Hi Everyone,

Welcome to the Economics Quiz Contest results post. This is the ninth economics contest for 2023. Unlike most other contest results posts, this one does not contain a video generating results. The results are determined based on the number of correct answers.

What is the Economics Quiz Contest?

The Economics Quiz contains 5 questions and 26 possible answers. It is a type of multiple-choice quiz. Instead of 4 or 5 choices per questions, there 26 choices altogether. The answer for a question could be any of the 26 choices and they are not presented in any particular order. The answer to Question 1 could be ‘T’ and the answer to Question 2 could be ‘K’.

The objective of the game is to answer the most questions correctly. If there is a tie for first place, the participant who entered first wins.

The format of the required entry is explained in detail in the contest itself.

For a more detailed explanation, you can access the contest post using the following link.

Results of the Economics Quiz Contest

Questions 1 to 3 made use of the same demand and cost functions/curves. The key differences in the questions was the extent of control sellers had over price.

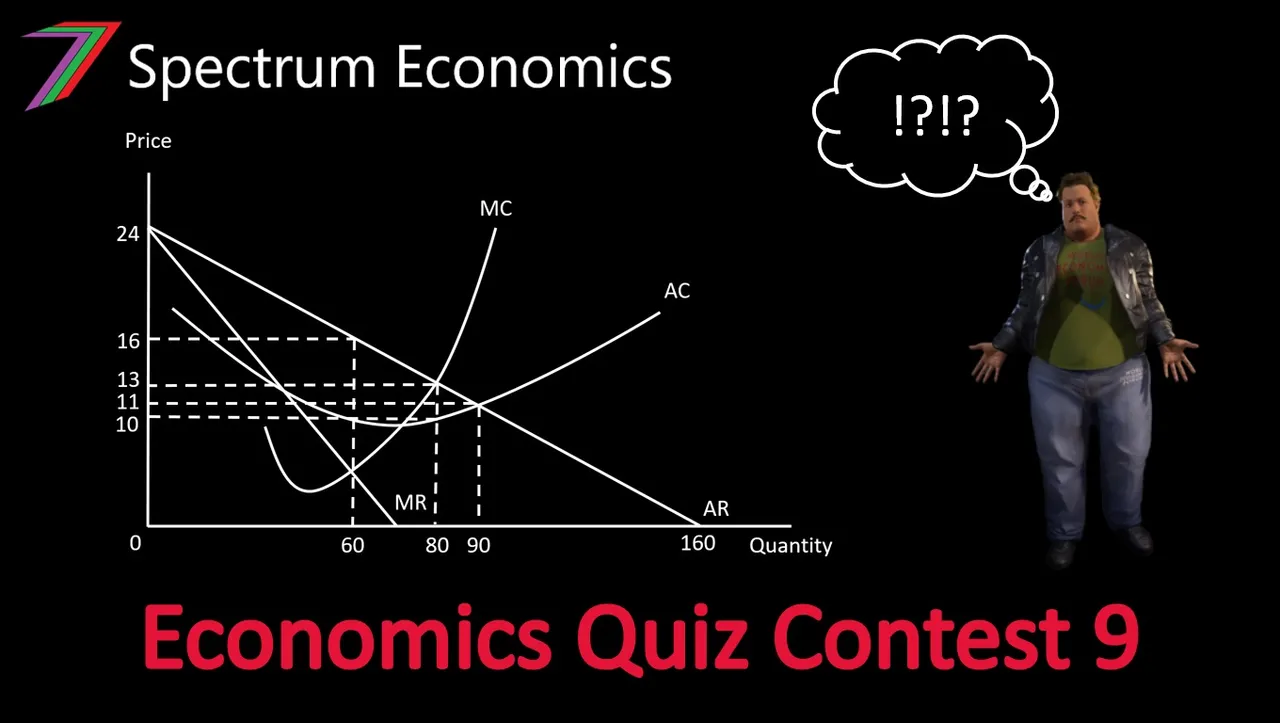

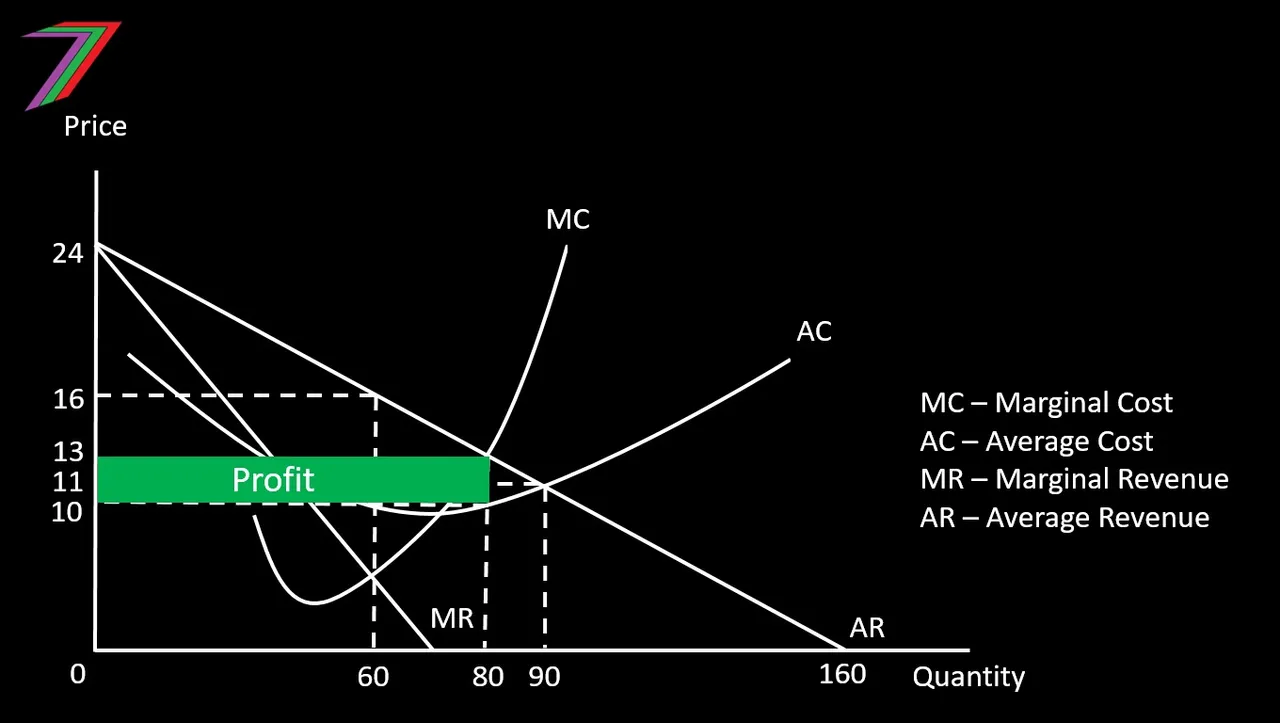

In Question 1, the market was a monopoly. Therefore, the seller had complete control over price but could not discriminate between customers. To maximise profits, the seller would produce up to the point marginal cost equalled marginal revenue. Producing beyond this point would lower profits, as the cost of producing additional units would exceed the additional revenue from selling them.

Marginal cost equals marginal profit at the quantity of 60. A quantity of 60 could be sold for the price of $16. The average cost of producing 60 units is $10 per unit. A profit of $6 per unit can be made. Total profit equates to the number of units sold and profit made per unit. Therefore, the profit is $360 (6 × 60). Answer is P. See Figure 1 for how the profit is determined.

Figure 1: Monopoly Profit

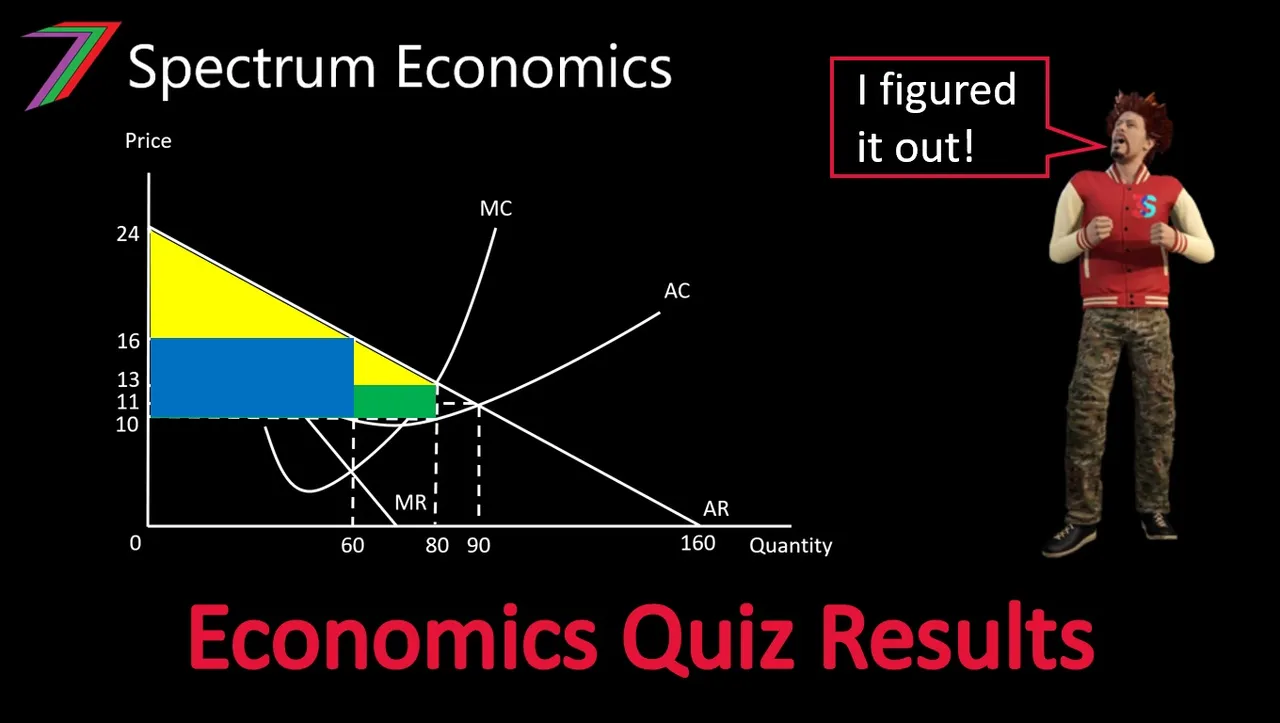

In Question 2, the seller has perfect knowledge of all customers’ willingness to pay. Therefore, is able to discriminate perfectly between customers. Therefore, is able to charge each customer differently based on his or her willingness to pay. The seller will continue selling up to the point that the revenue from each sale is equivalent to the cost of producing that unit (Price = Marginal Cost). This quantity is 80.

The seller’s costs are equivalent to the quantity multiplied by the average cost per unit produced/sold. For this question, that is $800 (80 × 10).

The seller’s revenue is equivalent to the entire area below the average revenue/demand curve up until the quantity of 80. The total revenue can be calculated to equate to $1480 ((24 – 13) × 80/2 + 13 × 80). Total profit is equal to total revenue minus total costs, which is $680 (1480 - 800). Answer is D. See Figure 2 for how the profit is determined.

Figure 2: First-degree Price Discrimination

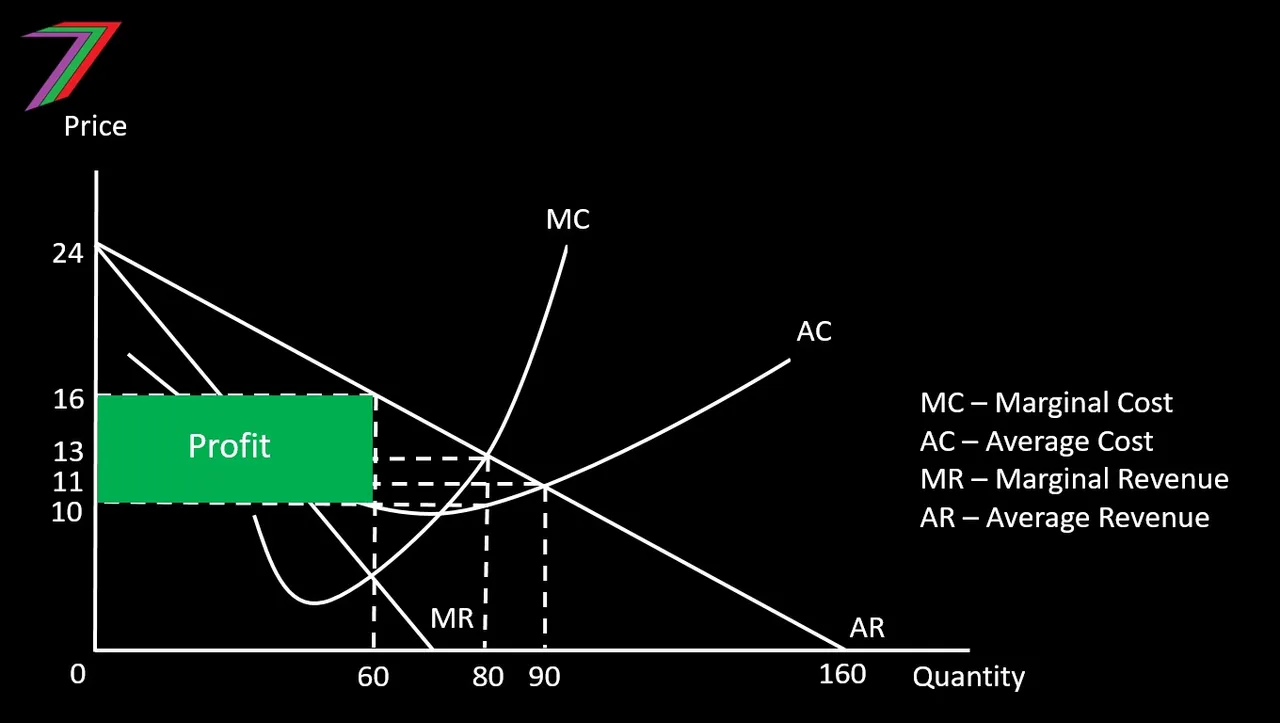

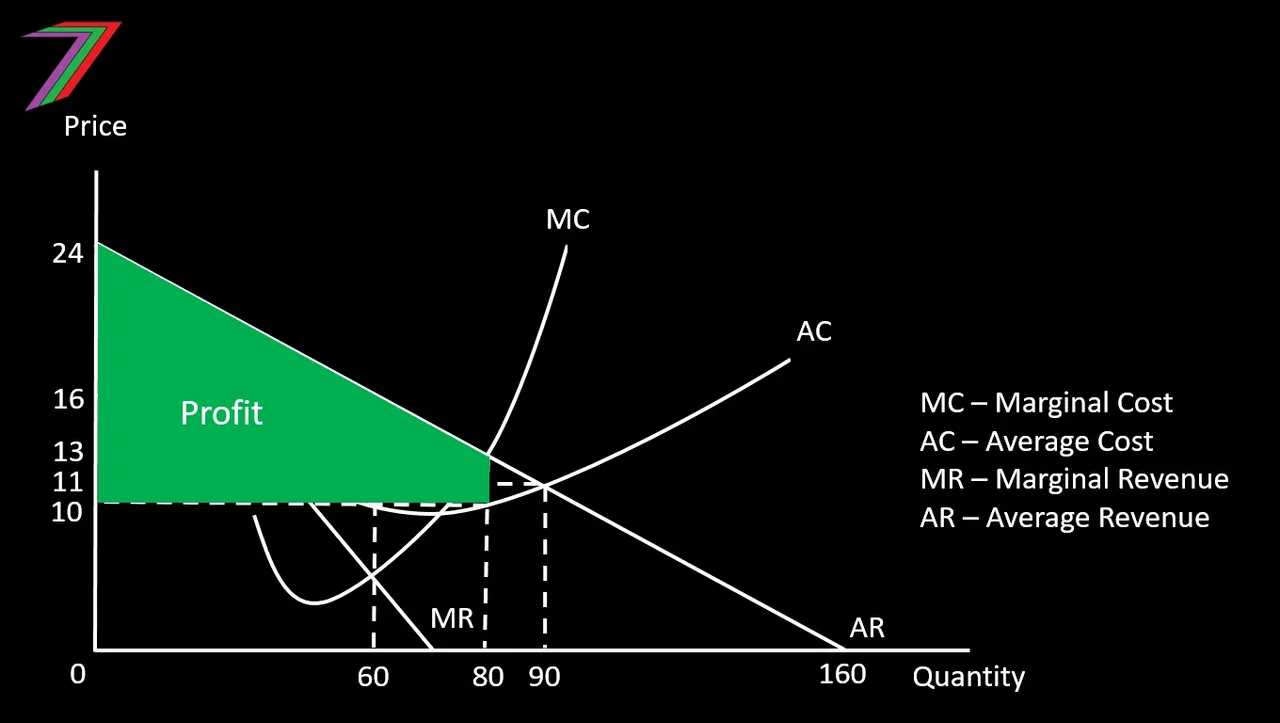

In Question 3, the market is perfectly competitive. The sellers have no control over price. Each firm faces flat average revenue and marginal revenue curves that are equal to marginal cost. Based on the figure in the question, average revenue/demand equates to marginal cost/supply at the price of $13 and the quantity of 80. As average cost is below average revenue at this point, firms still make a profit. The average cost per unit is $10. Therefore, the profit is $240 ((13 -10) × 80). Answer is K. See Figure 3 for how the profit is determined.

Figure 3: Perfect Competition Profit

Note: In the long-run, more firms would enter until the price dropped to $10; thus erasing all profits.

Question 4 focuses on opportunity cost. Opportunity cost is the next best alternative foregone. For this question, we can only assume the opportunity cost is to continue per usual (i.e. normal working days and not attending the cinema). Opportunity costs include the costs relating to the cinema such as transport to the cinema, tickets, popcorn and drink. These costs amount to $16 ($6 ticket + $6 transport + $1 drink + $3 popcorn).

To go to the cinema, Jack needed to forego one hour of working. This reduced his income by $15. This should be included as an opportunity cost.

As a consequence of eating too much popcorn, Jack is unwell. He buys medication costing him $4. This is an opportunity cost because he would not have been unwell if he did not go to the cinema.

His illness also stopped him from going to work for one day. When he is able to return to work, he works two less hours. Therefore, he works 10 less hours. This amounts to a cost of $150 (15 × 10).

His overall opportunity cost for his cinema experience is $185 ($16 + $15 + $4 +$150). Answer is O.

Note: The opportunity cost value is still based on incomplete information. For example, we do not know the cost of his discomfort from being ill nor his change in diet over that period.

Question 5 is about expected value. Expected value is based on possible payouts and probability. For example, if a coin toss pays out $10 for heads and nothing for tails, the expected value of tossing the coin is $5 (10 × 50% or (10 + 0)/2).

The probability of Jane rolling two consecutive sixes is 1/36 (1/6 × 1/6). This is because there are 36 possible outcomes and only one outcome results in Jane winning the $710 prize. All other outcomes result in Jane losing $10 (the money she bet). To obtain the expected value we need to summate the value of the possible payouts and divide by the number of possible payouts (∑Payouts/n). The expected value of Jane’s bet is $10 ((710 + 35 × -10)/36). Answer is W.

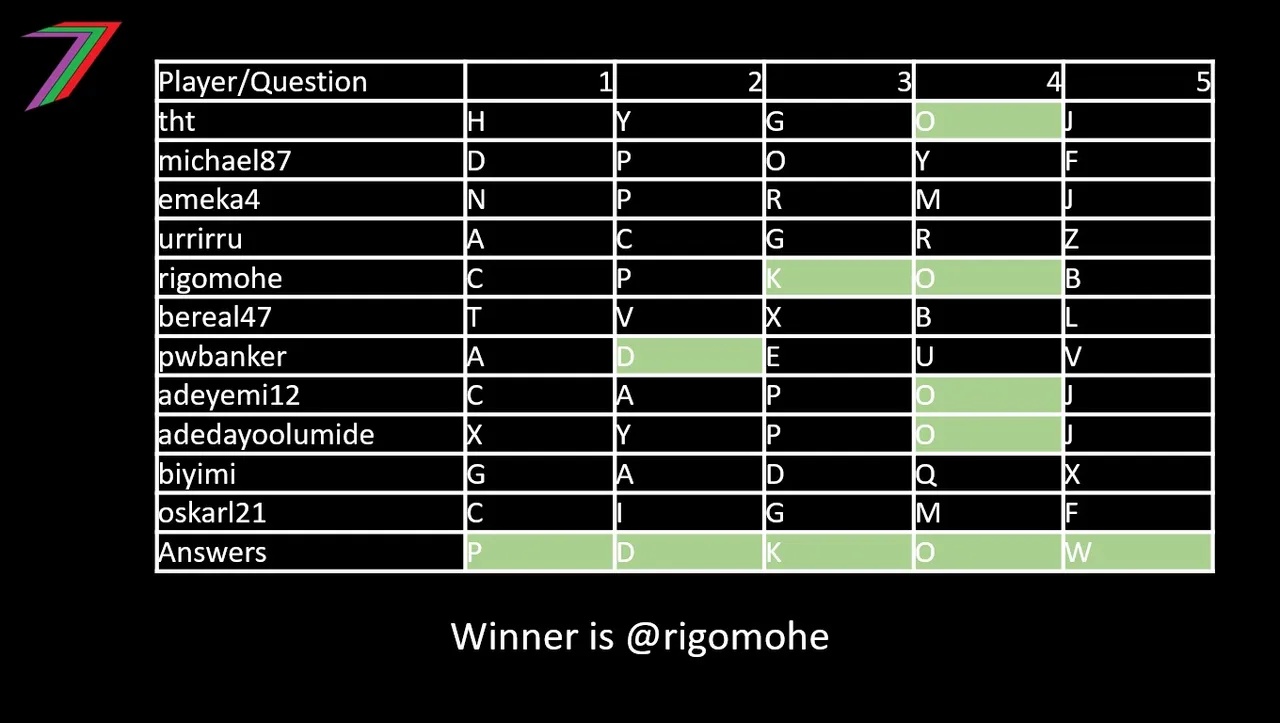

Table 1 contains the answers provided by the participants as well as the correct answers of this contest.

Table 1: Results of the Contest

Note: Correct answers are highlighted in green

The winner of the contest is @rigomohe. @rigomohe is the outright winner by answering two questions correctly. @rigomohe wins 30 Hive Power.

I would also like to thank @emeka4, @micheal87, @bereal47, @urrirru, @tht, @pwbanker, @oskarl21, @adeyemi12 @biyimi, and @adedayoolumide for participating.

Contest Tips and Analysis

This contest is based on economic theory. Most of the questions are equivalent to first or second year standard from when I was a student. The only advice I can offer is for participants to revisit this theory. The first three questions are based on consumer theory and market structure (see, Market Structure #1 – Introduction). The fourth question is based on opportunity cost (see, Economic Concepts #12 – Opportunity Cost). The fifth question relates to expected value and is often applied to game theory (see, Game Theory – Introduction).

More posts

I have several collection of posts. I have organised these collections based on content and purpose.

The first collection contains six collection posts created before PeakD had the collection feature. Four of these posts relate to the core of my content, one of them contains all my Actifit Posts, and one of them contains my video course ‘Economics is Everyone’.

The second collection consists of the posts that I consider define my channel. These posts are significant in terms of content as well as how they contribute to the growth of the channel. These posts reveal the most about what I believe in.

The third and fourth collection is what I call my ‘Freedom-base Economics living book’. They contain all the posts that support my ideas about the value and power of freedom. Some of these posts explain what we can achieve with freedom and what we need to utilise it. Some of them explain how we are deprived of freedom and how we often give up freedom for security and comfort. The third collection concludes with possible scenarios depending on what we (society) choose to do.

Hive: Future of Social Media

Spectrumecons on the Hive blockchain