The week has started and while US Fed's dovish comments were good enough to lift the equity markets, and crude, little has changed for Bitcoin. The positive is that Bitcoin, being a risk asset, will not be impacted negatively in the short term by Fed's comments.

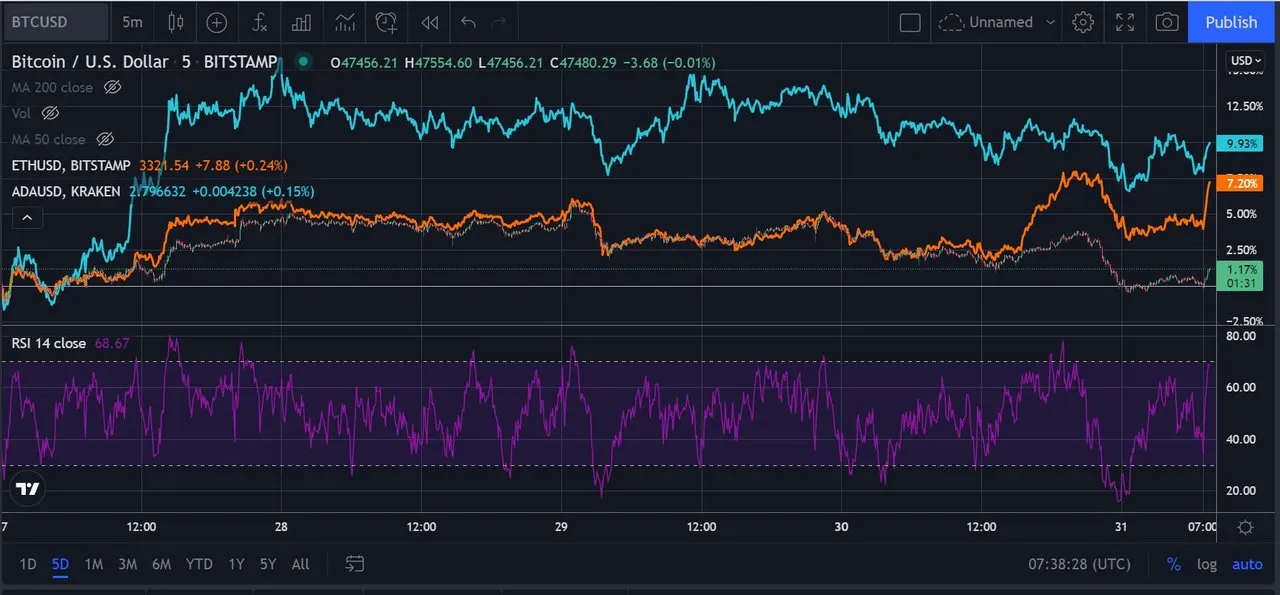

Bitcoin has struggled to break 200 DMA twice so far and even now is being supported at 200 DMA. Unlike the last time when Bitcoin crossed $50k, RSI has remained subdued and is not indicating an overbought condition. The consolidation at 200 DMA is also happening with low volume. The price action has been slightly negative over the last 8 to 9 days and will become positive if Bitcoin crosses the near-term high of $50,500. If bitcoin starts trading above $51k, then that will surely mean that new longs will be initiated.

Both Ether and Cardano are holding up well. ADA has to correct a bit with Bitcoin after its stupendous rise during the last 1 month. However, as Bitcoin goes up, ADA is registering a better outperformance compared to Ether. During the last week, both these assets still fared better compared to Bitcoin. A report on Cointelegraph Link suggests that Institutions are more bullish on these two altcoins over Bitcoin. It is to be noted that ADA is still a very small holding in institutional portfolios and it's mainly Ether that has a decent weight, best after Bitcoin. An analysis of weekly fund flows into crypto funds shows that the biggest loser was Bitcoin.

Expect Bitcoin to regain momentum in the coming weeks. Can't see much negative news coming that should prevent Bitcoin from making new highs.