The first thing you need to know about Max Keiser is he despises Goldman Sachs - Max wholeheartedly endorses Matt Taibbi’s 2010 Goldman quotable: “The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.” I’d wager that Taibbi was inspired to write his Rolling Stone piece taking cues from the Max Keiser playbook, when in 2009 Max calls out Goldman Sachs scum reporting that “Goldman Sachs is stealing every day on the floor of the exchange, they should be in the Hague, they should be brought up on financial terrorism charges!”

Almost a decade later and his message has reached critical mass with the more recent war cry, "Raise interest rates! Make the cost of financial terrorism too high! Do it today! If you don't you're a fucking terrorist!" Max Keiser consistently and vehemently calls out the international criminal banking cabal that strips away sovereignty from hard-working citizens, trading them debt for dollars. Max leads the charge in a global insurrection against bankster occupation (KR E191) that has ebbed and flowed as a mantra of defiance since the Arab Spring. He’s more a revolutionary than an entertainer and has been able to amass a global following as a financial expert and celebrity.

The second thing you need to know about Max is that he’s Satoshi Nakamoto, but you won’t find his name referenced in the Bitcoin Wikipedia. You’ll see usual suspects like Adam Back, Charlie Shrem, Amir Taaki, Ross Ulbricht, Roger Ver, the Winklevoss twins, and Erik Voorhees but no Max. Why?

By now we have all heard of Satoshi Nakamoto - An enigma, a recluse who chooses to remain anonymous. To the mainstream media outlets he’s more like Willy Wonka than Banksy, with a magical golden ticket into an unreal world of endless possibility. Satoshi, a name so revered that this moniker has become the unit of measure that drives the Bitcoin universe just as the legends that preceded him have become units of measure within the Ethereum Gas Ecosystem. You’ll never see a penny affectionately called a Mnuchin but it could be a rash: “I’ve got this flaming Mnuchin and I can’t close my legs!”

Peering into this world you discover a group of people who respect the math and each other before your profit. Hal Finney was the cypherpunk and first Bitcoin user after Satoshi Nakamoto. Nick Szabo was the researcher who came up with bit gold and developed the idea of smart contracts. Wei Dai is the cypherpunk who came up with b-money, a concept referenced in the Satoshi WhitePaper. They, and other crypto-visionaries and entrepreneurs, some listed above, drive the Bitcoin universe and Max Keiser is one of them. Actually if Max Keiser is Satoshi, Stacy Herbert is Nakamoto as the writer/producer/editor of their show Keiser Report on RT. These two have done more to evangelize Bitcoin, AltCoins, and the entire cryptocurrency universe than any other mainstream media presenters. Let’s just do a quick play-by-play of KR and BTC:

Max first broke the story on Keiser Report, May 2011 (KR E151), speaking with Jon Matonis about Bitcoin, the new peer-to-peer crypto-currency. “Jon, what is Bitcoin,” he says coyly. This coming from a man who’s had patents for virtual securities dating back to 1996. But that’s his style, a presenter’s trick, and Max gives guests an opportunity to enlighten and we learn with him. A few short months after he breaks the BTC story we see the crowds swell in Zuccotti Park as the Occupy Movement takes hold across America. Back then we had 99 problems but a bit ain’t one, now it seems the world has literally flipped the digital coin.

There are smatterings of Bitcoin references on the Keiser Report until the floodgates open January 2013 when Bitcoin jumps to $13/BTC. Then in March 2013 Bitcoin jumps to $47/BTC and Max proclaims, “I’m a Bitcoin millionaire!” (KR E416) Before you know it mainstream media outlets are racing to catch up, scratching their heads on the whole phenomenon.

Meanwhile Leah McGrath Goodman, a Newsweek reporter on her search for the elusive Bitcoin creator, harasses poor Dorian Percival Satoshi Nakamoto, a retired teacher with coke-bottle glasses looking as much like a Wes Anderson character as his name sounds, and for a moment we all caught a glimpse of Willy Wonka. But it’s the wrong guy, and poor Dorian’s life is flipped upside down with scores of reporters and crypto-fans beating down his door. He ended up 65 BTC richer for his troubles.

The intrigue and sensation soared as a financial disaster wrecked Cyprus, where corrupt banks froze accounts in what was called a Bail-in. This inspired innovative thinkers to set up the first Bitcoin ATM machines. We were seeing Bitcoin acting as a fungible life vest in a collapse that shook all of Europe. The conversation quickly turned to the EU Sovereign Debt Crisis, where Greece was looking at an exit from the Euro, and they weren’t alone. This financial chaos was a swoon and boom time for Bitcoin as it soared to over $100/BTC.

The soaring price of Bitcoin was causing a frenzy and new entrepreneurs began releasing their own altcoins, while the main-stream media outlets were still struggling to understand what the hell immutable store of value even meant. Max and Stacy start regularly producing shows about Bitcoin and all the emerging altcoins. In KR E569 Max interviews Charles Hoskinson, a cryptographer behind Ethereum. A few weeks later Ethereum launches and is a huge success, blowing the doors wide open for new and emerging cryptocurrencies. To put it in perspective: in 2013 there were around 40 cryptocurrencies and the concern was that competition would flatten the Bitcoin market.

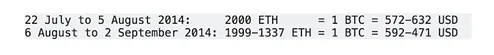

The Ethereum presale took place from Tuesday, 22 July 2014 to Tuesday, 2 September 2014 (42 days).

“We're witnessing the Cambrian explosion of cryptocurrencies. Those that are useful will survive - Those that aren't will be left to the primordial strata of crypto-fossils, to be discovered by future generations.” – Stacy Herbert

And the episodes kept rolling in: KR E340, E426, E527, E548, and on and on, and so it goes. The 300-600 Keiser Report episodes were a massive educational outreach about cryptocurrency and how it was(is) going to change the world, with some of the many influential stakeholders having their cotillions on KR with Max and Stacy as their gracious hosts: Reggie Middelton, Barry Silbert, Kim Dotcom, Amir Taaki, Peter Todd, Andreas Antonopolous, Matthew Mellon, Trace Mayer, Charlie Shrem, Cody Wilson, Erik Voorhees, Roger Ver, Patrick Byrne, and the list goes on. We were(are) watching the experts and innovators, in real time, use cryptocurrency to do amazing things, and Max and Stacy are introducing all of it to the world. Still do.

A quick back of the napkin calculation of Keiser Report Bitcoin episodes from 2011 to today puts Max and Stacy at over 300 episodes dedicated to Bitcoin and other cryptocurrencies, with an average YouTube viewership of around 40,000. Taking into consideration that the Keiser Report has over 20 million viewers worldwide the math just makes sense. There is no other mainstream broadcast with that level of in-depth coverage on what has become the new asset class. Max and Stacy made the top 100 most influential people in the cryptosphere, and I believe Stacy should have been in the top 5, which begs the question, “where would Bitcoin be without Max and Stacy?”

To understand why Max and Stacy are long on Bitcoin you need to better understand the underpinnings of why they are as necessary to Bitcoin as Bitcoin is to the revolution.

They are a voice against the fraud of our times inherently linked to the state of fiat currency, where 97% of the US money supply is interest-bearing debt - it’s a Ponzi scheme. Where the fed creates money out of thin air, lending at interest, a sovereign power taken from citizens, and we will never be able to pay it back, that is why the US dollar is a debt-driven instrument, not a currency, and the bubble is going to blow like Vesuvius. The same bubble instigated by Greenspan slashing interest rates to 1%, under Bush, only to see Bernanke level interest rates to ZERO, under Obama, for a 7 year give away.

Or the housing bubble that was essentially propped up by Bernanke’s infamous, “the housing market will always go up” spiel that led to American homeowners becoming a diaspora in their own country, living with friends and families, or worse in modern day Hoovervilles. Max and Stacy are very critical of the fact that we have sold off our sovereignty to a corrupt cabal of bankers that operate a kleptocracy; swindlers with a put option on Make America Great Again, selling our sovereignty to anyone willing to purchase our bonds in the tragic short sale of our American values.

It’s all the same bubble(s), it’s all a continuation of the same policies where quantitative easing has become the norm, and talk of raising the interest rates is as hyperbole as president Trump’s MAGA: “It will be really really great, the American economy is the best ever, record-setting.” Well it’s not. It’s 2018 and interest rates are at 1/2 of Greenspan’s rate cut of 2002. So we go from Stockmarket bubble, to real-estate bubble, to an escaping bond market bubble. There are bubbles all over the place, auto loans, student loans, cell phones, you name it, and a surmounting national debt doubled under Bush, and doubled again under Obama - what do you think is going to happen under Trump and a rashy Mnuchin? It’s getting so bad, bubbles aren’t really bubbles anymore, they are like the frothy gyre of swirling garbage choking the life out of our oceans, but this financial assault is choking out our very humanity.

I was chatting with Max and he stated frankly that, “buying/owning Bitcoin has been the revolutionary response in the face of government failure to reign in rampant financial terrorism. 0% interest rates discourage savings. Millennials are buying Bitcoin and HODL’ing as a store of value — as a savings vehicle. The coin pays no interest but appreciates in value as the legacy banking system — that refuses/hordes the interest payments — an enormous heist — amounting to hundreds of billions of stolen cash from American and global savers — crashes and burns. Buying Bitcoin is a play on banks blowing up. Millennials know this in their hearts.”

While bullish on Bitcoin, as Max sees it, the biggest fight is yet to come as the giant squid realized crypto blood tastes just as sweet as the real thing. As demand grows for Bitcoin Genesis Global Trading just announced it’s launching a digital currency lending business. So borrow to hedge or short, “short-selling those borrowed bitcoin to hedge their long derivative positions.” Max’s philosophy (like Crash JP Morgan, Buy Silver) is to get the world buying BTC to smother the sell and naked sell orders with overwhelming amounts of buy orders. “Crash banks, Buy Bitcoin will work where Crash JP Morgan, Buy Silver did not. It’s a pro-spiracy, a conspiracy for a positive outcome something John Perry Barlow invented,” says Max.

Max Keiser is Satoshi Nakamoto and Stacy Herbert is Satoshi Nakamoto because they are revolutionaries, because they believe in Bitcoin for all the right reasons, and there would be no Bitcoin revolution without their support. These two financial experts and raucous raconteurs have earned the title and will continue to enlighten us all as we see their predictions come true - as the mainstream media go full tulip over $60 billion that was wiped off the value of the entire cryptocurrency market in 24 hours recently, Max and Stacy see the record DOW drops, looming trade war, and all the frothy bubbles and HODL with smiles on their faces as the banking system burns to the ground. That’s Satoshi.