India's NIFTY Index is near ATHs. It is the perfect time for companies to list on exchanges and raise money via equity offerings. The IPO market has been very hot in the past couple of months with investors booking solid gains on good companies. I have been writing about these IPOs regularly and my last piece was a warning about 4 IPOs that went live on the same day. I stayed away from all 4.

A new month has started and 2 more companies are looking to raise cash. The IPOs went live today and one can subscribe via any broker. I submitted a bid for both. The companies are -

- Vijaya Diagnostic Centre Limited

- Ami Organics Limited

I usually wait for the last day of bidding to submit my bid after getting a glimpse of institutional interest in the names. It also helps to know how volatile the market is during that week so that listings do not turn into disappointment.

Vijaya Diagnostic Centre Limited

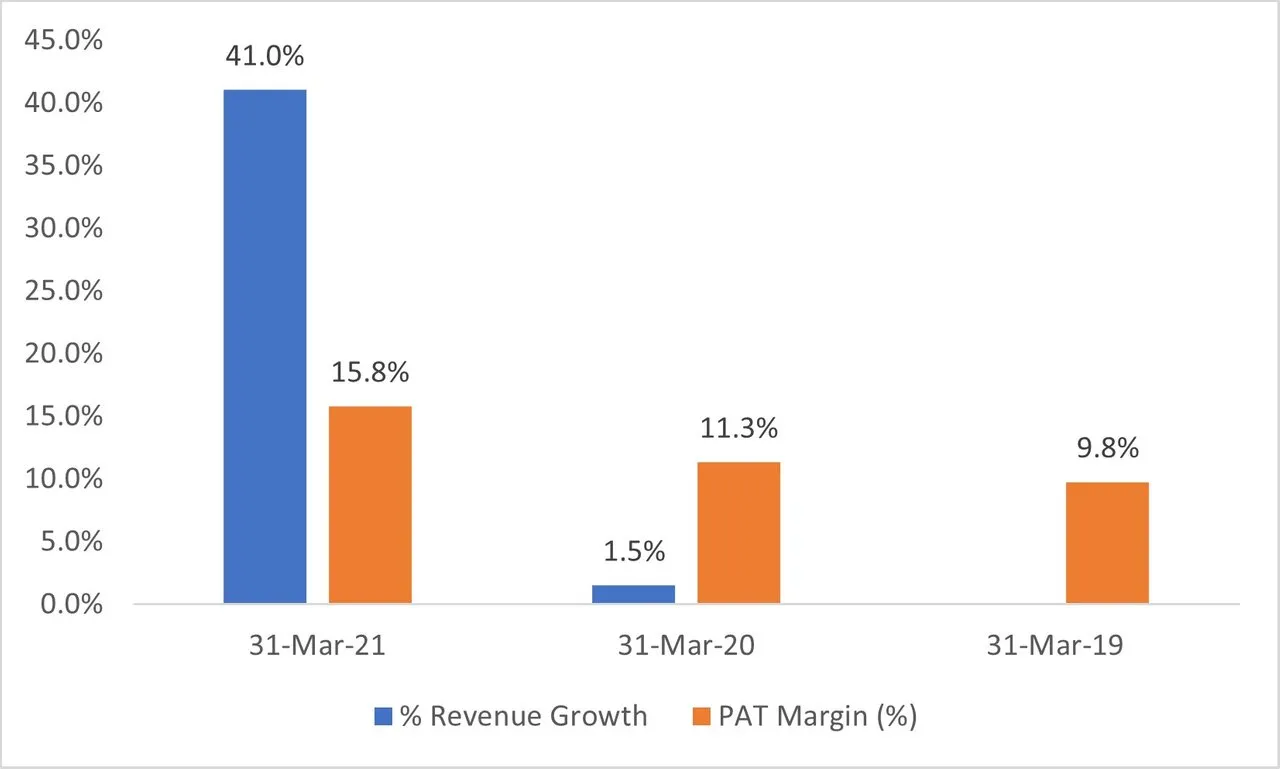

The company is one of the largest and fastest-growing path labs in Southern India. It also offers radiology services and primarily operates in Hyderabad. What I like about the company is that Revenues have increased during the last 2 years and profit margins are also positive and growing.

The sector is one that draws a lot of investor interest and there is tremendous scope for growth in India in such sectors. The list of anchor investors from an issue just prior to this IPO includes Fidelity, Aberdeen, ADIA, and KIA, to name a few. The lead managers are also reliable - ICICI, Kotak, and Edelweiss.

The GMP on the stock is positive, albeit low - INR 16, implying a 3% listing gain.

The low GMP is because of 2 reasons - The stock is priced on the higher side and given the slump of the last few IPOs, investor interest in primary markets has subsided. I still feel this is a good bet for the long term and there am willing to take a small risk.

Ami Organics Limited

The company manufactures specialty chemicals, another favored sector in Indian equity markets.

The company has developed over 450 pharma intermediates across 17 key therapeutic areas i.e. anti-retroviral, anti-inflammatory, anti-psychotic, anti-cancer, anti-Parkinson, anti-depressant, and anti-coagulant. It supplies its products to more than 150 customers (including international customers) directly in India and in 25 countries overseas

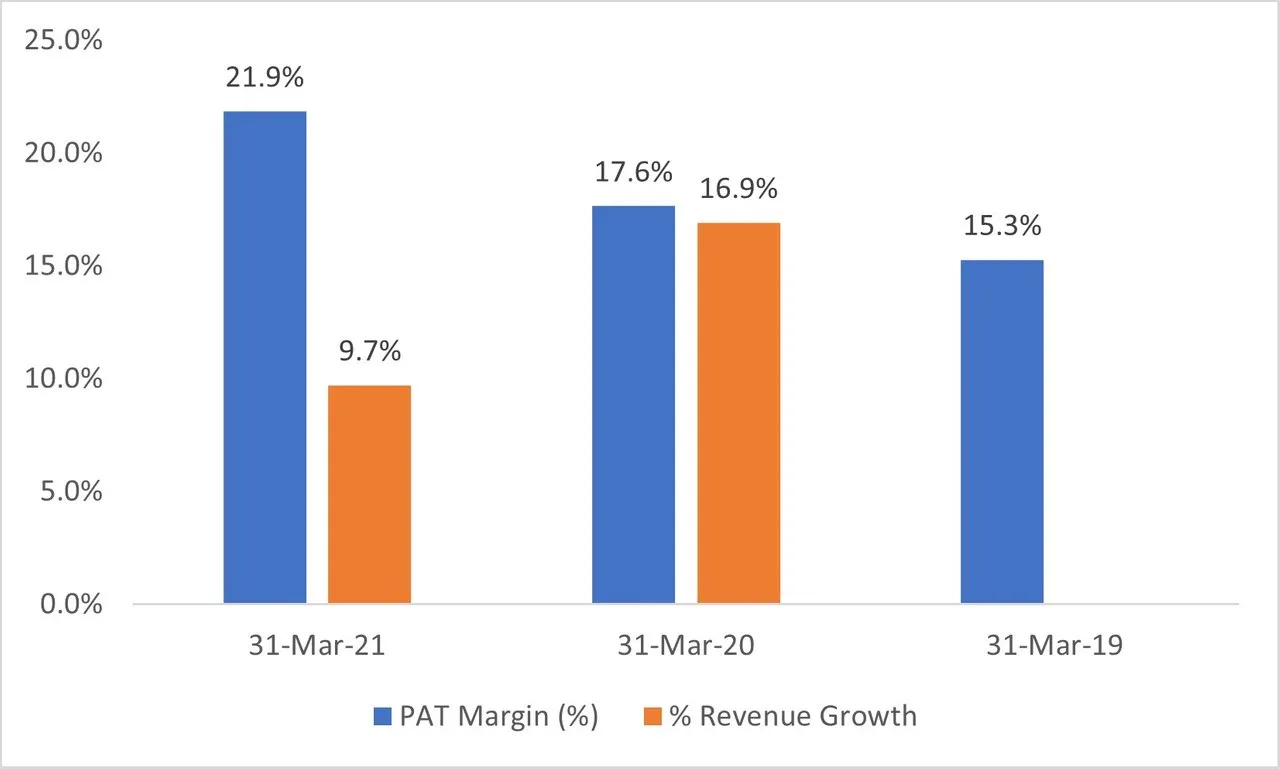

The revenue has been growing and the company has reported solid margin expansion.

The GMP on the stock is also positive - INR 162, implying a 26.5% listing gain.

The reason for higher margins in this one is that the company has very well-diversified operations and therefore business risk is low. Also, the issue is reasonably priced as compared to the other stock.

I am investing in both IPOs as I think these are names that can be held for the long term.