Coin base initially announced that it will be launching a lend feature that will enable their USDC(A stablecoin) to earn passive income of 4% yearly. This feature was supposed to be launched in June but it was placed on hold because of the threat from SEC. The U.S SEC(Securities and Exchange Commission) threatened coinbase, that a possible law suit will be slammed on their faces if they go further. source

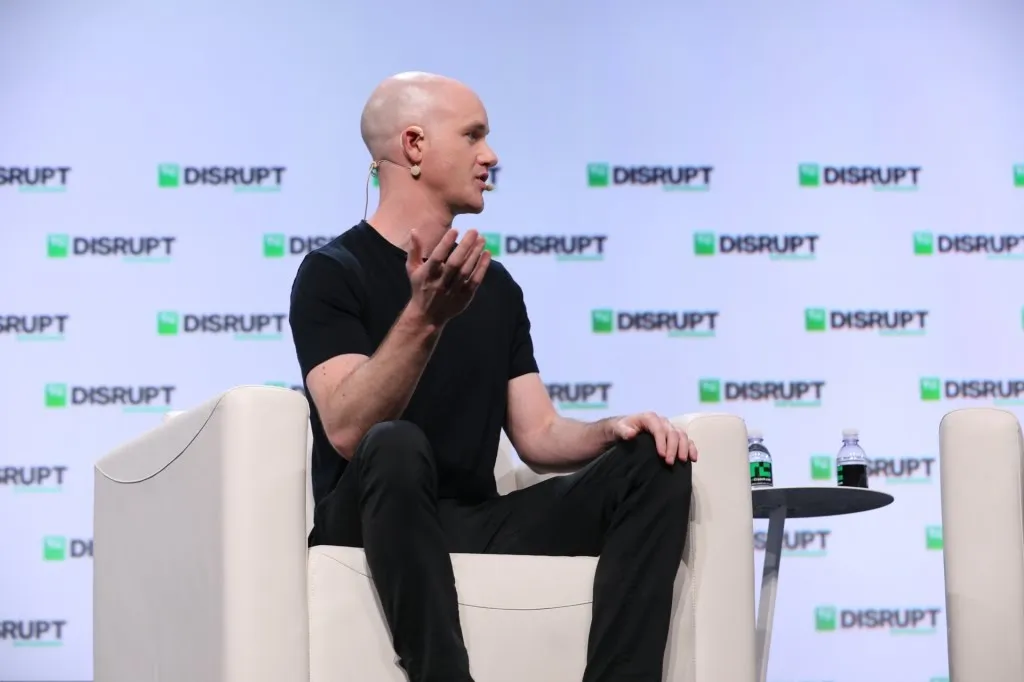

The CEO came on Twitter to rant and talk about how the SEC authorities were using their power to intimidate them, he also said he scheduled a friendly meeting to let SEC know before hand what the lend feature will be, so as to avoid any regulatory issues. But unfortunately, SEC is not interested in what he had to say, but SEC suggested they don’t release the feature. What a way to get controlled by the authorities, if only they knew about HBD(Hive Backed Dollar). He tried to play the tough guy to show that he won’t be intimidated by the SEC. He boldly said he didn’t mind going to court if that was the only option he had, I guess that didn’t last long. source

The company used a subtle announcement over the weekend to announce in what seems like an embarrassing way, that the company will discontinue the lend feature. This just shows how not decentralized and free or how easily the company can succumb to unfair regulatory actions.

The HBD(Hive Backed Dollar) is the only best option for people to use right now because it gives you higher yield compare to USDC. USDC was expected to give you a 4% APY meanwhile the HBD will give you 10% APR. Coinbase is a centralized entity while Hive is a decentralized entity that allows you control your account with your keys. SEC law suit has shown how these people can easily be controlled but not HIVE.