Let's analyze Glassnode's latest charts on the crypto market.

First of all, I would like to give a broader picture, linking cryptos to the situation of stock exchanges.

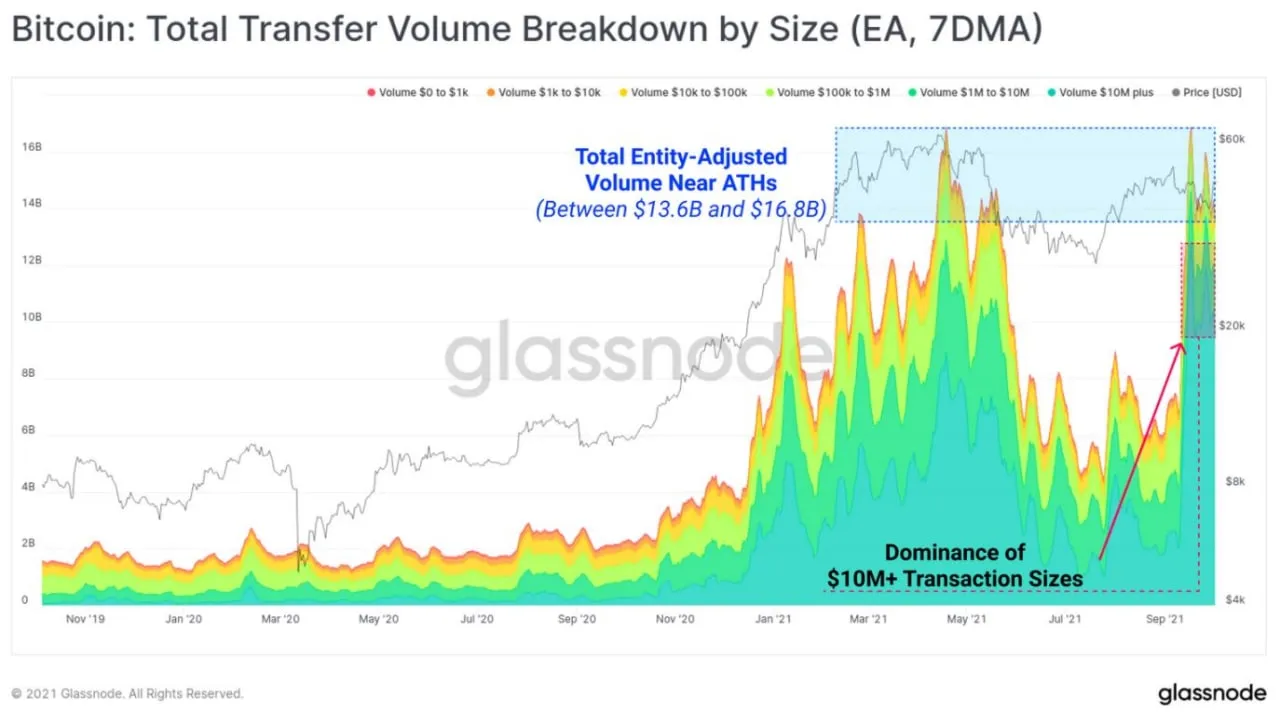

So let's start with the following chart:

The chart shows that btc transactions on average are exceptionally large, ranging from 13.6 to 16.8 billion per transaction. At this stage it is mainly institutional investors who are moving cryptos (only they are able to make such large transactions).

What considerations does this data suggest to us?

The transactions made mainly by institutions allow to have prices quite sustained despite the market, in fact, after the peak of April, is largely sideways-bearish.

A short time ago I had posted metrics that revealed few movements in trading platforms, suggesting that "normal", non-institutional investors make few movements, exactly as it happens in stock exchanges as well, and this is a characteristic of the late stages of the bear market (or at most in a preparatory phase of a future bull market).

In reality, we have not yet emerged from summer dormancy. Against the backdrop of these "institutional" transactions that support prices or indices, all the ups and downs we are witnessing, both in the exchanges and in cryptocurrencies, stem only from movements in the futures market that generate short-term trends, unable to change the underlying "laterality".

As it happens now in cryptocurrencies, the U.S. stock market is also supported, as much as possible, by "institutional" trades that are made with derivatives on those 10-15 securities that make up most of the capitalization of indices. For this reason, in the summer we had the paradox of sometimes reaching new highs in the S&P500 even though we do not have a real bullish market.

The same thing happens in cryptocurrencies, where btc for example manages to periodically exceed the threshold of $40,000 without having a real bull market.

After this overview, I post a couple of specific crypto charts.

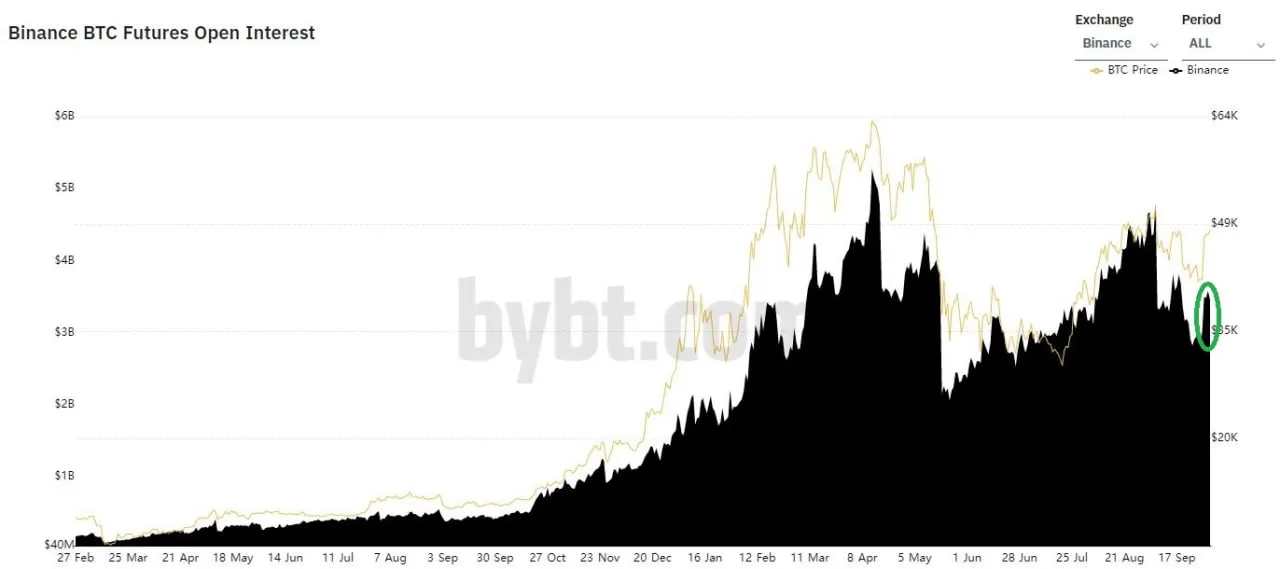

The current rise in bitcoin and other cryptos has been triggered by a steep increase in futures positions (green circle). How has the actual crypto market reacted, beyond the false trends in derivatives?

Exactly as it has been reacting for the past two months....

Basically, once again holders have held their coins without selling them at a profit.

So the only sales have been made by medium-short term investors. And this reaction is typical of a late bear market or the beginning of a bull market.

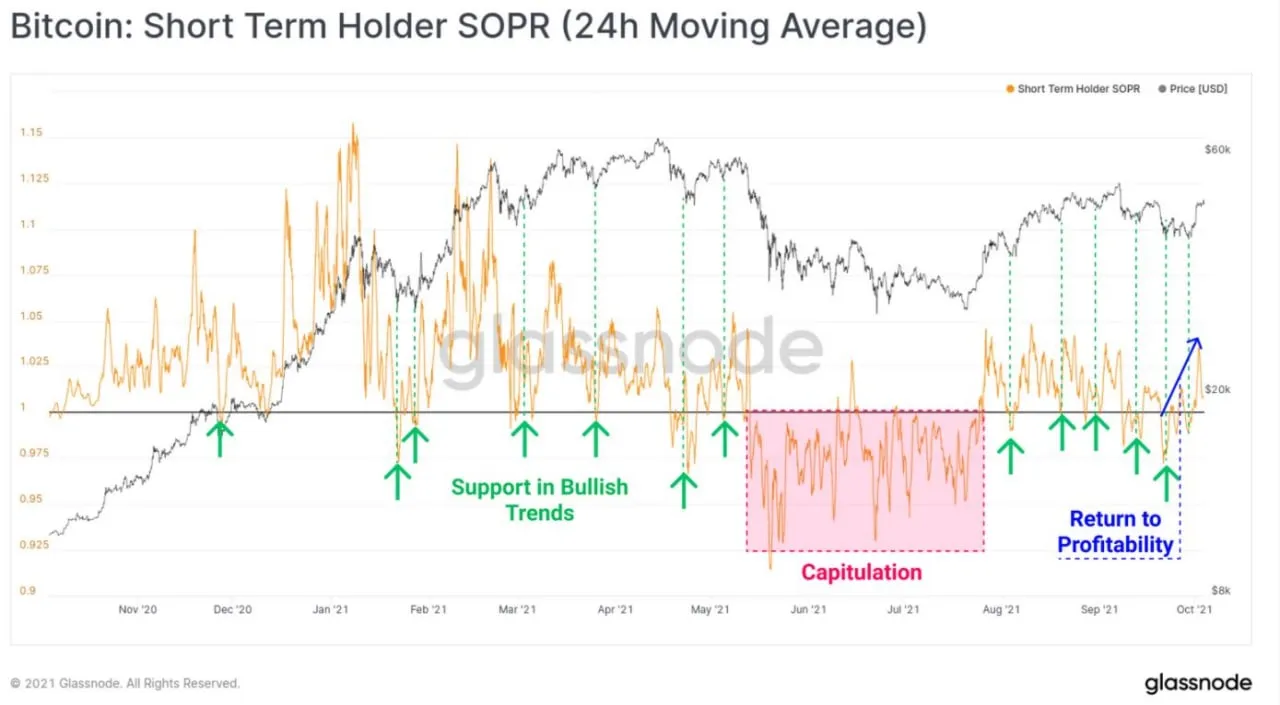

The short and medium term traders were the only ones to make some operation, are on average in profit (the SOPR value is around 1 = black straight line). A SOPR around 1 indicates that the market moves in a limited price range, without making sensational rises or falls.

Once again then it is confirmed a lateral market that allows medium-short term traders to make some profit (often using derivatives), but keeps holders still out of the game, as the price fluctuations are not yet those extreme that can be interesting for those who have been operating for a long time and have a lot of capital invested.

In conclusion: the situation has not changed since two months ago.

Thanks for reading.