Dear Investors,

It is time to check your exposure to banks who borrowed money to Chinese Real Estate companies or b.

Why?

Just look at the news about Evergrande and similar companies in China. They have huge liquidity issues and are about to go bankrupt. This is causing a lot of turmoil in China and bailing out all companies in problems is impossible for the Government.

Hundreds of civilians have tried to storm their office asking for payments on their bonds.

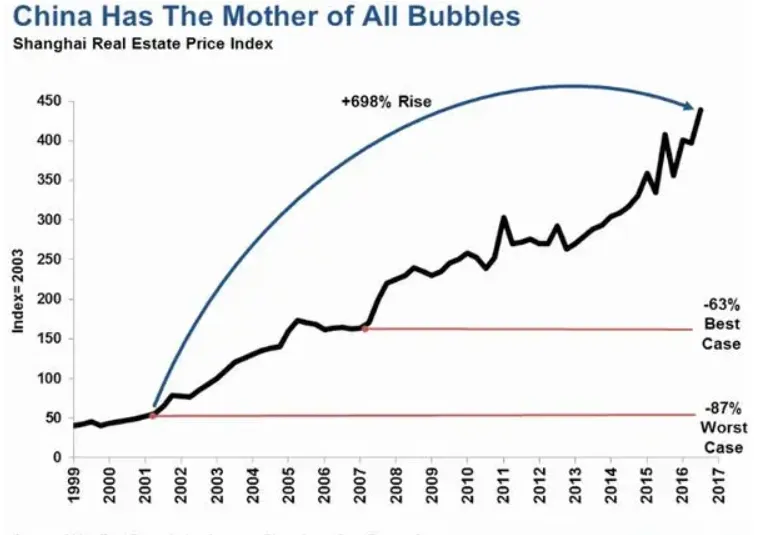

Evergrande has 300 billion liabilities but the whole market is trillions of dollars. The houses/flats are not sold anymore as the one child policy now results in less buyers (one child is no longer a policy for this same reason)

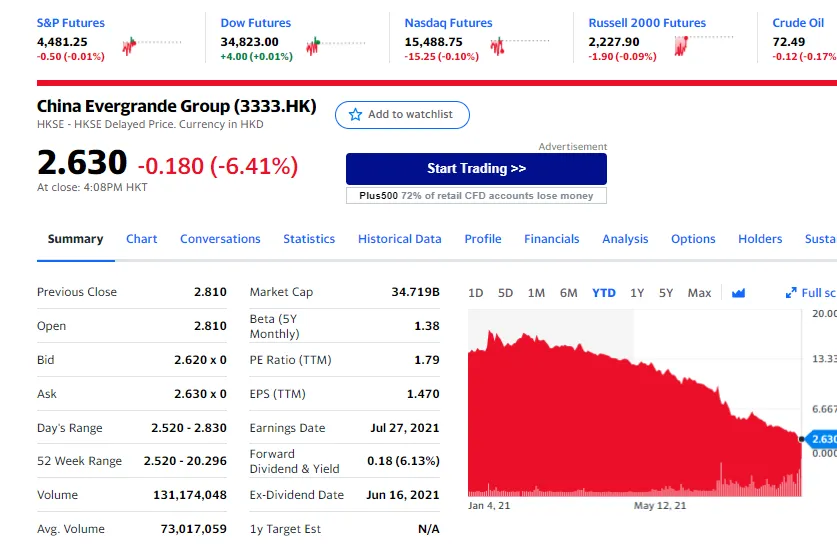

Bonds have decreased 25% in one day and trade was stopped! The share itself is down 70% this year.

Could it impact you?

Be aware that large banks often have provided loans to these CHines moguls. A 100 million left and a hundred million left. Before you know they are impacted a lot.

As the video says at least citigroup and credit suisse are involved al

The problem is that you cannot see if the bank you haveshares of is imapcted or not. They have to come with info as soon as it is relevant and known. And then it is too late although most large banks can handle a few 100 millions but anyway.....

As said it could get a lot larger than only a few companies when the Chinese RE market is collapsing..

Keep an eye out yourself.

As always I end with the advice to spread your investments. A little bit of everything and especially some gold and silver for real bad times.

take care

Goldrooster

update to include the next day market development