This is a question that you often see getting asked when people are new to the crypto space. It is so common, in fact, that it has led to the rise in altcoins that have little-to-no value outside of mirroring the model of Bitcoin but giving rise to unit cost biases.

Similar to the phenomenon of penny stocks vs. AAPL, AMZN, etc. - many people believe that it's in their best interest to buy "cheaper" stocks / cryptos as opposed to higher priced once.

They're right in the sense that a lower priced coin with a lower market cap has the opportunity to rise exponentially higher than a higher priced coin - since it can be theorized that the higher market cap coin has already had it's initial legs and now it's so large, it takes more $$ flowing in to push the price signifcantly.

That is correct - but many people miss the point that smaller cap = more risk. When you're dealing with any alt coin vs. bitcoin, you are likely looking at a currency with more downside risk than Bitcoin. More volatility, etc.

Bitcoin is currently hovering underneath $50k. Some people believe it's too expensive so they (wrongly, in many cases) turn to shitty altcoins with better unit bias.

Not all altcoins are shitty, but some are downright toxic waste.

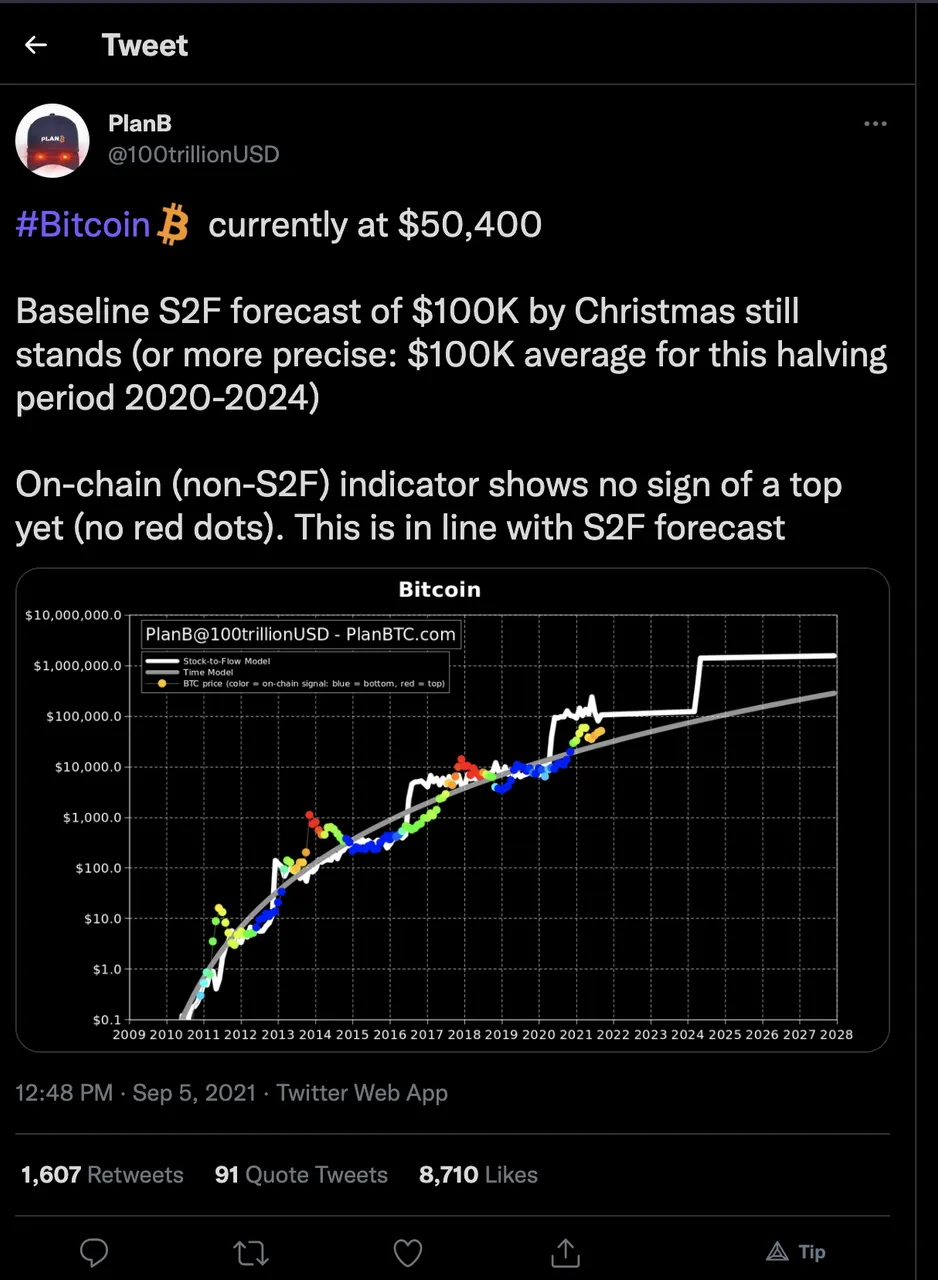

Given all of this, noobie crypto investors should not be afraid to jump into Bitcoin. Afterall, most price prediction models like this S2F (stock to flow) model show BTC rising to $100k and beyond by the end of this year.

Where else do you have the opportunity to make a 2x (100%) ROI in 3 months with relatively low risk since you're in the largest cryptocurrency on the planet?