One of the most important reversal signals is the Evening Star candlestick pattern. It's forming following a clear upward trend. Although three candles are optimal for an Evening Star pattern, but it is possible to use more than three candles.

Image source

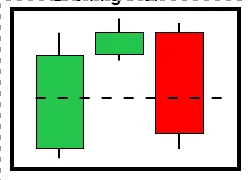

Evening star anatomy

Three candlesticks make up the majority of the Evening Star candlestick motif.

The installation candle is the first candle. This is a bullish candlestick that should come at the end of a large upward price movement.

A signal candlestick is the second candlestick. This candlestick features a little body top, often known as a doji, which suggests market hesitation or an even struggle between sellers and buyers.

A confirmation candlestick is the third candlestick. This is a strong bearish candlestick, as it closes below the signal candlestick's low.

Evening star Criteria.

Before the Evening Star candlestick pattern to appear, there must be a clear upswing.

The first candlestick is bullish, indicating that the present trend will continue. The market forms indecision on the signal candle.

The third candlestick suggests that sellers are beginning to exert their influence. At least half of the installation plug should be covered by this spark plug.

Evening star formation

The Evening Star candlestick setup or perttern appears at the end of a price movement that has been moving upward. Two options are possible depending on whether this movement is part of a long-term trend or a short-term correction:

The Evening Star candlestick pattern indicates a decrease in buyers and sellers entering the market when it appears at the end of a long-term rise. Sellers will be more likely to enter the market at this point by offering a currency pair at a relatively high level. At the conclusion of the signal candle, neither party has an advantage in the battle between buyers and sellers. By the end of the third candle, it's clear that the sellers have retaken control.

When price temporarily retraces, preferably to a resistance level, the Evening Star candlestick pattern might appear in a downtrend. This brief price increase could be due to profit-taking on the part of some sellers, the entrance of buyers in the market at bargain prices, or the regular cyclical fall in sell orders. As a result, the price will rise to the resistance level, where sellers are ready to resume selling, causing the price to fall.

Conclusion

Evening star and candlestick patterns are the market's pulse, determining price activity as well as market participants' sentiment, which is the driving factor behind price action.

This is @benie111

I would like to hear from you. Do you have contribution or comment? Do well to drop them in the comment section.