As the Splinterlands DEC price rips higher, we take a look at the demand generated outside of our Hive bubble.

Looking at Hive-Engine token charts following a rip your face off HIVE rally, can be a little depressing.

Thanks to our friends in Korea, all of the Hive-Engine charts look like a dog’s breakfast.

Well.

All but the somewhat disconnected Splinterlands DEC chart that is!

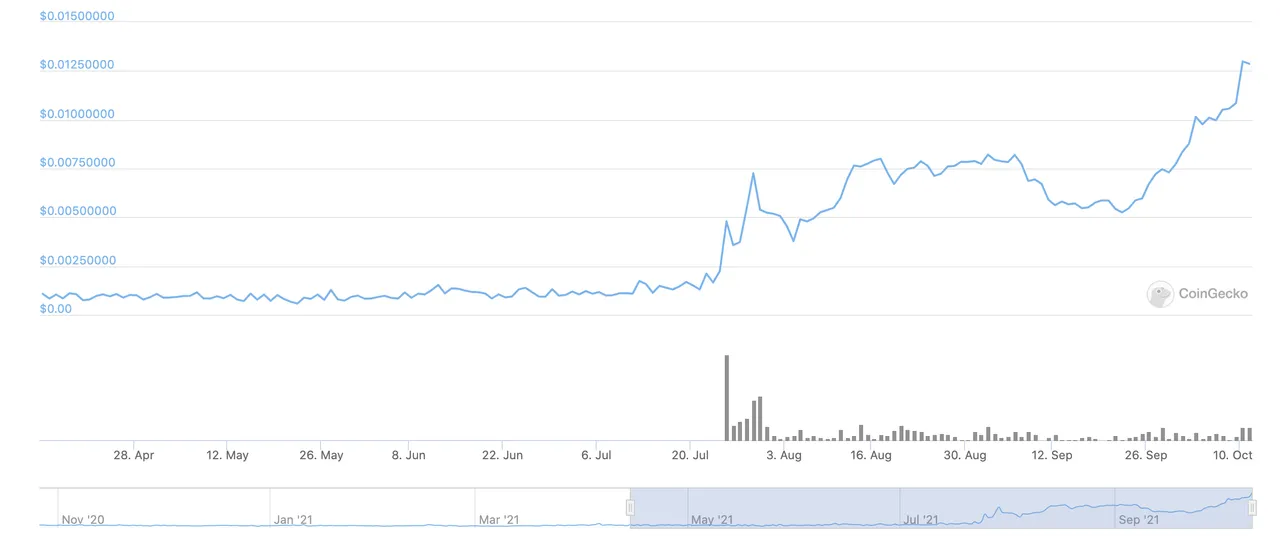

Let’s take a look at what the price of DEC is doing in terms of both HIVE and USD, then share some thoughts on where things may be headed.

The Splinterlands DEC Price

When it comes to pricing Hive-Engine tokens in HIVE, there are some quirks.

While a HIVE rip will bring the USD price of layer-2 tokens up too, it also means that they fall when priced in HIVE.

With the base pair for all tokens on Hive-Engine being HIVE (funny that), we usually end up with a sea of red.

As I’m sure anyone here in this community who is overweight LEO when compared to HIVE, knows perfectly well.

Damn that LEO:HIVE conversion rate!.

But with Splinterlands already becoming so much more than the humble Hive-based game it began as, DEC continues to buck the trend.

Take a look at the following DEC chart from the Leo DEX below.

You can see that price did initially fall, but that V-shaped bounce found on no other Hive-Engine chart, is telling.

What this tells us is that there is true demand for Splinterlands DEC outside of the little Hive bubble we’ve created for ourselves.

Most notably on Binance Smart Chain, where liquidity pools featuring DEC have not only sprung up and flourished on Cub Finance, but on massive platforms like PancakeSwap as well.

The V-shape bounce you can see on that chart is arbitrage bots taking advantage of the initial price mismatch between native and wrapped versions of DEC.

It took them a sec, but free money is free money and as Hive ripped, the mismatched DEC left in the market was quickly snapped up by our savvy robot colleagues.

It would have then been immediately sold on BSC and with so much external demand for the token, normal service then resumed.

Normal service being the bullish trend you will see on the following DEC/USD chart.

Not even a blip.

True penetration outside of the Hive bubble like this is something that the Hive ecosystem needs.

LEO has made steps to achieve this via their wrapped versions of LEO on both Ethereum and BSC, while the Cub Finance platform has provided a cross-chain use case.

But the largest demand is still driven by the LeoFinance community.

Splinterlands DEC is the first Hive layer-2 token to truly break free from the Hive bubble and didn’t the Hive blockchain need it.

Final thoughts on the Splinterlands DEC price

Something else I wanted to mention was that the Splinterlands card market has also staged somewhat of a recovery.

We’re also seeing fresh demand for the in-game Splinterlands NFTs.

Anyone who bought a Gold Furious Chicken while they were on sale will certainly be smiling today.

While wrapping up the content on this DEC blog, the price of SPS is also going ballistic.

With holding DEC being one of the most cost effective ways of receiving SPS airdrop points, it doesn’t look like demand will be drying up any time soon.

Best of probabilities to you.

Direct from the desk of Dane Williams.

Why not leave a comment and share your thoughts on the Splinterlands DEC price, within the comments section below? All comments that add something to the discussion will be upvoted.

This Splinterlands DEC blog is exclusive to leofinance.io.