I finally did it guys!

My all in on the cub den was an abysmal failure! I lost $10k for no reason. If I had just stayed in the LP I would be down very little due to the BUSD hedge combined with superior farming. That's gambling for ya! Hopefully you all bet against me like you were supposed to. Perhaps you should bet against me again? Maybe CUB about to moon and you should FOMO back into the DEN? I do have a knack for timing these things, after all.

That's kind of the point though. I joined the CUB farm... to farm. So I want to be in the pool where farming is the highest. Even after losing 25% of my stack and a huge reduction in price I'm still making $1000 a day at these yields, which is obviously insanity.

At the end of the day the pool with the most security in every direction is also the one with the highest farm. I can no longer deny that, and have learned the error of my ways. I feel secure now, and even if CUB crashed to $2 I wouldn't be mad, whereas if I was still in the den I'd be furious, mostly at myself. My bad for crashing the price 10 cents :D. Whales gonna whale.

That being said CUB whales still want to buy at $3, so for now support looking pretty good. However, judging by the FOMO and hype I've been seeing most of the bulls have done what they always do: FOMO. More often than not, the vast majority of users simply can't help themselves and refuse to dollar cost average over time. Especially in a farm like this that actually incentivizes FOMO because APR has diminishing returns every day.

CUB inflation can't be contained.

CUB is different than Hive/LEO because the stake holders can not control the inflation. Even the two main LP pools require half of another asset that isn't CUB, diluting the power of the stakeholders.

CUBs backend is in place and looks great: we are luring outside money into the platform and giving them inflation in return for locking stake in our contracts. That is a double edged sword, because we offer the token to outside farmers who are potentially paper hands that will do nothing but dump their gains.

CUBs frontend needs a lot of work. To make up for all the dumping and lack of control over the native token, we have to implement new defi contracts and burn mechanics that can stabilize the price for a healthy ecosystem. Despite everyone asking @khaleelkazi wen every second of the day, he's faster than 99.9% of the projects out there. I have no doubt that by the time Q2 & Q4 roll around CUB will have a lot more utility than it does now. Speculators gonna speculate.

Inflation schedule

Come Monday there is a strong chance we encounter another round of paper-handed dumping due to all yields being reduced by 50%. Even after said drop, ROI will still be relatively high compared to the vast majority of other options. But like I said CUB is crack and when you reduce the drugs: people panic.

What we have to remember is that even though this hyperinflationary period is ending: CUB still has massive inflation. We basically just jumpstarted the platform and did 5 weeks of farming in the first 2 weeks.

Come Monday it looks like there will be 1.1M CUB total. Five weeks later another 1M will be added to the supply, and every five weeks after that: another 1M coins will be minted. Again, stakeholders can't control the dumping because we are allowing 22 pools to farm the token. The only way to put a lid on it is to keep building value and products that will add token sinks to the ecosystem. It's a totally different model than we're used to. We are very much playing with fire by attracting these moths to the flame of phat gainz.

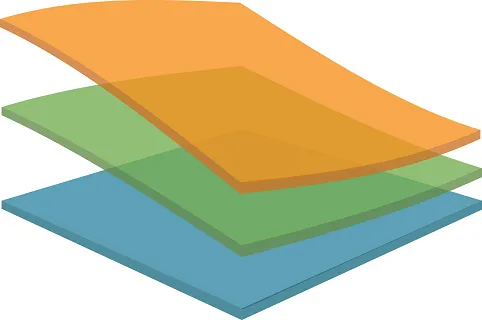

Layered Farming 2.0

I don't know exactly how layered farming works on Goose Finance, but apparently bots took over and filled up all the farms before anyone could join. Obviously their implementation of layered farming is garbage, so I kinda don't even want to research how it was done. I could literally think of a better idea off the top of my head right now:

Layered farming is literally the perfect option for the CUB ecosystem because we already have 3 tokens in the pipe for our layers. Unlike Goose, that likely just created new tokens as ridiculous cash grabs (don't quote me on that I don't know what I'm talking about) we actually have 3 tokens that could be farmed with actual utility.

Three tokens

- LEO

- Project _________

- 2nd layer consensus nodes

All three of these tokens have utility. None of them are cash grabs and none of them could be merged into another one of our projects. Their existence is necessary for the ecosystem to flourish over time.

Because two of these networks don't even exist yet, creating inflation for layered CUB farming is a trivial process. All we have to do is mint some coins with CUB in mind when these products go live. LEO might be a little more tricky. We could sap tokens from the dev fund, create a donation/income pool, or even print them out of thin air if LEO holders consent (I would).

How would it work?

There's no need to overcomplicate this process. Again, I don't know how Goose was doing it, but they were wrong. All we have to do is add the layered farms to the den.

Two variables

There are a pair of variables at play here:

- How much money do we have for the given layer?

- How much time will pass before all the money is gone?

That's pretty much it.

For example, lets say we somehow came up with 1M LEO tokens to add to the CUB den. The ONLY WAY to farm these tokens would be with CUB.

Again, we have to do everything possible to create demand for the base token. A high CUB price increases APR across the board on all 21 farms This is the outside entry point. Anything we can do the raise CUB price will get more users farming these ROI outlets. Because CUB is connected to the entire Hive ecosystem, it's a net win for everyone.

So now we need a time period. Let's say those 1M LEO tokens are going to be farmed over an entire year. That's about 0.1 LEO every BSC block for an entire year until it's gone. Not too shabby. If the yield on that isn't high enough we can reduce the time period to 6 months or even 3 months for maximum FOMO/hype.

So imagine it:

A bLEO layer pops up... huge yield... huge returns... and the ONLY way to farm it is in the DEN using CUB. Unlike goose, there is no limit to how many users can farm the pool, so bots will not corrupt this process. The more users farm the bLEO pool with CUB the more competition there will be and the less coins they'll get... just like the rest of the farms. Seriously how did Goose mess this up? I don't get it.

The demand for CUB in this scenario will absolutely SKYROCKET. Whatever the yield is for the bLEO layered pool, enough competition will join that pool until the APR comes into equilibrium with the other pools. This pulls CUB out of the LP's and the den, vastly increasing yield and making it easier to spike the price of CUB, while at the same times still leaving plenty of liquidity for new users to buy in.

Repeat this process for Project _____ and the second layer consensus governance token. This would allow us to hit the timing right and increase demand for CUB for a year or more as these pools get slowly drained. It's also possible that we could implement systems to refuel these pools should that be determined to be the right play. Again, CUB demand would skyrocket out of control compared to now due to the exclusive farming privileges of the CUB token. This legitimately creates massive value across the entire Hive network.

Another thing to note here is that the governance token of LEO is going to control voting on CUB. It's pretty much a given that allowing CUB holders (and CUB holders only) to farm the governance token that will control them is 100% necessary. Of course the airdrop to LEO holders will probably be a lot bigger than any kind of layered farming situation on CUB, all I'm saying is that random farms shouldn't have access to these exclusive pools, as the value gained from that exclusiveness already trickles down into every other pool in the form of a higher token price and less competition.

LEO is not greedy enough!

In the AMA we got grilled pretty hard, to the point that someone even skeptically asking how LEO is going to make money if the token mechanics of CUB don't really reflect that value capture. This question straight baffled me. "LEO is not greedy enough, I don't trust them!"

I guess that's what's expected on BSC as it pertains to this new technology. Everyone just thinks everyone is in it for themselves rather than participating in equitable value generation.

It's also just completely ridiculous to assume that LEO isn't going to gain value from CUB. Even with the non-greedy mechanics in place... that's exactly why we will gain so much value from CUB: because it's actually fair, and users on BSC are going to see that sooner or later. Only a matter of time.

Even giving away 1M LEO tokens to CUB layered farming would end up being a huge net gain for LEO. We are so early in the game and there is so much capital on BSC, all we have to do is convince these people that we are the most legit network out there: which we are, hands down. There is so much money out there to be captured, and so many greedy dev teams that don't know what they are doing. It's not going to take long to forge this diamond.

Conclusion

I got greedy and I got caught with my hand in the cookie jar. I got slapped! I deserved it! Lesson learned. LP farm stronk. Back to farming $1000 a day... lol wild.

Layered farming is going to be a game changer if we do it right. Again, no need to overcomplicate the process. It should be exclusive to CUB holders only, as the value generated in this way increases the APR of all 22 farming pools and provides evidence as to how utility is going to be added to CUB in the future. The CUB brand can easily become the most trusted asset on BSC.

Many outsiders are looking at CUB like: "Yeah, but what's the point except to farm more CUB?" Layered farming is just one of the many exclusive features that the CUB token will provide. Of course I say that assuming that this is how it should/will be done. Big assumption on my part, but it sounds correct when I say it so whatever.

Other defi dapps are also on the table. Lending and stable-coin minting are huge cash cows, and would again pull CUB out of the farms and into the new dapps, increasing yield and token price across the board, once again showing that CUB is not just a nameless farming token cash-grab.

Again, the most important thing with layered farming is that we don't just create a token just for the sake of farming it... that's... really dumb and an obviously greedy play. We literally already have 3 tokens in the pipe the fit the bill perfectly. We can completely blow BSC out of the water at this point.

Exciting times.