We have a lot of graphs to comment on this week, so I'll try to make an initial outline and captions short so as not to weigh down the reading.

The various metrics show overall that:

1 We have reached an advanced (perhaps final) stage of the bear market.

2 The conditions for the start of a bull market are not yet in place, although the brief recovery in August might have suggested otherwise.

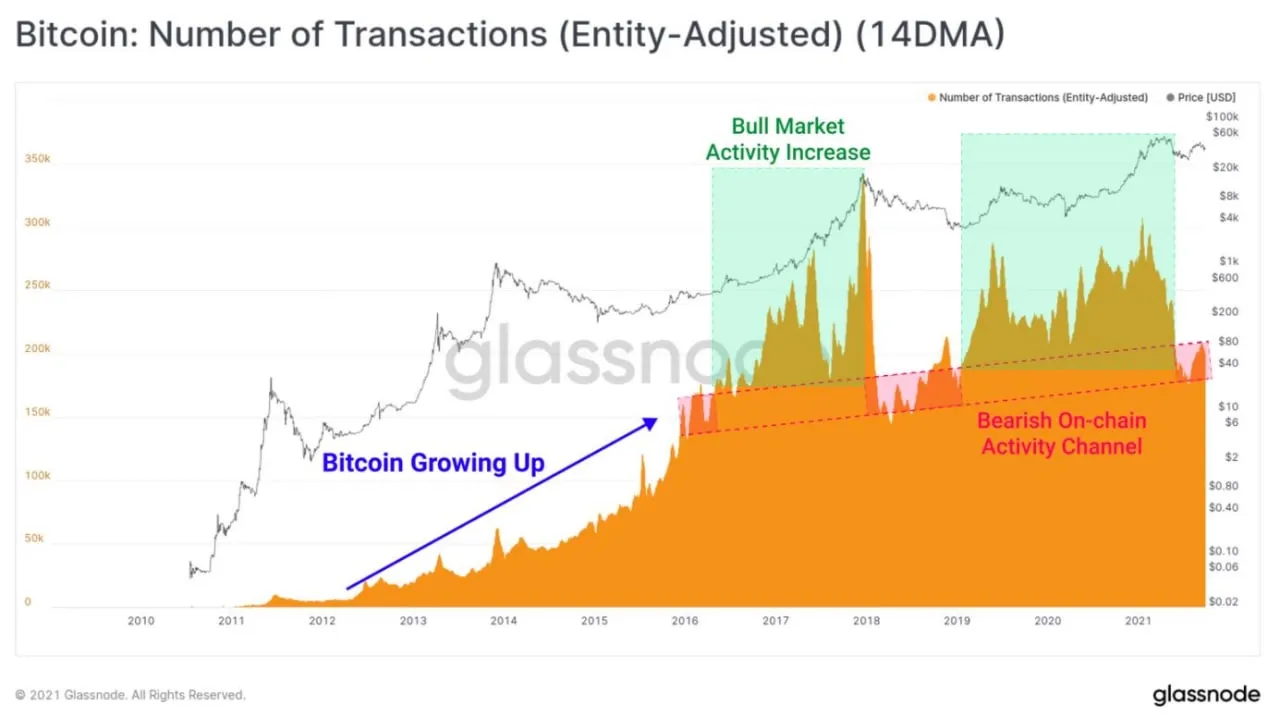

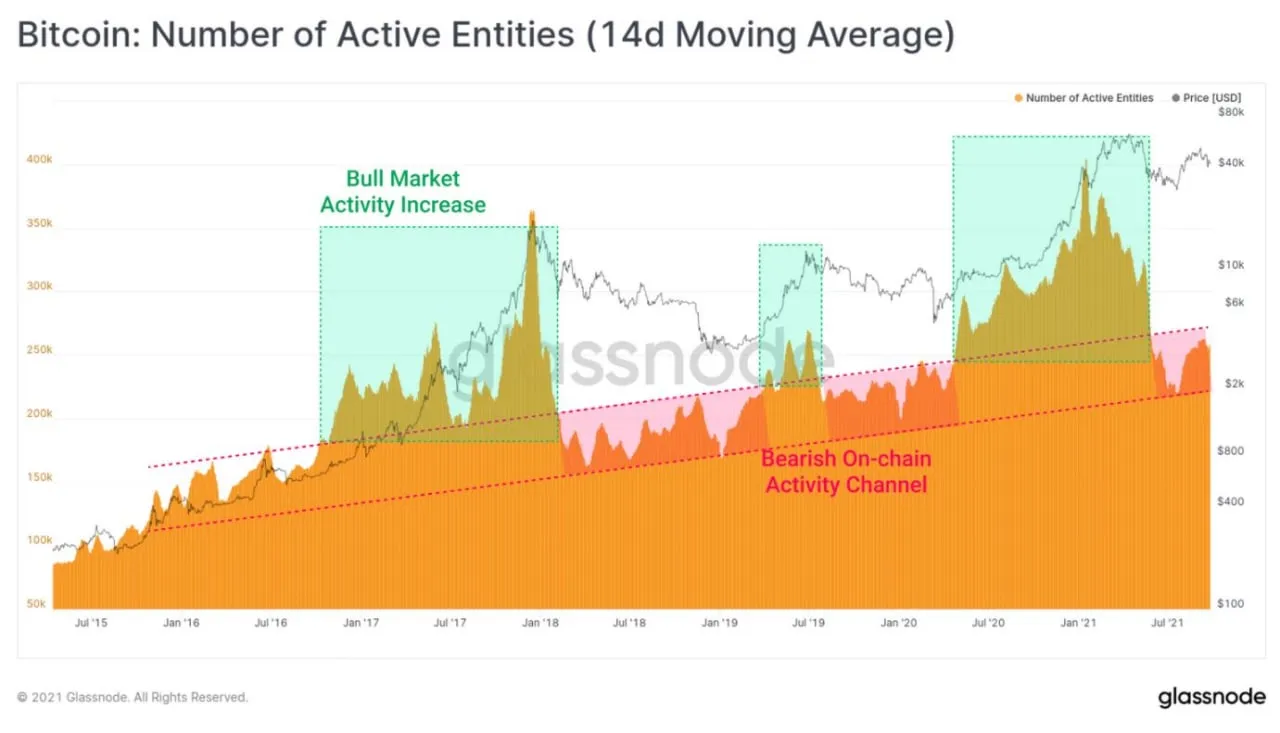

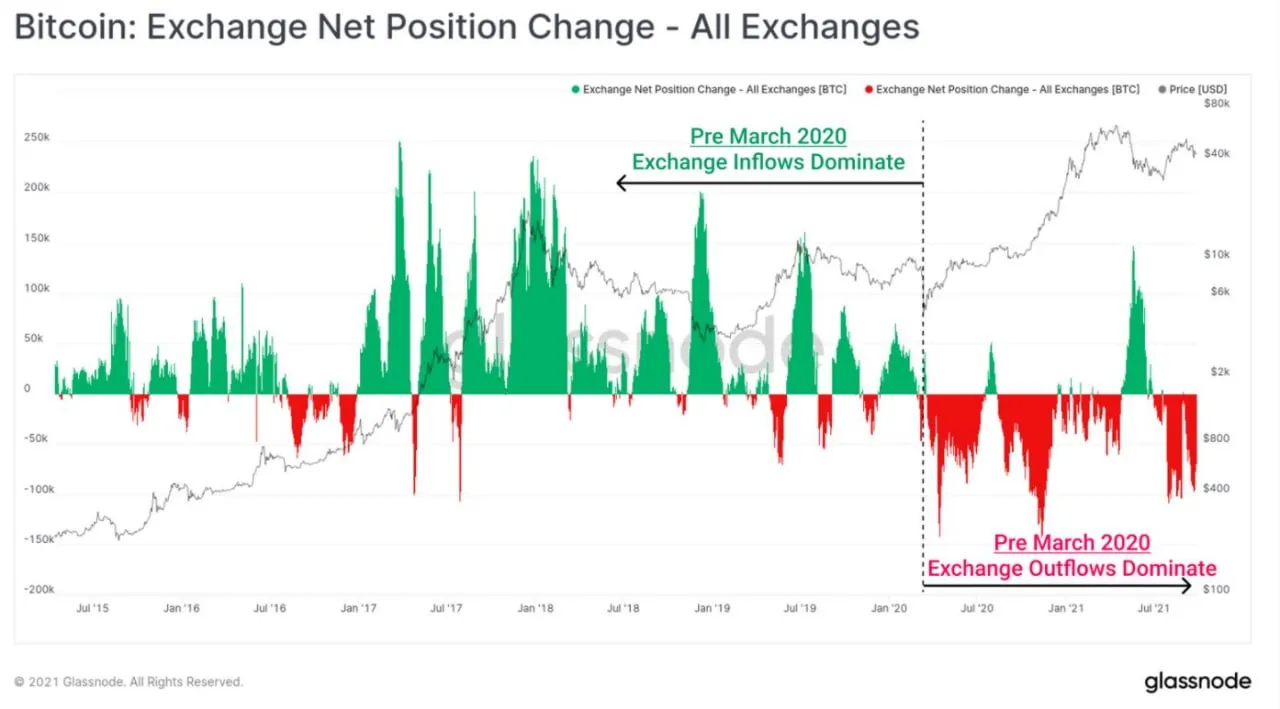

The three graphs below show an overall abandonment of investing, i.e. a drastic reduction of investors in the platforms:

The number of active entities is at its lowest (this is a more accurate measure than the previous chart, but reflects the same concept: trading activity at its lowest).

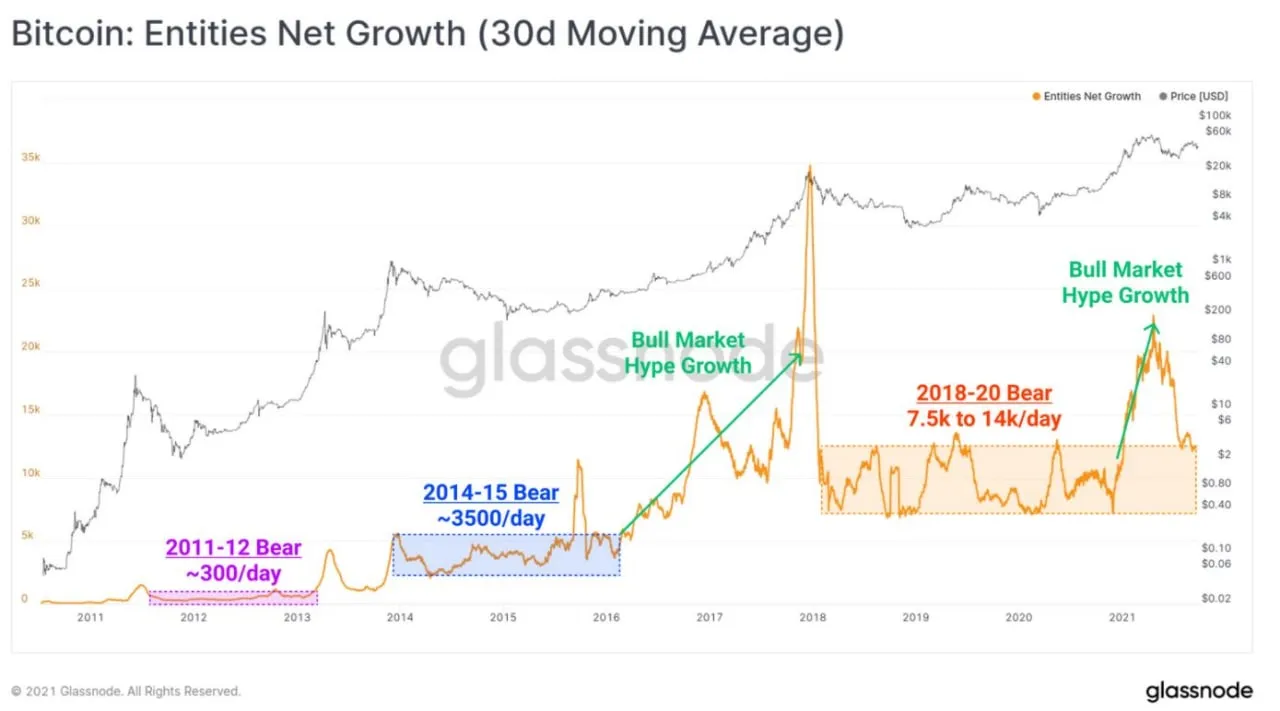

The ratio of new investors/old investors shows a very low level of new investors, comparable to what was there at the end of the 2018-2020 bear market.

So, to use the language of previous posts, the accumulation phase still prevails.

In the brief August uptrend, one could think of a beginning of a distribution phase, but now we are back to pure accumulation, which indeed has reached extreme levels.

In the extreme phases of accumulation, long term holders are the only ones left to support the market.

The question is: are they able to do so?

Let's try to answer with the following graphs.

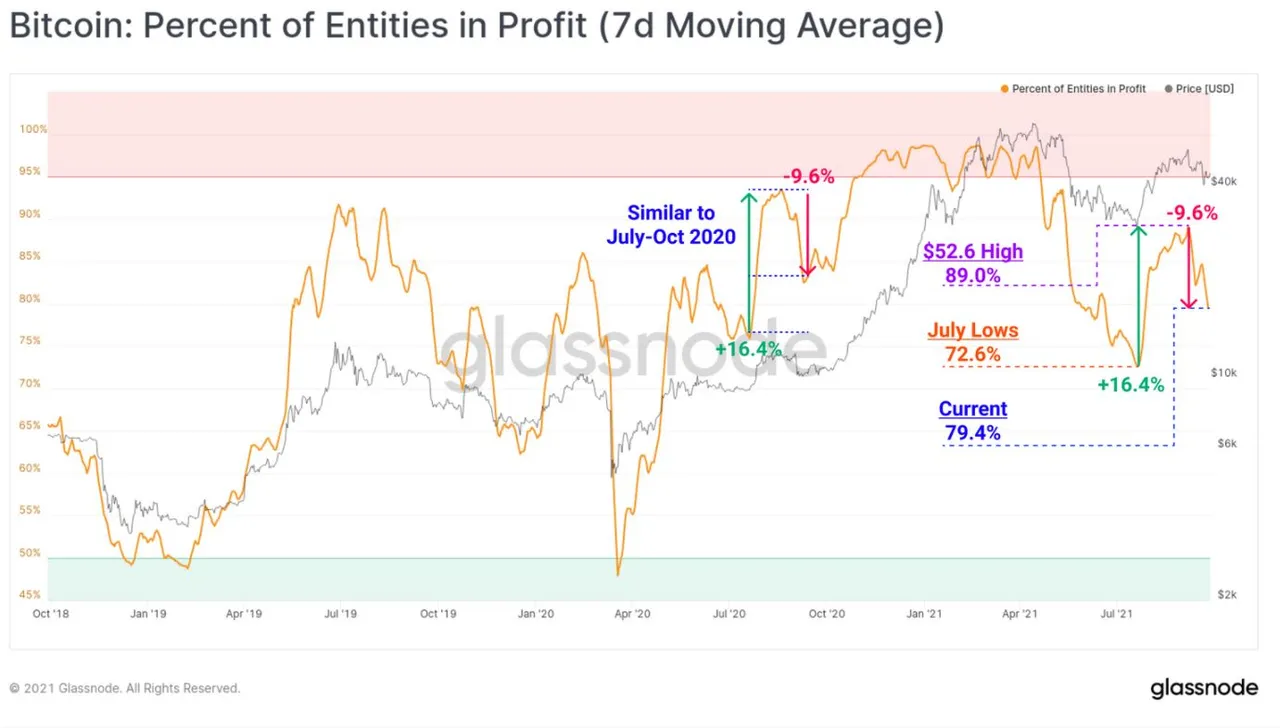

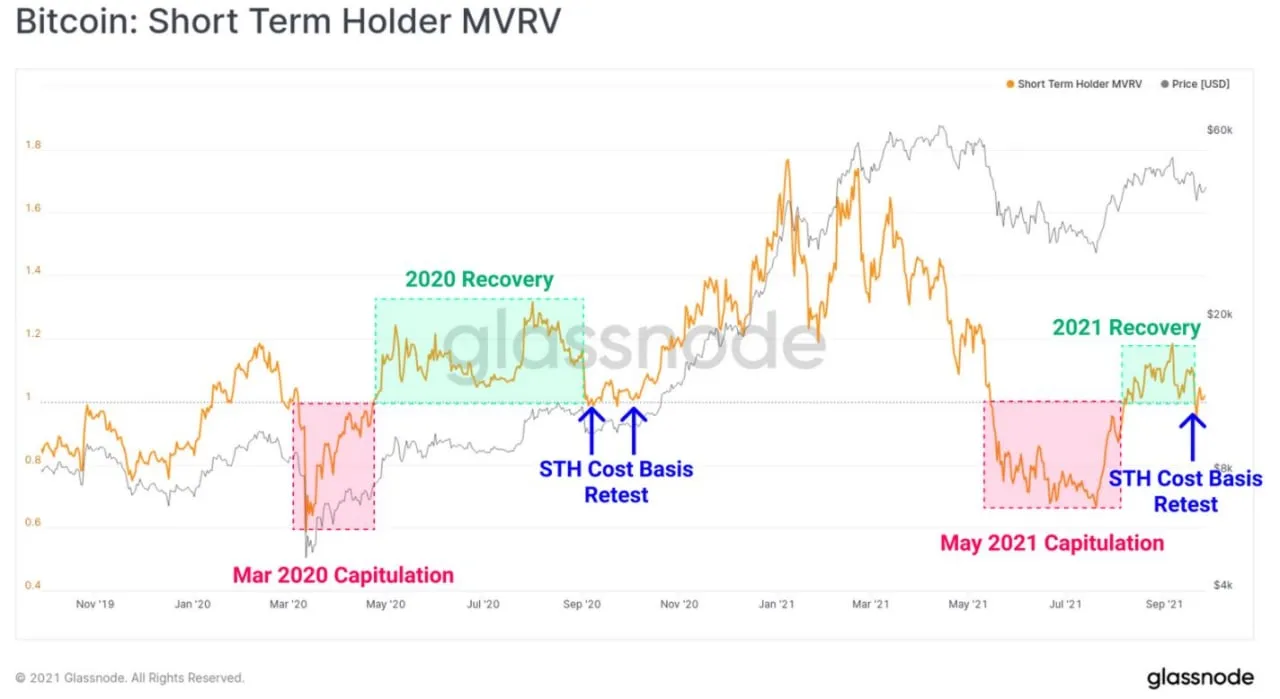

During the August rally, some holders sold at a profit.

Now, with the descent of the prices, the holders who did not sell and who still have coin in profit have reduced, reaching the same level as in July-October 2020 (final bear market before the bull market).

In the last 90 days, the "seniority" of the spent coins has been reduced to the minimum, corresponding to the final phases of the previous bear markets.

This means that we are at a point where historically holders are no longer inclined to sell more of the coins they hold.

There is also an indicator that has reached levels rarely reached before:

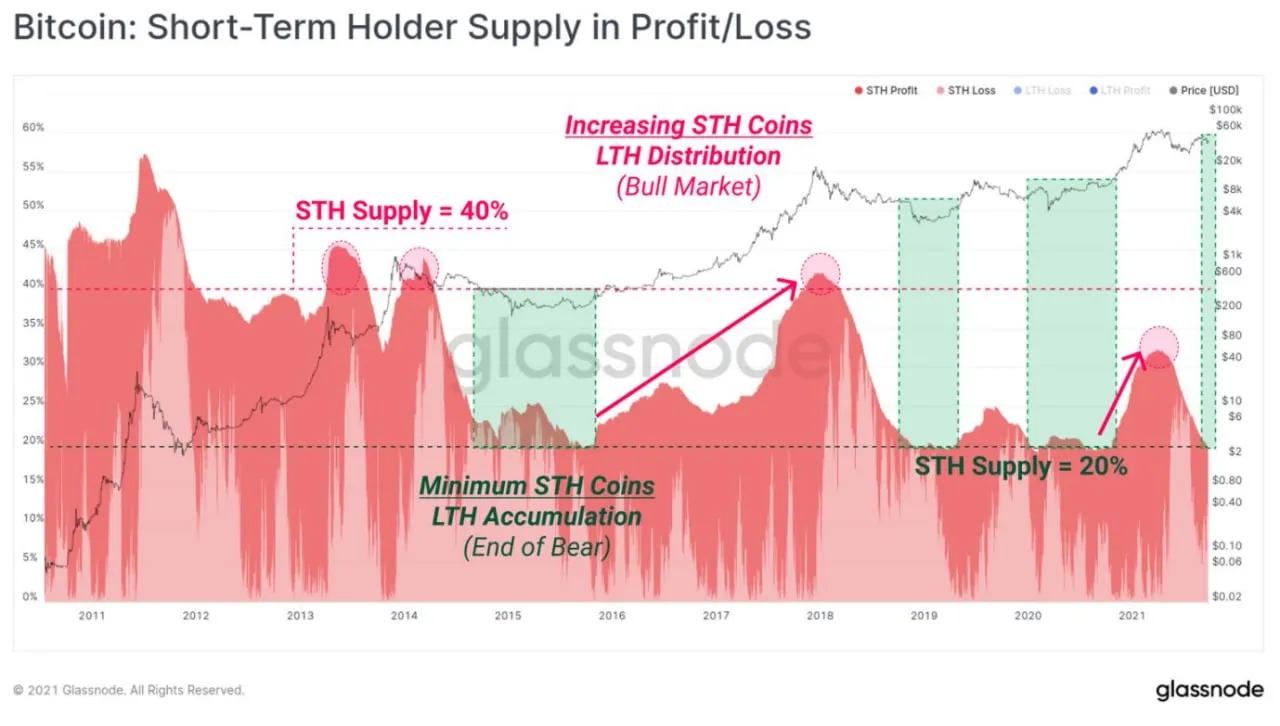

The number of coins held by short-term investors is at a low, indicating a truly extreme bear market phase.

Very low levels, although not yet extreme, have also reached the number of open positions in the platforms.

To summarize:

trading and investment activity is reduced to minimum levels. Nobody invests. Nothing is moving on the platforms, while holders continue to keep their coins on deposit, even though they sold part of them in the August rise.

It is to be expected that these holders will not sell much, even if there were any phases of temporary upswings or downswings.

All this is characteristic of the very last phases of bear market or the beginning of bull market (pure accumulation phase).

The news of the day is that Glassnode has just introduced new metrics that give us unexpected insight into the behavior of bitcoin users in El Salvador and on Twitter.

It seems that in that context a new trend is emerging, even if it will not directly impact price dynamics. This topic will be covered in a future article.