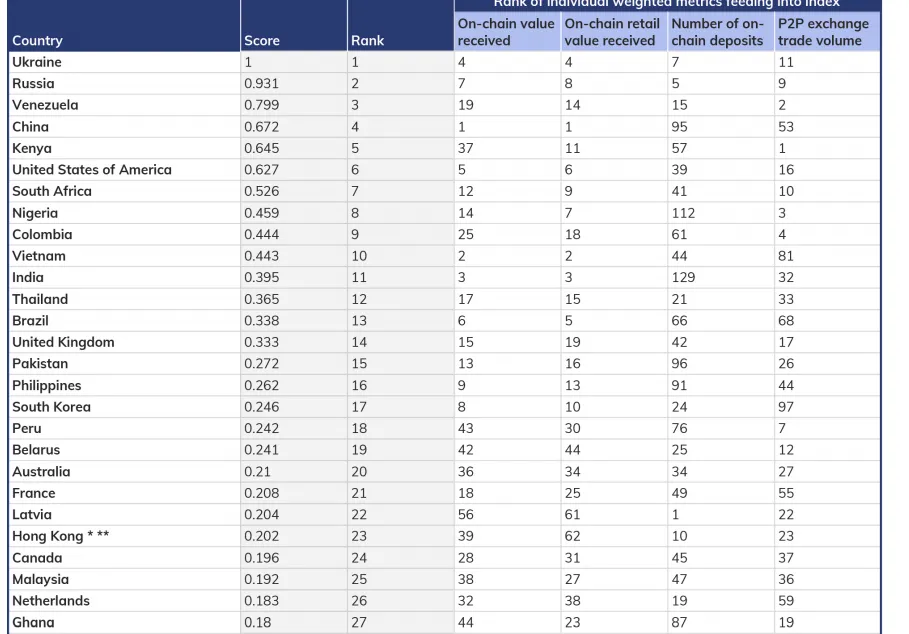

And last year in 2020

What's driving this change?

In terms of the pure rankings, it's mainly the changes in P2P volumes - If you look at the right hand column from the 2020 chart compared to that in 2021 you can see that many of the countries in the overall T20 in 2021 have very high rankings for P2P volume (which Chain Analysis modifies using Purchasing Power Parity BTW to take account of relative cost of living).

- Kenya (1)

- Togo (2)

- Vietnam (3)

- Tanzania (4)

- Venezuelan (6)

- Afghanistan (7)

- Pakistan (8)

- Ghana (10)

- Colombia (12)

- Nigeria (18)

Meanwhile for more developed countries regarding P2P usage:

- The U.S. dropped from 16th to 109th

- China dropped from 53rd to 155th

- The UK dropped from 17th to right off the chart!

These changing adoption trends are validated to an extent by a survey of new blockchain wallet creations conducted recently by blockchain.com, which found that India topped the rankings for the most rapid increase in the creation of new wallets, with Nigeria trending too.

NB - the two lists don't match up entirely, so there's clearly more going on than just revealed in the Chain Analysis data!

Why are we seeing increasing crypto adoption across Asia and Africa?

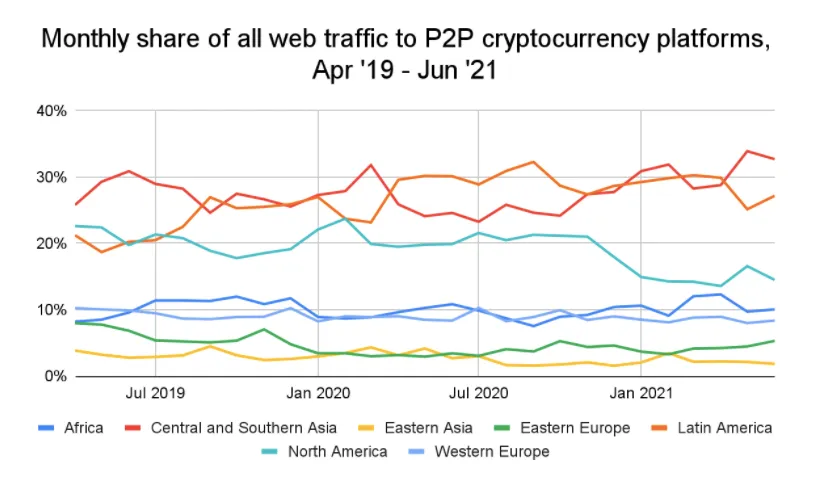

Chain Analysis reports that this growth is mainly driven by an increasing number of people using crypto for relatively small transactions, mostly less than $10 000 where P2P exchanges are concerned.

This chart shows the difference nicely by region:

This article from Quartz Africa suggest this is driven by two main factors

- everyday people trying to reduce the costs of sending remittances from abroad - the costs of transferring fiat currencies across borders tends to be more expensive to/ from and within Africa especially.

- as a way of hedging against the weakness of local currencies - or in other words hedging against inflation!

NB these are basically the same reasons for the widespread adoption of crypto in Venezuela, so either this is lazy analysis or we are seeing a general global trend here.

The rapid move towards P2P exchanges in Nigeria may well have also been fuelled by concerns about government regulation of crypto being ramped up.

Meanwhile in the UK, US and China, P2P dropping in signficance but retain their Top 20 presumably because of largeer investors moving on centralised exchanges/ insittions.

Exceptional India?

Interestingly India ranks very low on the P2P index but highly on the other two measures, suggesting maybe significant take up by billionaires and institutions, but not yet the ordinary people - but with such a large population and ETC things could be set to explode in India (regulating allowing).

Analysis/ Methodological concerns

These changes in rankings DO NOT mean there are now huge sums of money flowing through exchanges in countries which rank highly for P2P amounts, because all of these indicators are modified to take account of the cost of living (by factoring in Purchasing Power Parity).

So in this new 2021 top twenty list we've got an odd mixture of countries where A LOT of people are using crypto for small transfers - mainly those in Africa, Asia and Latin America, but with relatively low dollar volumes, and then we also have the US, China and Russia, where there is less use of P2P but in these countries i guess we've got the power users and the institutions adopting, which is why they feature in the top 20 still.

I'm not sure how useful it is considering ALL of these at once in one index... might be more interesting to focus on one at a time, depending on whether you're interesting in number of people using crypto (for smaller txs) or 'power crypto users' - based on sheer wealth.

NB - it's also worth noting that Chain Analysis removed one indicator from the index, reducing the count from 4 to 3 indicators, but the removed one was overlapping so this alone didn't change the results significantly.

Final Thoughts

This shift towards Africa and Asia has been rapid, and the stats seem to support the many pieces of qualitative, anecdotal evidence about the surging use of crypto in these regions.

This certainly seems to be a movement towards everyday people using crypto to empower themselves and protect their wealth and just keep money flowing in the midst of economic instability which is the case in so many countries.

As a final note, I think India is really going to be a country to watch as a future 'power use base' for crypto - with a well educated population, a functioning democracy, a global outlook, a huge middle class and lots of wealth conflated with lots of poverty, I'd be amazed if India doesn't hit the number one spot in 2022, regulation allowing, of course!