The Big Four & the American Dream.

In the United States there are four big items that Americans exclusively attach to the American Dream...the items that prove you “made it” in America. House, car, college education (with career) and/or a business.

For most people, using credit to buy these costly items, and then paying for them decades into the future, is encouraged in our culture. But buyer beware, this American Dream can easily turn into a financial nightmare.

As I wrote in another post, credit is easy to obtain as opposed to income earned, and when something is easier to obtain, we value it less, therefore use more of it and less productively.

Whether we are buying “too much” house; buying a new car rather than a used car; getting a college education in something that isn’t marketable; or starting a business that has a high risk of failure; credit often pushes us to spend faster than we think. Plus, we don't have to pay it back for years, which encourages short term pleasure at the expense of long term pain.

So let’s go through the Big Four now.

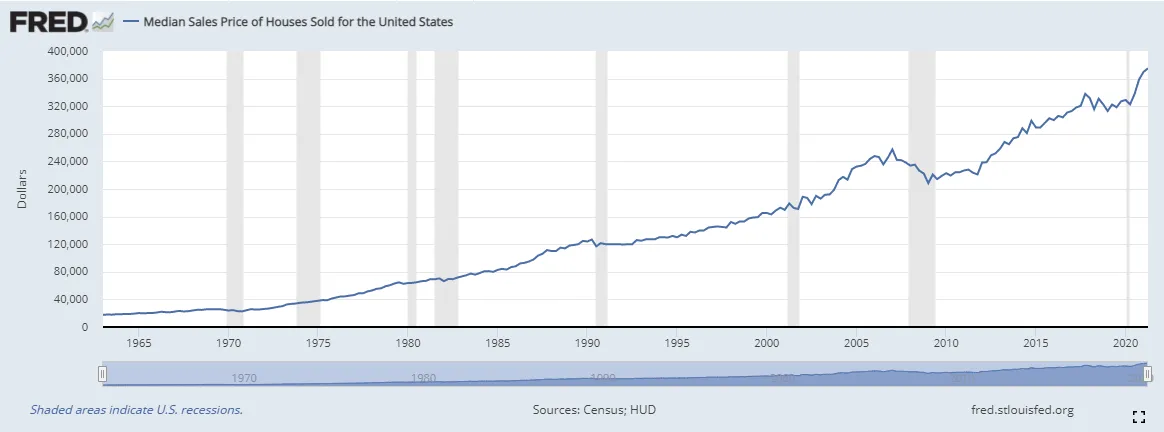

Figure 1

https://fred.stlouisfed.org/series/MSPUS

A house is probably the most productive use of credit...

Houses are definitely not an investment, but they are an appreciating asset, so under the right conditions, it is a productive use of credit because as your debt drops by paying off the mortgage, the value of your home continually increases over the long-term which builds net worth. (Figure 1).

What are the right conditions? Using very conservative loan terms...15 year mortgage, the mortgage payments are less than or equal to 25% of your net take-home pay, you have no other debt and at least a 6 month emergency fund.

The 6 month emergency fund gives you enough time to get a new job, if you lose your old one, so you can continue to make your mortgage payments, and not be forced to sell your home at depressed prices in foreclosure.

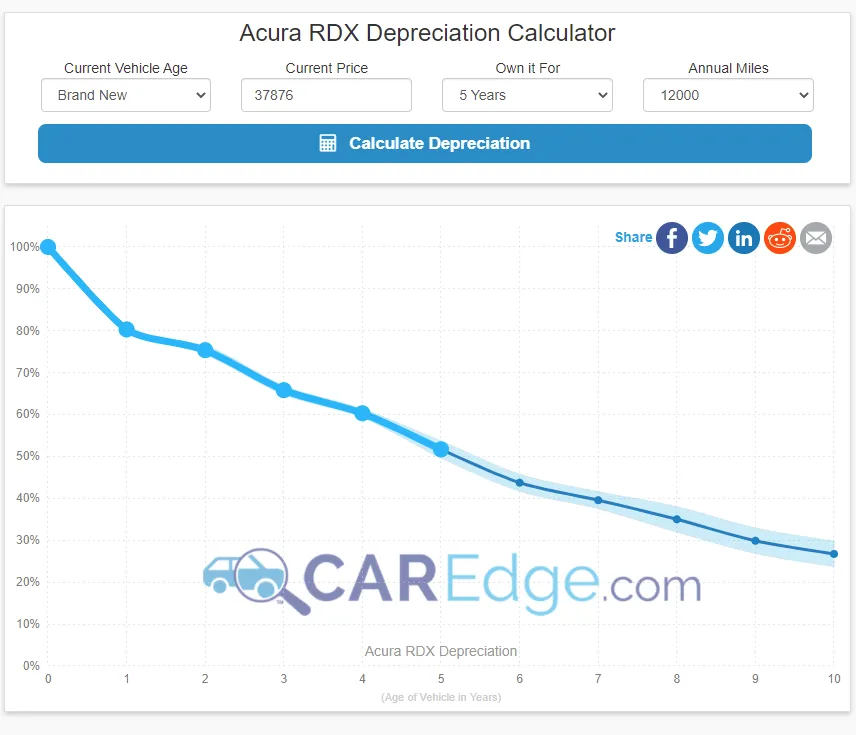

Figure 2.

https://caredge.com/acura/rdx/depreciation?y=0&p=37876&o=5&m=12000

A new car is not a productive use of credit.

A car is a depreciating asset. As soon as you buy it, and drive it off the lot, it loses 10% to 20% of its value. And it loses 60% to 70% of its value in the first 6 years. And continues to lose value.

By the end of your loan term of 72 months, your $37,876 loan at a 4.21% interest rate would total $42,927. By the time you pay off your vehicle, your car would now be worth 60% less than it was 72 months ago, at only $16,571. So you spent almost $43K for something that is only worth about $16K six years later (Figure 2). And that doesn't include maintenance cost.

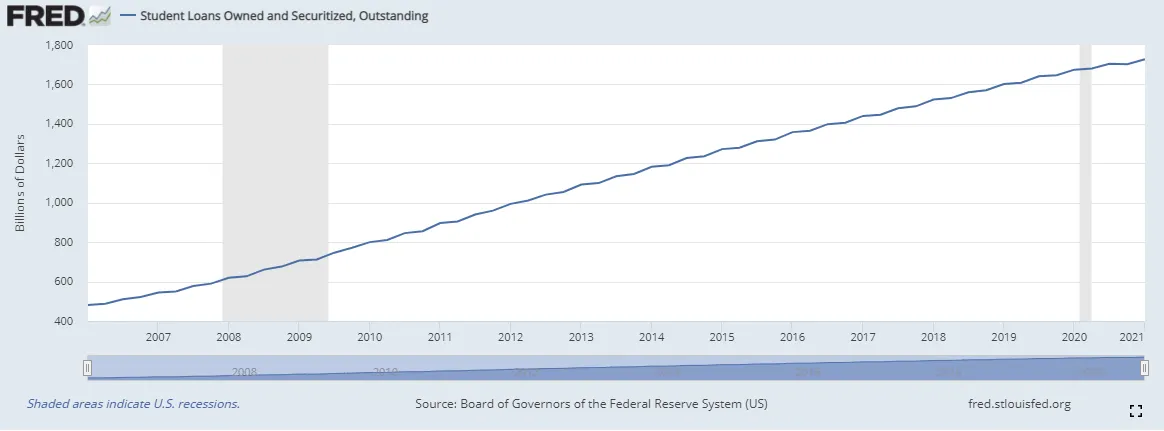

Figure 3.

https://fred.stlouisfed.org/series/SLOAS

A college education is not a productive use of credit (on average).

In the United States, there's $1.72 trillion in educational debt, with only 62% of students graduating with a degree. Out of that 62% of college graduates, 62% had student loans owing an average of $28,950 and taking 21.1 years to pay off their debt. And 11.1% of student loans were 90 days or more delinquent or are in default.

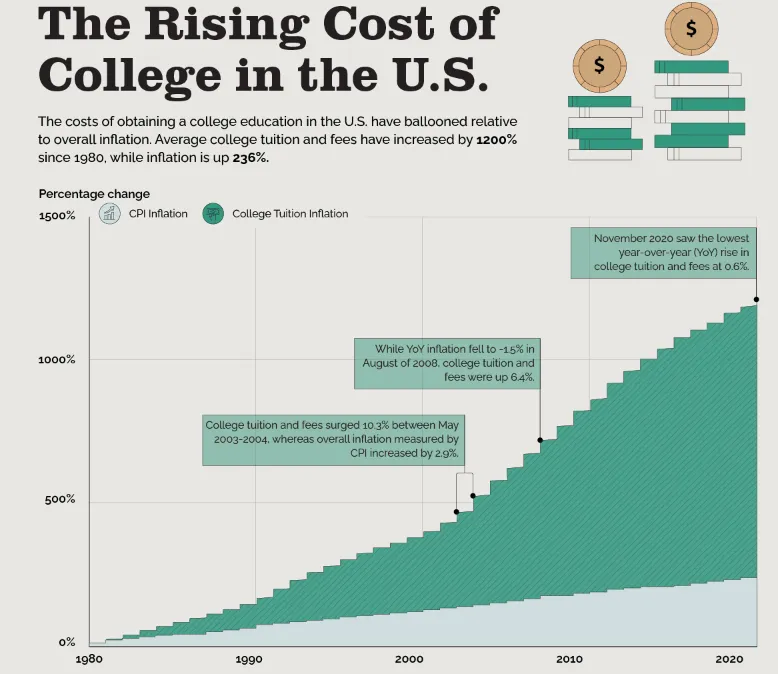

Figure 4.

https://www.visualcapitalist.com/rising-cost-of-college-in-u-s/

In addition, the US Federal Reserve conducted a 2018 study entitled Is College Worth it?. Their conclusion, “On current wealth trends, college may not be worth it for many.”

Their reasoning for this, “Declining college wealth premiums may be due to the luck of your birth year; financial liberalization; and rising college costs.” In other words, financial liberalization has made credit more accessible, that money (credit) pushes college prices up much faster than average inflation for other goods since 1980. The numbers, “Average college tuition and fees have increased by 1200% since 1980, while inflation is up 236%.” (Figure 4.)

Starting a new business is not a productive use of credit.

In the US, “approximately 20% of new businesses fail during the first two years of being open, 45% during the first five years, and 65% during the first 10 years. Only 25% of new businesses make it to 15 years or more."

Plus, since people don't value credit as much as money earned because it is easier to obtain, they use it a lot more and more unproductively. "70% of small businesses have outstanding debt".

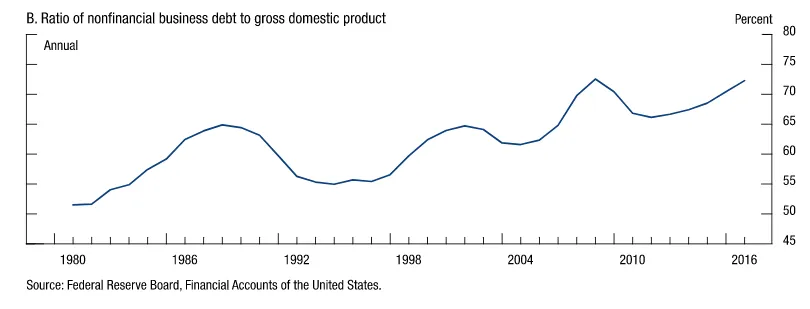

Figure 5.

source

The last 40 years of interest rate reduction has contributed to more reliance on business debt as a percentage of income (Figure 5).

Borrowing too much money at the beginning because business owners are overly optimistic about their business idea (not vetting it properly) and the income it will provide; makes it more difficult to keep up with operating costs, because the debt service payments are too high and the income is too low. 42% of small business's fail "because there’s no market need for their products or services, which can also translate into a capital shortage."

I'm not saying that starting and growing a business is bad. I think working for oneself carries a lot of benefits. But going slow, carefully vetting each idea to determine its financial feasibility and keeping operating expenses low (no debt) until income shows a sustainable path, will increase the probability of long-term success.

Let's sum this up…

The American Dream is a worthy attainable dream. It provides for a higher standard of living, a feeling of accomplishment, and a set of goals that gives people purpose. But the American Dream should not be rushed into and most of it should not be bought with credit. The American Dream should be well thought out, sustainable, and a blessing...not a full-blown nightmare full of regret and debt.

A house, car, college education and a business are all good things. We just have to do it with cash (house being an exception) so we can make every dollar (or Satoshi) count. The American Dream is just a dream...the Venezuelan Dream, the British Dream, the China Dream, the Polish Dream, the Malaysian Dream, the German Dream, the Korean Dream, the Nigerian Dream, etc...can all be achieved if we are financially disciplined and not too much in a hurry.

Stay frosty people.