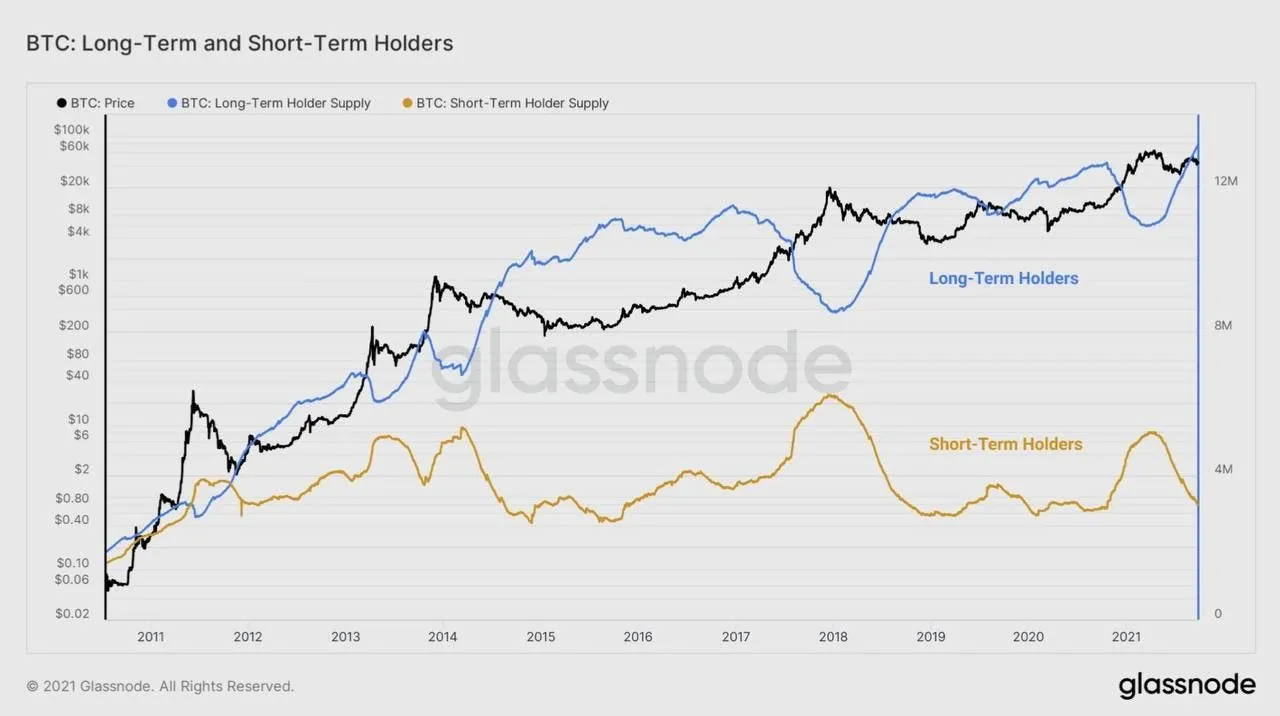

As we can see from this comparison, between supply of Short Term Speculators and Long Term Holders, right now the latter are increasing their holdings, and the former are reducing their positions.

It is as if, the short Term Holders who often coincide with inexperienced investors, now that Bitcoin is growing are taking advantage of this short growth to sell. This leads, as often happens to those who do not know the markets, to cut profits and stop as soon as the asset generates the first positive percentages.

Long-term holders who know the industry well, on the other hand, know that the Bitcoin asset will grow further and instead continue to accumulate.

In the immediate period after a coin is accumulated, the owner is probably going to experience market volatility around their cost basis, creating a natural incentive to react. This effect generally lessens over both time and as price appreciates aloof from the price basis. The degree of profit or loss realised by this cohort can an provide indication around aggregate sentiment for these new entrants. It also can provide insight on supply dynamics like whether marginal buyers/sellers are holding, taking profits or panic selling (https://academy.glassnode.com/indicators/sopr/sth-sopr).

What do you guys think? How high will bitcoin go? How long will the bull market last?