Hi investors,

Today we're talking about Bitcoin's impressive performance throughout 2020.

Happy Halloween!

🎃🦇

Bitcoin Market.

BTC is trading at $13,825 against the USD at the time of writing. We're +29.03% MtD and an eye-popping +90.21% YtD.

We've also cleared last year's previous ATH and slowing creeping back up to $14k USD.

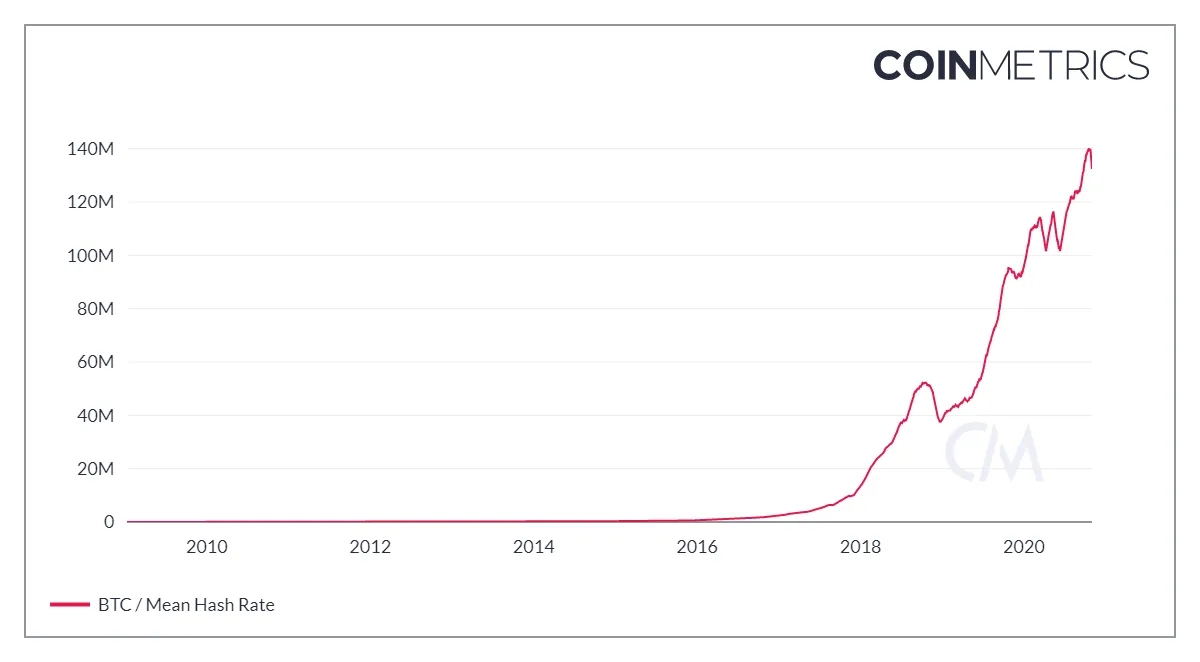

Network-wise, total hash-rate is hovering just under all-time-high levels, indicating bullishness from miners and willingness to front capital for future block reward.

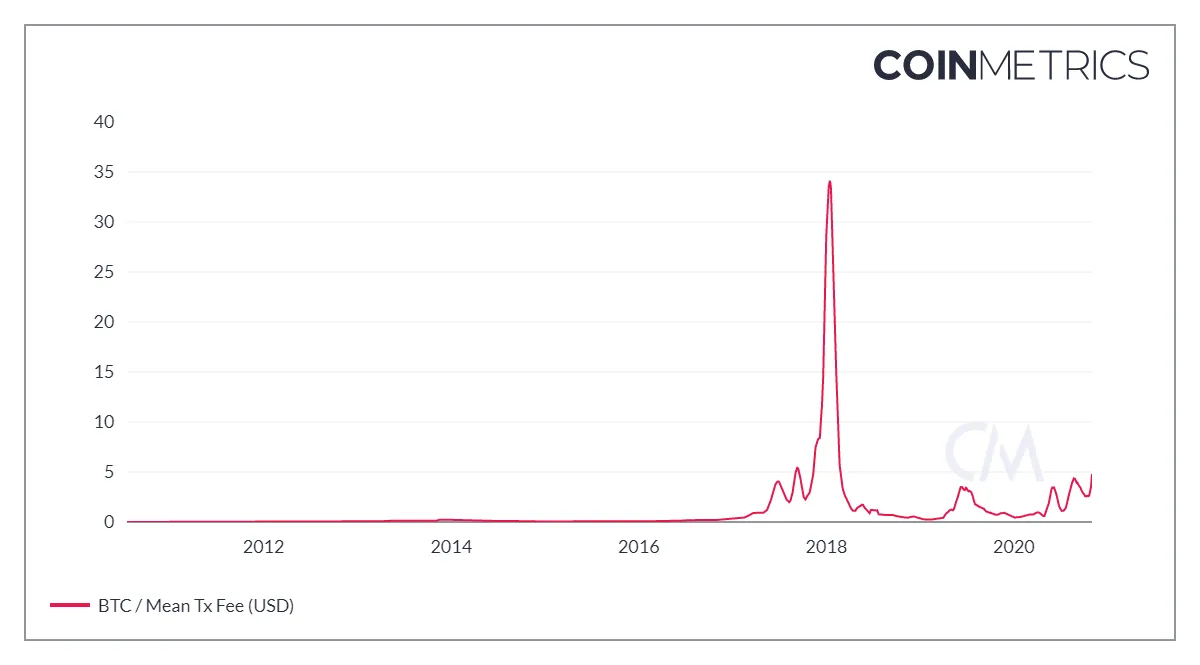

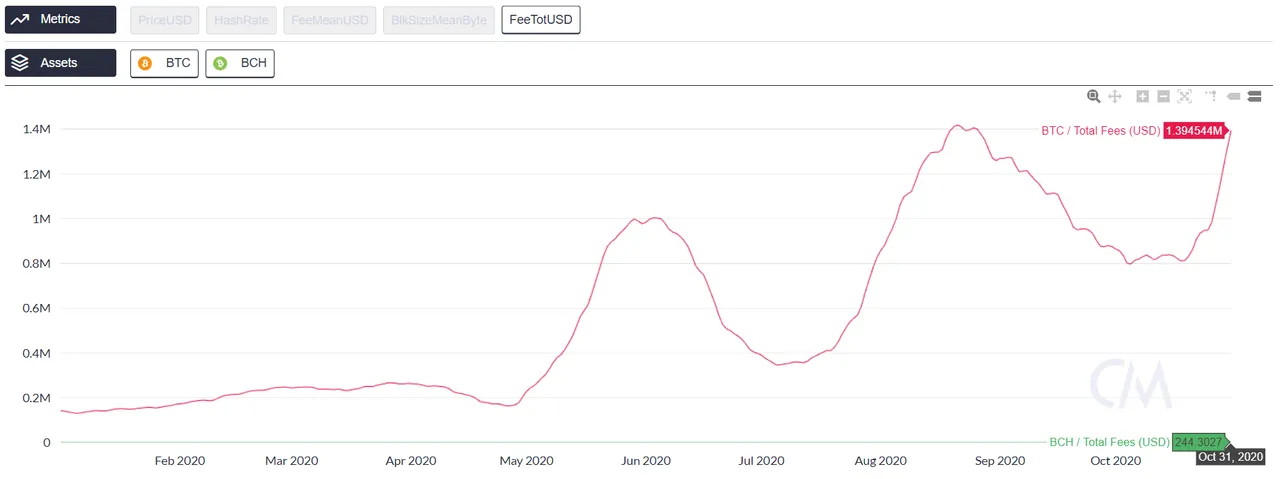

Corollary to that but not less key to the long-term health of the network, fees to miners are picking up.

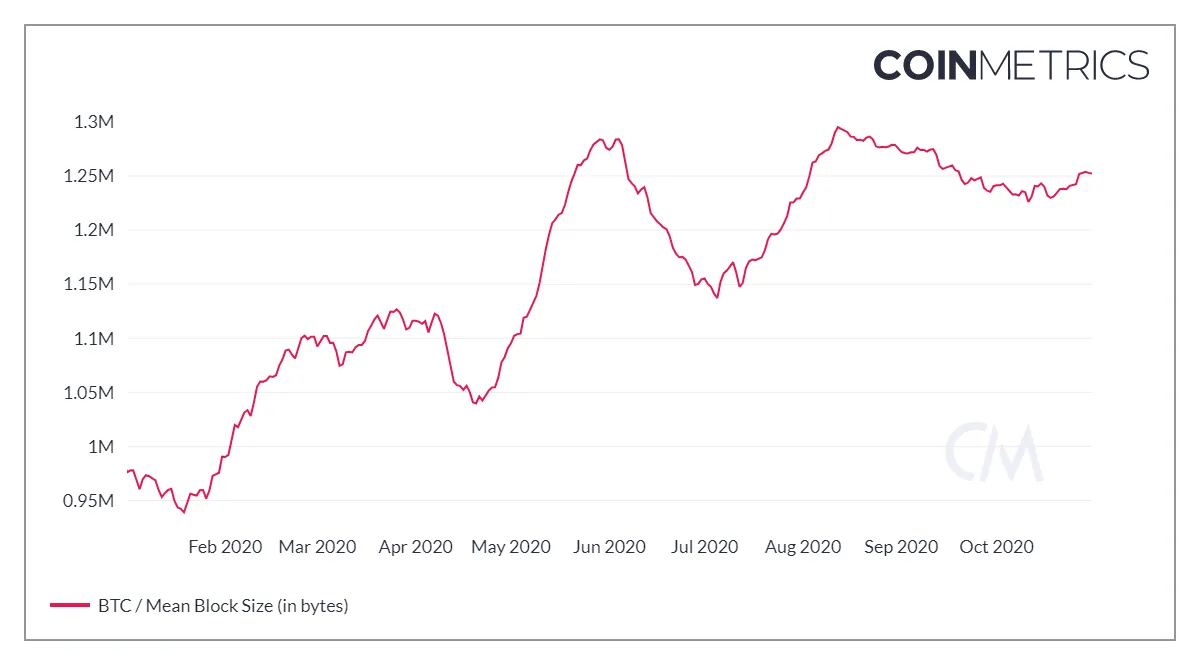

This increase in fees is in my opinion a consequence of scarce block-space. Bitcoin blocks are capped to 2 megabytes (or 4mB in some very particular cases) and the average block size for the past few months has been clocking at around all-time-high levels of 1.25 megabytes.

This means that the auction to have transactions included in a block is becoming more competitive. As a result, participants are willing to pay higher fees to have their transactions executed faster. More fees attract more hash-rate and the cycle reinforces.

This is healthy for the network and denote that scarce block-size has always been the right strategy.

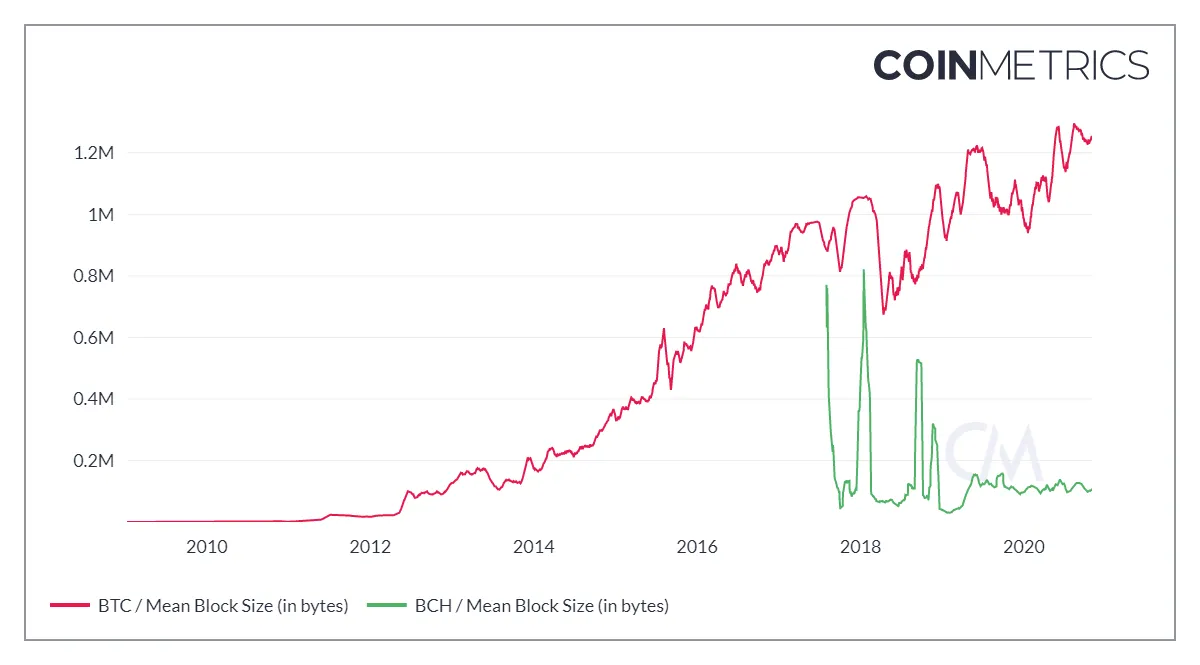

Compare that to Bitcoin adjacent projects like (god forsaken) Bitcoin Cash (BCH) which forked on the hope that offering much cheaper block space would attract more activity on chain.

Well, it didn't work.

Bitcoin Cash medium block size is languishing around a pathetic 100Kb with no growth.

This results in a very weak fee market which hurts the appeal for Bitcoin Cash, keeps the hash rate low and threatens the security of the chain.

But anyways...

Looking back, 2020 has been pretty cataclysmic for the rest of the world but it's been a great year for the Bitcoin (BTC) network.

Let's recap.

2020: A Year of Bullish Catalysts for Bitcoin.

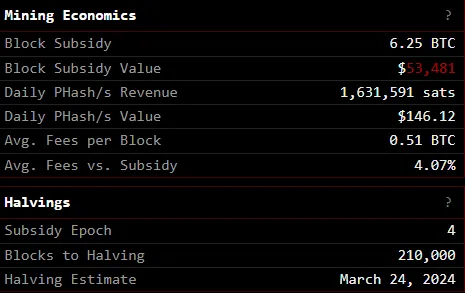

In May 2020, the Bitcoin network automatically halved the block reward down to 6.25 BTC/block.

The halving constricted the supply of BTC, making the asset scarcer and, if you believe Plan B's now famous stock-to-flow model, ushered the beginning of a new 4-year bull cycle which could take the asset within the vicinity of 100k per coin sometime around late 2021 (this is definitely not investment advice).

Source: https://digitalik.net/btc/

The Bitcoin halving was quickly followed by bullish news coming from the institutional side. In his widely-circulated May 2020 Market Outlook legendary investor Paul Tudor Jones laid out in very eloquent terms the case for BTC as a hedge against the negative consequences of QE-induced "great monetary inflation (GMI)".

Jones concluded:

Owning Bitcoin is a great way to defend oneself against the GMI, given the current fact set. As Satoshi Nakamoto, the anonymous creator of Bitcoin, stated in an online forum around the time he launched Bitcoin, “the root problem with conventional currency is all the trust that’s required to make it work.

The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” I am not an advocate of Bitcoin ownership in isolation, but do recognize its potential in a period when we have the most unorthodox economic policies in modern history.

So, we need to adapt our investment strategy. We have updated the Tudor BVI offering memoranda to disclose that we may trade Bitcoin futures for Tudor BVI. We have set the initial maximum exposure guideline for purchasing Bitcoin futures to a low single digit exposure percentage of Tudor BVI’s net assets, which seems prudent.

Then, came a true bombshell of a news.

On July 22, the Office of the Comptroller of the Currency (the regulatory body that supervises chartered banking in the US) announced in a letter that banking institutions that fall under their rule were now allowed to custody cryptographic assets.

The letter made it clear that "banks [must] continue to satisfy their customers' needs for safeguarding their most valuable assets, which today for tens of millions of Americans includes cryptocurrency".

As Acting Comptroller of the Currency Brian Brooke highlighted in his latest podcast appearance on Laura Shin's Unchained podcast:

One of the most interesting thing I observed after that letter came out was that the price of most crypto assets went up [...] which I think signals that institutions felt safe for investing in [assets] they can now leave in the custody of a bank.

The price of BTC indeed went up and broke 10k just days following the news.

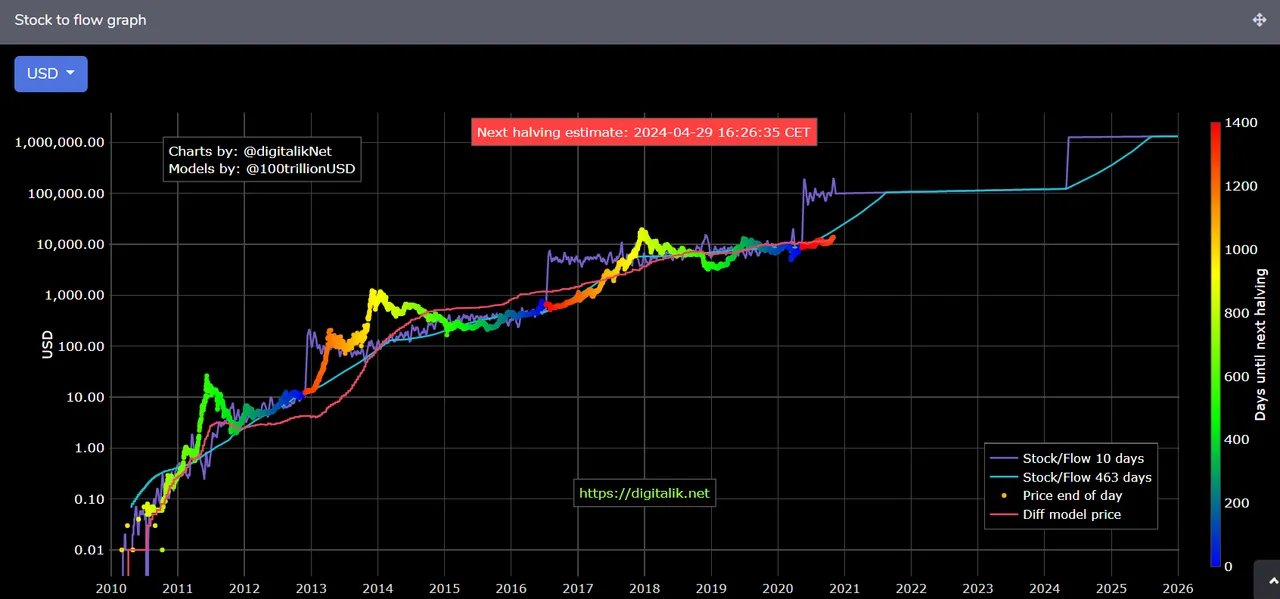

On the heels of this we started to see a bit of corporate FOMO as business intelligence provider Microstrategy and Jack Dorsey's Square announced they had purchased Bitcoin as a treasury asset.

Source: https://bitcointreasuries.org/

Microstrategy in particular went as far as making BTC its primary treasury reserve asset, sweeping 90% of its cash reserves ($425,000,000 USD) into the cryptocurrency.

“Our investment in Bitcoin is part of our new capital allocation strategy, which seeks to maximize long-term value for our shareholders,” said Michael J. Saylor, CEO, MicroStrategy Incorporated.

“This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash.

Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions.

MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.”

Saylor's bet paid big as the Bitcoin is now valued at $529,131,375 for a net $104,131,375 USD gain.

Source: https://bitcointreasuries.org/

Finally, on Oct 21, 2020 Paypal announced support for Bitcoin and other large-cap cryptocurrencies:

To increase consumer understanding and adoption of cryptocurrency, the company is introducing the ability to buy, hold and sell select cryptocurrencies, initially featuring Bitcoin, Ethereum, Bitcoin Cash and Litecoin, directly within the PayPal digital wallet.

The service will be available to PayPal accountholders in the U.S. in the coming weeks. The company plans to expand the features to Venmo and select international markets in the first half of 2021.

Last but not least, there is indications that Bitcoin is being accumulated by Central Banks (although not necessarily the ones you hoped for...).

Bitcoin as a... Central Bank Asset?

In an October 25 article, Iran Daily announced:

The Iranian government amended its regulations on cryptocurrencies to allow them to be exclusively used for funding imports at a time of increased pressure on the country’s normal use of hard currencies.

The cabinet amended a previously issued legislation on the use of cryptocurrencies in Iran by redirecting digital monies into the Central Bank of Iran’s funding mechanisms for imports, according to a Saturday report by IRNA.

The report said new regulations have been enacted in response to a joint proposal by the CBI and the Iranian Ministry of Energy.

Based on the laws, cryptocurrencies legally mined in Iran will only be exchangeable when they are used to finance imports from other countries.

“The miners are supposed to supply the original cryptocurrency directly and within the authorized limit to the channels introduced by the CBI,” said the report.

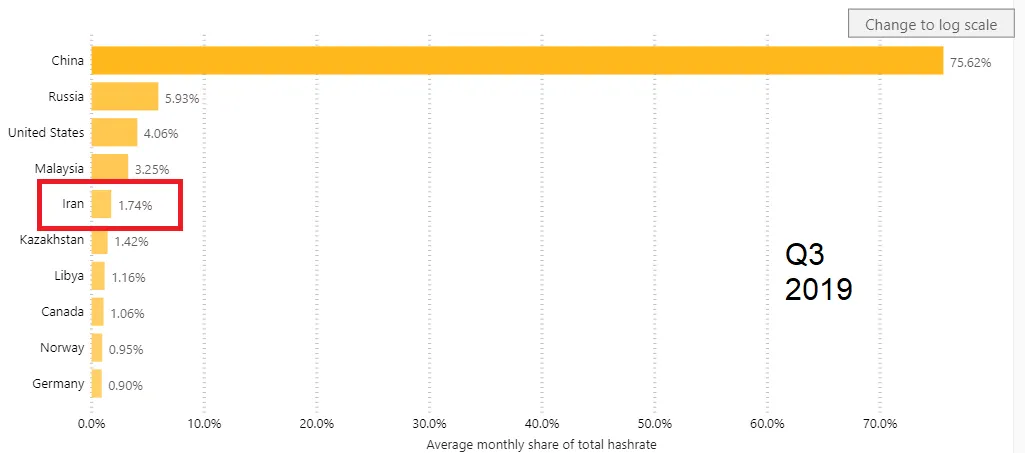

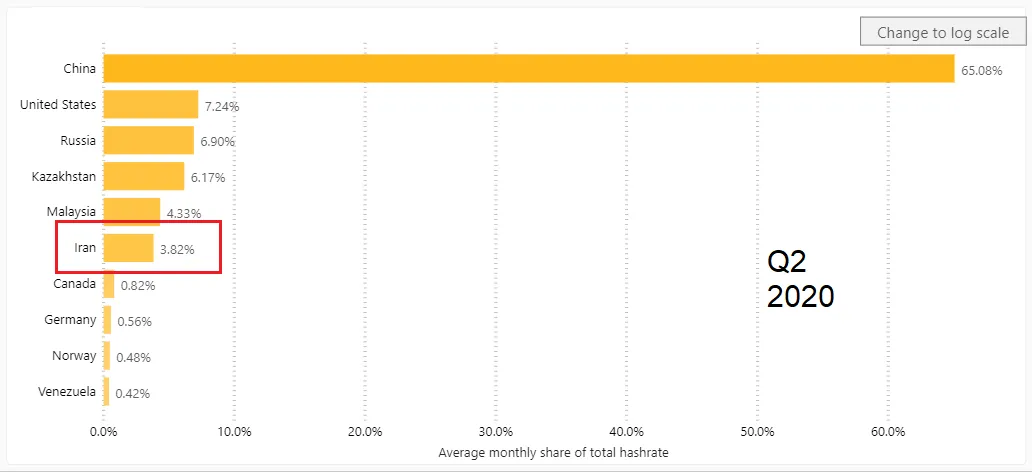

Bruised by almost three decades of US sanctions that crippled its economy and restricted its access to international payment rails like SWIFT, Iran has been ramping its Bitcoin mining capacity to almost 4% of total hash-rate as part of its 2020 National Crypto Mining Strategy.

Source: https://www.cbeci.org/mining_map

In a January 2020 article in Foreign Policy, Tanvi Ratna remarked that:

The economic sanctions imposed by the United States on Iran in the last two years have been effective, shrinking the Iranian economy by 10 to 20 percent. But they have also accelerated Iran’s use of cryptocurrencies such as bitcoin, which are increasingly used by the Iranian government and public to evade legal barriers.

This has led to an attempted crackdown on bitcoin by international regulators—but the cryptocurrency industry is proving more nimble than the enforcers of sanctions.

It's now clear that Iran's Bitcoin adoption is part of a national strategy to leverage alternative financial systems to evade US sanctions. There's been rumors' that Iranian Bitcoin mining is heavily sponsored by the state and it would be surprising if the CBI didn't keep at least some BTC in reserve on its balance sheet.

Iran getting involved in crypto is likely to draw outcry from the enemies of Bitcoin (and Iran). Though I believe this is actually missing the forest from the tree.

Echoing the point made by Nic Carter on the last episode of On the Brink, I think it simply shows that Iran "trusts" Bitcoin as neutral payment rails which, unlike SWIFT or the dollar, cannot be weaponized to serve US political agendas.

In this sense, Bitcoin is serving exactly its intended purpose as an alternative financial system and asset which supply cannot be altered or its use prevented by governments.

A true trustless and permissionless payment infrastructure for the world.

As Bitcoin grows and its neutrality become established and leveraged by a growing number of State actors, it will inevitably lead to geo-political consequences.

Notwithstanding the fact that the US government (or any government) cannot stop anyone from using the network to transfer value, Central Banks in "pariah" countries accumulating BTC could find themselves incredibly wealthier if BTC ever grow to many multiples of the market cap of gold.

Source: Central Bank of the Islamic Republic of Iran

In a sense, public blockchains like the Bitcoin network are great equalizers. Their permissionless nature makes them resistant to political interference and gives anyone a chance to participate in global finance.

That is as long as you can pay for block space to get your transactions included into the blockchain.

As the world wakes up to public blockchains, one can see a Central Bank FOMO profiling on the horizon as nation-states race to acquire a significant portion of the total supply of BTC in an attempt to secure blockchain real-estate (i.e. native coins).

In a world where public blockchains become ubiquitous and largely used by nations to settle value I think we would eventually see countries aligning around different networks. This will be the ultimate acid tests for public blockchains. Those that can live up to the goal of decentralization in the face of governments trying to control them will emerge as the true victor of the crypto war.

My bet is on Bitcoin... and possibly Ethereum.

But time, as always, will tell.

See you next weekend for more market insights.

Until then,

🦊