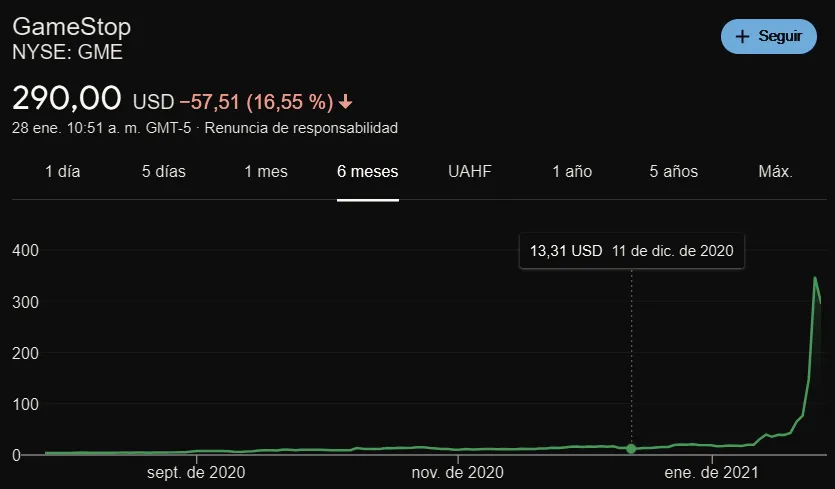

I am sure most of you guys are aware of what has been happening with the wallstreetbets subreddit and how that community managed to increase Gamestop's stock price more than 10 folds forcing losses of several billion to hedge funds shorting the stock. However, in case you don't know, the summary is that people from that subreddit found out there was massive money from hedge funds shorting Gamestop's stock and decided to pool money together, buy a massive amount of Gamestop stocks increasing its price, and forcing losses on the hedge fund. Shorting stocks works like this:

Short selling is a fairly simple concept—an investor borrows a stock, sells the stock, and then buys the stock back to return it to the lender. Source

People who short stocks are basically betting for the company to fail and is the opposite of a pump and dump scheme, but since they are obliged to return the stocks they borrowed, they lose money if the price of the stock increase because they have to buy it back but pricier. Doing this to a company in the middle of a terrible pandemic is reprehensible but legal. Thanks to internet communities, now a new way to combat these vulture-like strategies from the financial elite is possible, or so we thought.

After crazy increases in the price of Gamestop (there were other companies but this is the main one), reports began to be published about huge losses suffered by a hedge fund called Melvin Capital. They lost around 30% of the total amount of money they manage.

This could have been considered business as usual except the people making gains were regular people and not the financial elite. Since the hedge funds shorting stocks were getting slaughtered and the little people were happy with their gains something had to be done to rectify the way the system works and put everything back in their place. This is when Big Tech started to attack the little guys to protect the elite.

First, it was discord. The wallstreetbets subreddit had a very active channel on that platform but it got banned because of supposed hate speech. It is no coincidence this ban happens exactly when hedge funds are getting destroyed by the community. They only mention hate speech to force silence on anyone who criticizes this decision. The only people that defend "hate speech" are nazis, right? So everyone against this ban is probably a nazi... That's how the logic goes.

Now, there are enough platforms to allow for the free flow of information to continue despite discord turning to the dark side. However, what happened just a few hours ago turns the game on its head because it becomes market manipulation from a platform that claimed to be "democratizing finance for all".

Robinhood is a company that provides an easy to use platform that allows people to invest in stocks. Most of the investment coming from the wallstreetbets subreddit into Gamestop's stocks and others were possible by using this platform. Since they didn't like what was happening they decided to disable new purchases of the stocks getting shorted by the hedge funds and getting bought by the wallstreetbets peeps, and now they pretty much fixed the game in favor of the elite. Leaving the little guys with no way to participate in it.

There are talks about a potential class-action lawsuit against them but this proves once again that centralized platforms will always favor the powerful. This story is getting hotter by the hour so expect new information to come out at any time.