I can't help but look at the Bitcoin chart multiple times during the day. There is never a dull day in this market. However, the last many days have been epic boring. The bulls and bears have been battling and there is just not enough firepower from the bulls that can be seen on the Bitcoin daily chart. BTC has been and is still struggling hard to break any significant resistance, and is hovering above $30k. The trading range has now narrowed between $32.5k to $35k. Volumes have fallen and there isn't any sign of bullishness on the chart.

Consequently, shorts on Bitfinex have risen during the last few days.

The chart of Bitcoin is indicating that a sharp move is imminent. The trading range has narrowed, volumes are declining, and I guess most are waiting for a clear direction to bet on. Bitfinex traders are increasingly betting on the downside. However, not all news is gloomy.

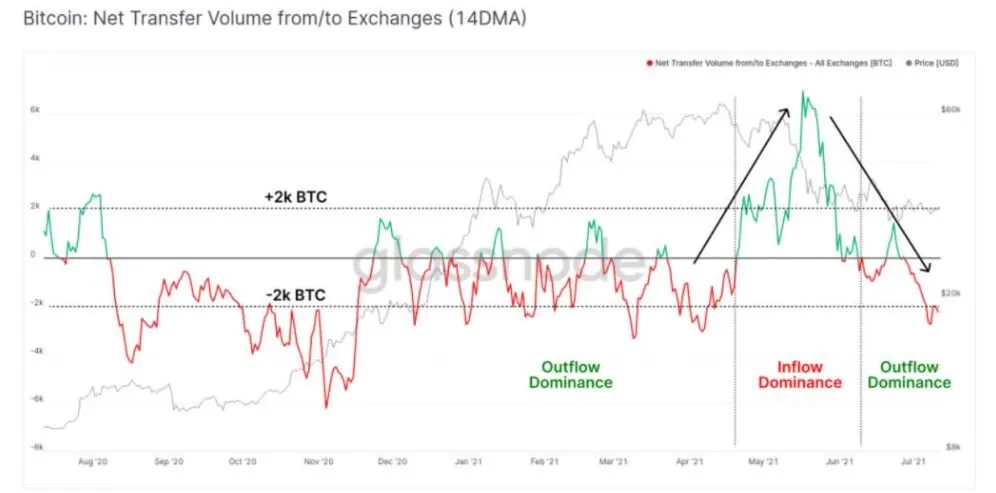

Glassnode's on-chain data shows that accumulation is also happening.

Net-net, about 2,000 BTC is being withdrawn from exchanges on a 2-week average basis. The withdrawal has been high enough to deplete Bitcoin on exchanges to levels that were seen in April. April was the month when BTC touched $65k. Accumulation is a good thing, as it limits liquidity available on exchanges and pushes borrowing costs higher for traders looking to go short.

Fundamentals are the only thing positive right now about Bitcoin. There is no telling how long Bitcoin may continue to drag on around $33k. BTC has been between $30k and $40k for over a month now. For a market that is supposed to be volatile, such subdued volatility can be boring and frustrating. However, what follows a period of subdued volatility is increased volatility, which is why a sharp move is imminent. I really hope the break happens to the upside.